DAX Attempts to Test All-Time High with US Inflation Data on the Horizon

The stock exchange opened bullish this morning while waiting for US inflation data this afternoon. GDP Growth estimates for the Eurozone

The stock exchange opened bullish this morning while waiting for US inflation data this afternoon. GDP Growth estimates for the Eurozone matched the expected forecasts with an improvement from 0.1% to 0.4% YoY.

The market is still riding the sentiment of interest rate policy change, with clear expectations that the first cut in rates from the ECB will come as early as June. Increasing estimates for GDP growth might help the stock market, but lower inflation and ECB expectations are the real drivers.

Comments from Fed Chair Powell yesterday didn’t exactly give brighter hopes for a pivot from the Fed. Yet Treasury yields are down again today, despite the higher-than-expected PPI yesterday. Showing the market in general is gearing up for interest rate cuts by September in the US also.

We could see an increase in volatility later today after US inflation, especially if there is an unexpectedly higher number. A lower than expected or as forecast number should drive the DAX even higher.

Technical View

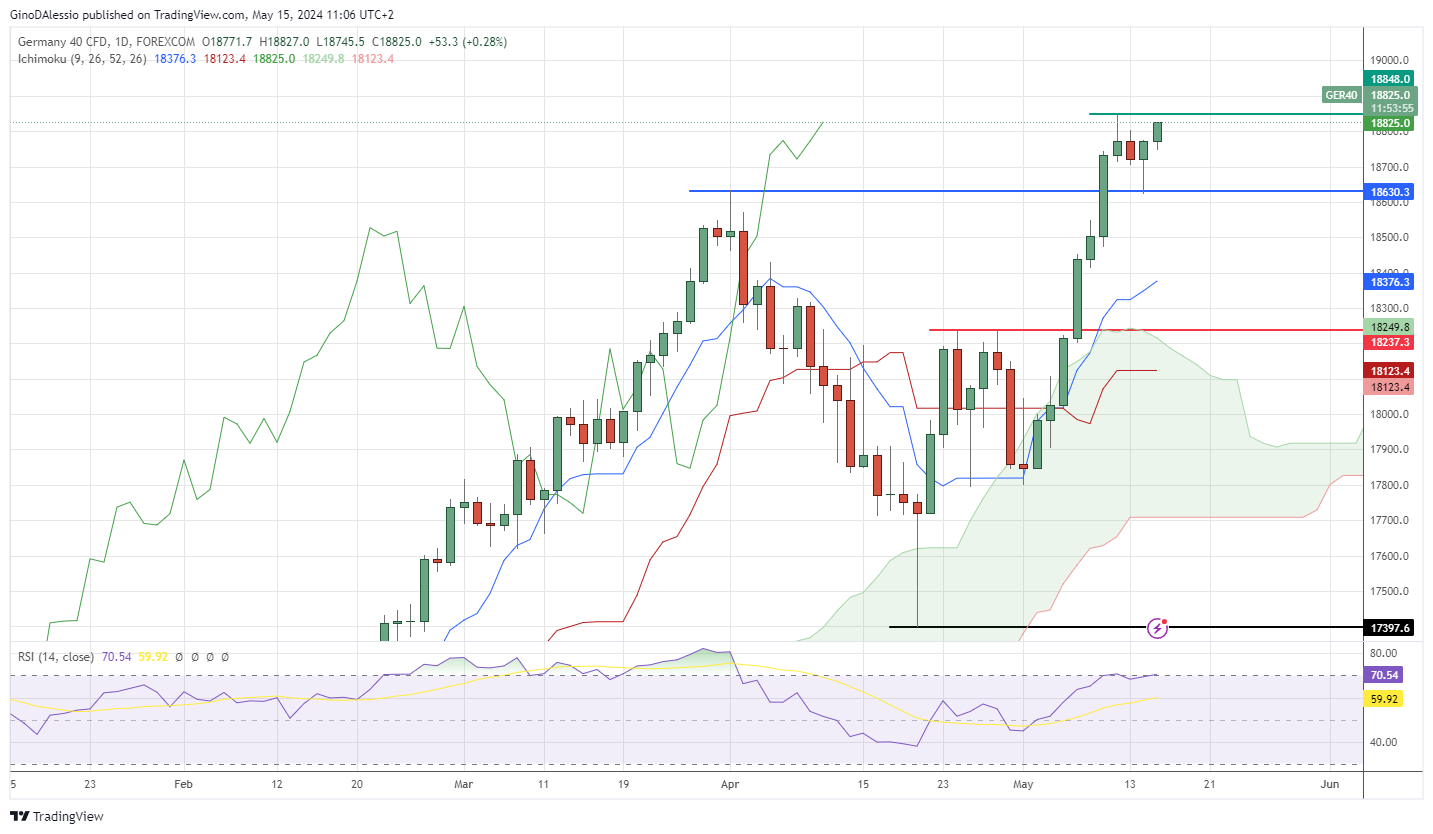

The day chart below for the DAX shows a market in a bullish trend, with today’s green candle looking set to test the all-time high of 18848. The RSI is struggling to close above 70, a close higher than that number would indicate strong bullish momentum.

Whereas a close below would indicate the current leg of this bullish trend is set for a correction. For the bullish trend to regain momentum we would need to see a close above the ATH of 18848, which would indicate bulls are still in control of this market.

To the downside a correction would find support at 18634, a previous high set on April 1, from which the market declined 6.6%.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account