EURUSD Holds Above the 1.08 Resistance After EU Q1 GDP

The EUR to USD rate climbed above 1.08 but stopped again, as traders prepared for the Eurozone Q1 GDP, and US April CPIP inflation.

The EUR to USD rate climbed above 1.08 again yesterday, but the gains slowed at this resistance zone, as traders prepared for the Eurozone Q1 GDP, as well as the US April CPI inflation reports. Both reports were released earlier today, offering considerable volatility for this pair.

EUR/USD has experienced a notable uptrend since April, marking considerable gains. However, this upward momentum has encountered resistance around the 1.08 level, which aligns with significant moving averages on the daily chart. Despite briefly surpassing the 1.08 level earlier this month, EUR/USD faced rejection in the vicinity of the 100-day simple moving average (SMA), subsequently retreating below it. But, yesterday we saw a return above this level where this forex pair closed the day, with buyers afraid to push higher ahead of important economic data today, such as the Eurozone GDP, US Retail Sales and of course the US CPI consumer inflation.

EUR/USD Chart Daily – Yesterday Buyers Pushed Above 1.08

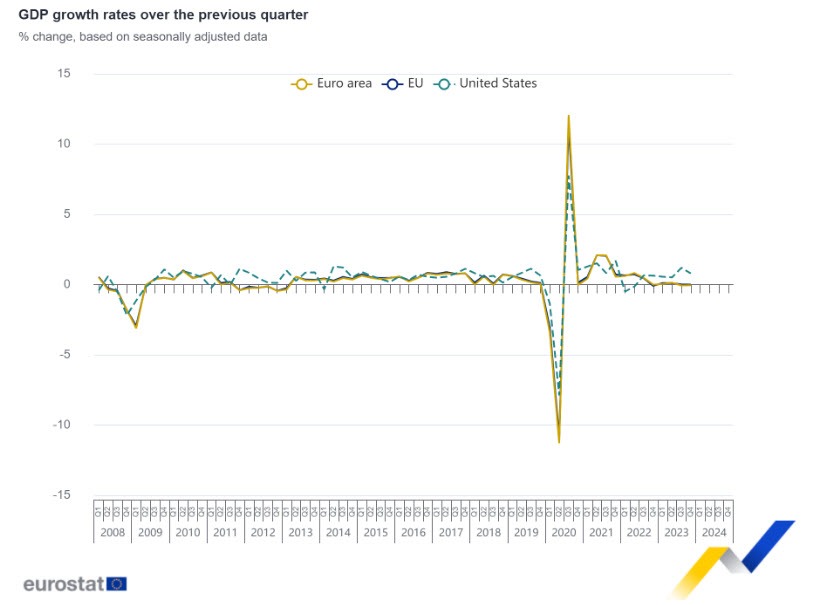

- Q1 GDP second estimate +0.3% vs +0.3% q/q prelim

- Q4 GDP was 0.0%; revised to -0.1%

Eurozone Flash Q1 GDP Report

- March industrial production +0.6% vs +0.5% m/m expected

- March industrial production +0.8%; revised to +1.0%

The details show an increase in capital goods (+1.0%) but that was offset by a decrease in intermediate goods (-0.5%), energy (-0.9%), durable consumer goods (-1.1%), and non-durable consumer goods (-2.7%).

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account