US Unemployment Claims Fall, USD Recovers

The labour market is showing signs of weakness again in the US, with a number of employment reports coming weaker in recent weeks.

The labour market is showing signs of weakness again in the US, with a number of employment reports coming weaker in recent weeks. Besides that, inflation has resumed the decline as the PPI and CPI reports showed this week, so the FED doesn’t have many reasons left to keep interest rates high. Therefore, today’s Unemployment Claims were important after the jump in he previous weeks.

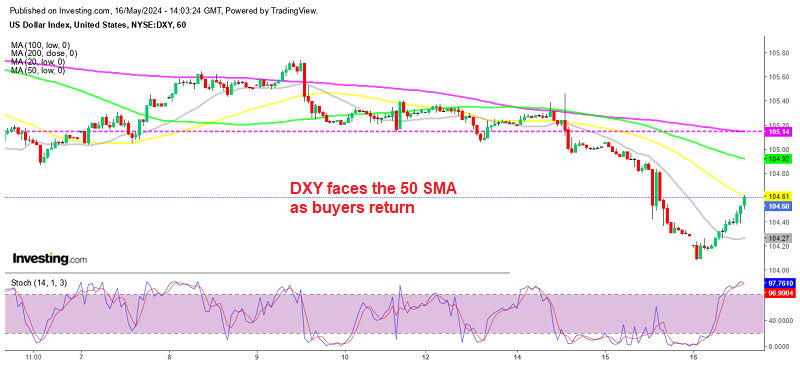

USD Index DXY Chart – Buyers Facing the 50 SMA

Last week’s initial claims figure, which missed expectations. jumped to 231K versus the anticipated 215K, marked the largest jump since August last year. While one instance does not necessarily establish a trend, it did warrant attention by USD traders, especially given recent disappointments in other key economic indicators such as the Non-Farm Payrolls (NFP) report on Friday and lower PPI and CPI inflation numbers.

Job vacancies have been declining aligns which indicates a broader softening of the labor market in 2024. This indicates reduced hiring activity amid economic uncertainties and high FED interest rates. Regarding ongoing claims, the increase to 1.78 million suggests that individuals continue to rely on unemployment benefits, reflecting persistent challenges in the labor market despite efforts to stimulate economic recovery.

The 4-week moving average of continuing claims, which provides a smoother representation of trends by smoothing out fluctuations from week to week, also rose slightly. So, the labour/employment data underscores a negative impact in the labor market and in the conditions on individuals’ livelihoods, therefore today’s Unemployment Claims received a lot of attention.

This week, initial claims were projected to come in at 219K, lower than the previous week’s figure. The consensus for Continuing Claims is for 219K, a slowdown after the unexpected increase in the prior week’s release.

The weekly initial and continuing claims data for the current week

- Initial Jobless Claims:

- Current week: 222,000 claims.

- Estimate: 220,000 claims.

- Prior week: 231,000 claims (revised to 232,000).

- 4-Week Moving Average of Initial Jobless Claims:

- Current: 217,750 claims.

- Previous week: 215,250 claims.

- Continuing Claims:

- Current week: 1.794 million claims.

- Estimate: 1.785 million claims.

- 4-Week Moving Average of Continuing Claims:

- Current: 1.779 million claims.

- Previous week: 1.780 million claims.

Key Takeaways:

- Initial Jobless Claims: Slightly higher than the estimate and the previous week’s revised figure.

- 4-Week Moving Average of Initial Claims: Increased compared to the previous week.

- Continuing Claims: Slightly above the estimate.

- 4-Week Moving Average of Continuing Claims: Marginally decreased from the previous week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account