DAX Declines on Cooling Expectations for Rate Cuts

The DAX looks set to finish the week lower after reaching a new all-time high yesterday.

The DAX looks set to finish the week lower after reaching a new all-time high yesterday.

Expectations on interest rate cuts faded yesterday after the DAX index placed a new ATH. Comments from various FOMC members have dampened outlooks on the pace of a monetary policy pivot.

Several Fed members have stated that the market should not expect rate cuts without support from data. Indicating that interest rates may stay high for longer than previously perceived. Today an ECB policy maker Isabel Schnabel, stated that the pace of future rate cuts would depend only on data.

In the statement given in an interview with Nikkei, the policy maker also said that a second rate cut in July isn’t warranted based on available data. This statement impacted further the Eurozone markets, although the DAX is holding better than other indices, and is down only 0.06% on the day.

Technical View

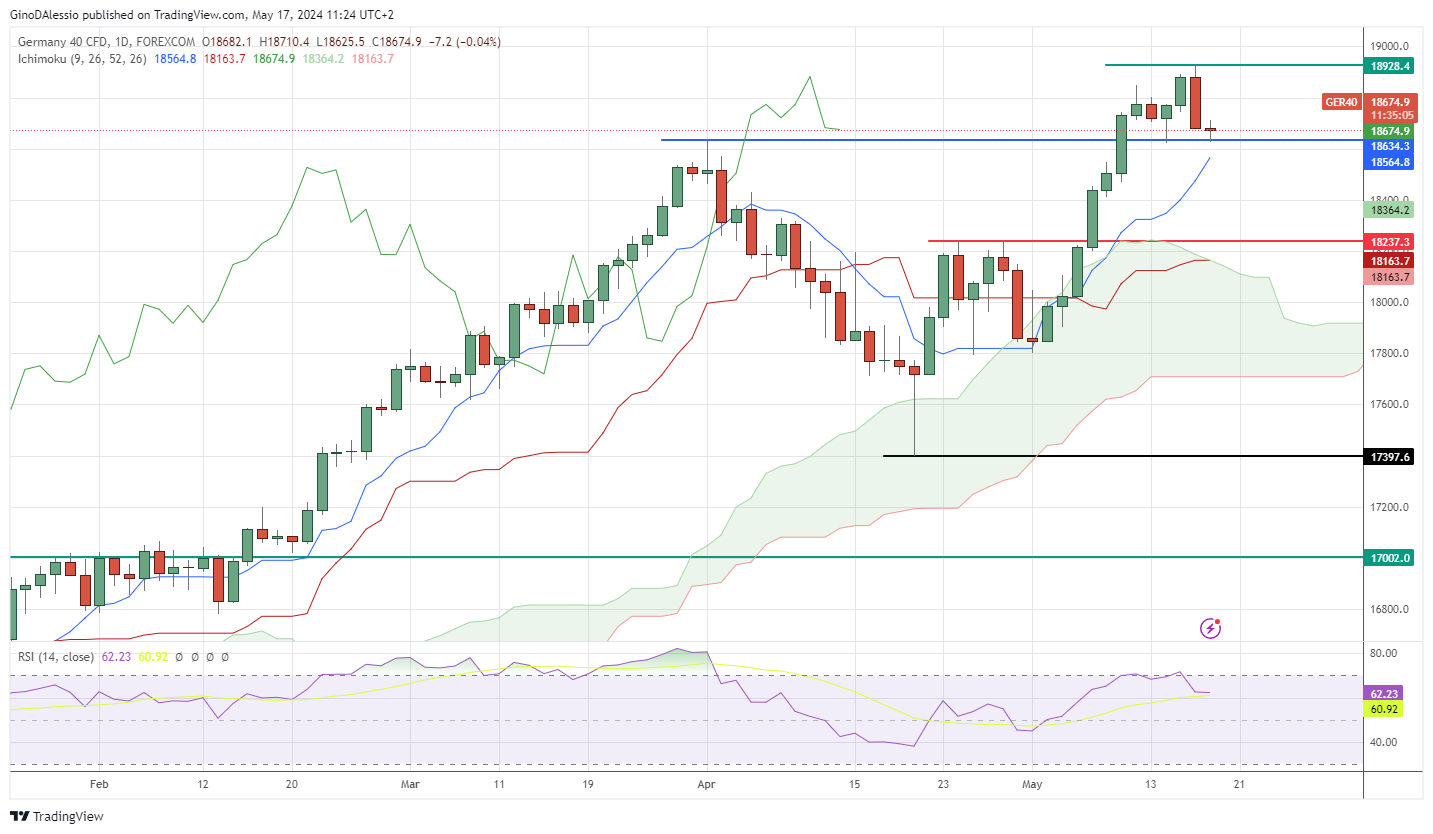

The day chart below for the DAX shows a market undergoing a strong bullish trend. Yesterday’s candle set a new ATH yet closed red. The current candle has found support on the previous ATH from April 1, of 18630 (blue line).

Should that level not hold, then the next support would be at 18237 (red line), with further support just below from the Ichimoku cloud. From the RSI, we can see that it dipped below 70 yesterday after rising above the level the day before.

A close below 70 indicates that the current bullish trend has weakened, and we may see a correction. To see the bullish trend take off again we would need a close above the ATH of 18928.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account