USDCAD Remains in Uptrend After the April CPI from Canada

The USD to CAD rate has been on a downtrend since early April but recently found support at key MAs, suggesting a potential reversal higher.

The USD to CAD rate has been on a downtrend since early April but recently found support at key moving averages, suggesting a potential reversal higher. The release of Canada’s April CPI inflation report earlier today is a critical factor to consider in this context, with the Bank of Canada starting to give hints on rate cuts.

USD/CAD Chart Daily – The 50 SMA Held As Support

USD/CAD Technical Analysis

The recent economic data releases, particularly the unexpected decline in US inflation and retail sales in April, have reignited expectations of a potential interest rate cut by the Federal Reserve. As a result, the likelihood of a rate cut in September has increased to around two-thirds. This development has put pressure on the US dollar, leading to a decline in USD/CAD towards the 1.36 level, where the 50-period Simple Moving Average (yellow) was acting as a support. Sellers attempted to challenge this level multiple times, but the moving average held firm, leading to a rebound in the pair.

Bank of Canada (BoC) Policy Expectations

The upcoming release of the Canadian Consumer Price Index (CPI) data for April, scheduled for Tuesday, will play a crucial role in shaping future interest rate policy by the BoC. Market expectations suggest a 40% probability of the BoC beginning to decrease its policy interest rates from the current 5.0% in June.

Impact on USD/CAD

The CPI data from Canada will have a significant impact on the future direction of USD/CAD. If the data comes in as expected or weaker, it will support the case for a rate cut by the BoC, so it should weaken the Canadian dollar and lead to a decent bounce in USD/CAD. Conversely, stronger-than-expected CPI data could delay rate cut expectations and support the Canadian dollar, potentially leading to the break of the 50 SMA in USD/CAD.

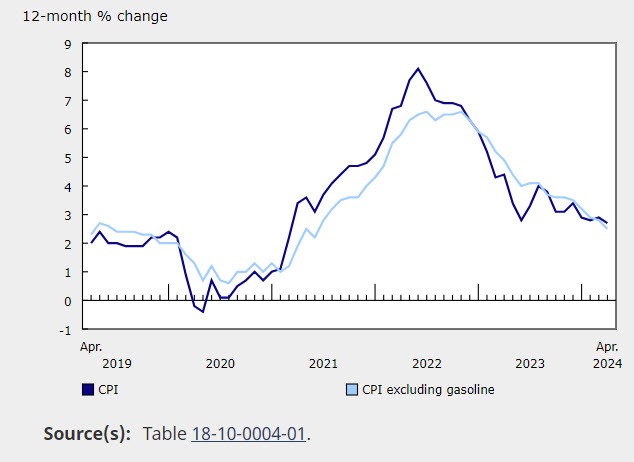

Canada April CPI Inflation Report![Canada CPI]()

- April CPI 2.7% versus 2.7% expected

- March CPI was 2.9%

- CPI MoM 0.5% vs 0.6% estimate

Core CPI Measures

- CPI Bank of Canada core y/y + 1.6% vs 2.0% prior

- CPI Bank of Canada core m/m 0.2% versus 0.5% prior

- Core CPI MoM SA 0.0% vs 0.1% prior (revised to 0.2%)

- Trim 2.9% versus 3.2% prior (was expected at 3.1%)

- Median 2.6% versus 2.9% prior (revised from 2.8%)

- Common 2.6% versus 2.9% prior

- full report click here

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account