Forex Signals Brief May 24: Durable Goods Orders Close the Week

Today the US durable goods orders will close the week, s well as the UK and Canada retail sales.

Yesterday began with New Zealand’s Retail Sales report for Q1, which showed a significant increase, keeping the NZD well supported throughout the day. In the European session, PMI numbers were released for the UK and the euro area. The Eurozone figures were positive, with slightly improved readings in Germany offsetting slower readings in France. This led to the EUR/USD pair closing the day at a low of 1.08.

Meanwhile, in the UK, the statistics weren’t the best, with manufacturing activity finally increasing as the PMI indictor came out of contraction, while the activity in the Services sector on the other hand, slowed last month. But there wasn’t much to worry.

Meanwhile, in the US, initial jobless claims unexpectedly increased to 215K, which was better than the previous week’s figure of 231K. Despite this increase, the job market is still considered strong. Additionally, the S&P/Global flash PMI readings for both manufacturing and services exceeded expectations, with manufacturing at 50.9 points versus a forecast of 50.0, and services at 54.8 versus a projection of 51.3. This positive data sparked a recovery in the greenback and drove rates higher.

Today’s Market Expectations

Today started with the April CPI data from Japan reflects a modest cooling in inflationary pressures, with core measures suggesting a more subdued price environment when volatile components are excluded. National Core CPI (Excluding Food) for April registered a decline to 2.2%, aligning with market expectations. Headline CPI (Consumer Price Index) declined to 2.5% in April from 2.7% in March. Core CPI (Excluding Food and Energy) recorded a decrease to 2.4% in April from 2.9% in March.

In the European session we have the German Q1 Final GDP which is expected to remain unchanged at 0.2%, while the Retail Sales are expected to show a 0.5% decline in the UK for April. After that the Swiss National Bank Chairman Jordan will hold a peach which will likely send the CHF further down.

In the US session, it kicks of with the US Durable Goods Orders, which are expected to show a -0.9% decline in April, but the core order are expected to remain positive at 0.1%. Retail Sales are expected to show a similar picture in Canada, with headline sales expected to decline but core sales expected to turn positive.

Yesterday the volatility increased further, with the USD jumping higher after the PMI data and getting us on the wrong side, since we were long on GBP/USD on EUR/USD , given the recent bullish momentum in both. The stock market also retreated, despite the Nvidia earnings beating expectations.

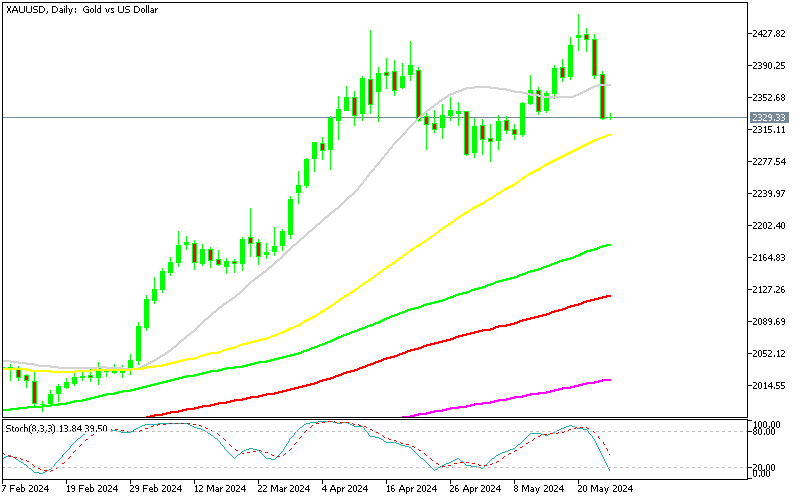

Gold Continues to Retreat Below $2,400

Yesterday the Gold price retreated lower after XAU/USD achieved a significant milestone last week by closing above $2,400 for the first time in history, signaling a potential for further upward movement in the near term. The market’s response to weaker-than-expected CPI data prompted a flight to safe-haven assets, particularly gold, which propelled XAU back towards the $2,400 level. But after a couple of doji candlesticks on the daily chart, the price reversed lower yesterday, as the USD fought back.

XAU/USD – H4 chart

Higher Retail Sales Don’t Save NZD/USD

Commodities, including copper, silver, and gold, have experienced significant declines in the past two days, marking a bearish trend. Despite reaching a recent high of $2,450 earlier this week, gold has seen a decline for three consecutive days, reaching one-week lows. Currently, the XAU/USD pair is trading at $2,332, reflecting a 1.90% decrease from its recent peak. The downturn in gold prices is attributed to favourable US economic data, which has boosted US Treasury yields and strengthened the US dollar.

S&P 500 – Daily Chart

Cryptocurrency Update

Bitcoin Continues to Retreat

Bitcoin recently experienced a price drop to around $61,000, providing investors with an opportunity to buy, as the 100-day Simple Moving Average (SMA) now serves as a support level, aligning with our perspective. Previously, technical indicators like the 20-day and 50-day SMAs acted as resistance, impeding Bitcoin’s upward momentum. However, with these resistance levels surpassed, the 50-day moving average is likely to become a new support level, as observed on the daily chart. Bitcoin’s surge past $70,000 on Monday indicates that its upward trend remains intact despite the retreat of the last three days.

BTC/USD – Daily chart

Closing the Ethereum Signal in Profit

The signals of the SEC’s approval of the Ethereum ETF in January significantly boosted sentiment in the cryptocurrency market earlier this week, however yesterday there wasn’t much reaction after the actual approval. The SEC’s more positive stance on spot Ether ETFs has increased market confidence, leading to Ether reaching a recent high of $3,832.50. Ethereum has sustained its upward trajectory, rising from a low of around $3,000. This rapid growth has propelled Ethereum’s price up by over 25% and yesterday we decided to close our buy Ethereum signal in profit.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account