DAX Rises on Speculation of More Rate Cuts After June

Philip Lane, chief economist ECB, talking to the Financial Times stated that the pace of inflation was declining sufficiently to pave the wa

Philip Lane, chief economist ECB, talking to the Financial Times stated that the pace of inflation was declining sufficiently to pave the way for further monetary easing after June.

The ECB moving on interest rates before the Fed could devalue the Euro, which would create inflationary pressure. However, Lane said that it would take a considerably large move in the FX rate for inflation to pickup again in a meaningful way.

He also mentioned that the impact from the interest rate differential may be short lived. Citing indications that the economy in the Eurozone is expanding, while the US economy is showing signs of contraction.

The central bank has been concerned about wage growth, which could create inflationary pressure. However, the chief economist sees evidence that overall wage growth is contained:

“Looking at the full detail, the overall direction of wages still points to deceleration, which is essential.” Adding “So, we are a step along this journey.”

Lane continued to say that further rate cuts would be on the table going into 2025 as inflation settles closer to the ECB target of 2%.

“Next year, with inflation visibly approaching the target, then making sure the interest rate comes down to a level consistent with that target; that will be a different debate,” he said.

The chief economist’s words are very bullish, although most Eurozone indices felt little for it. Yet they are still indicative of what is going on within the ECB and how monetary policy may look like throughout 2024/25.

Technical View

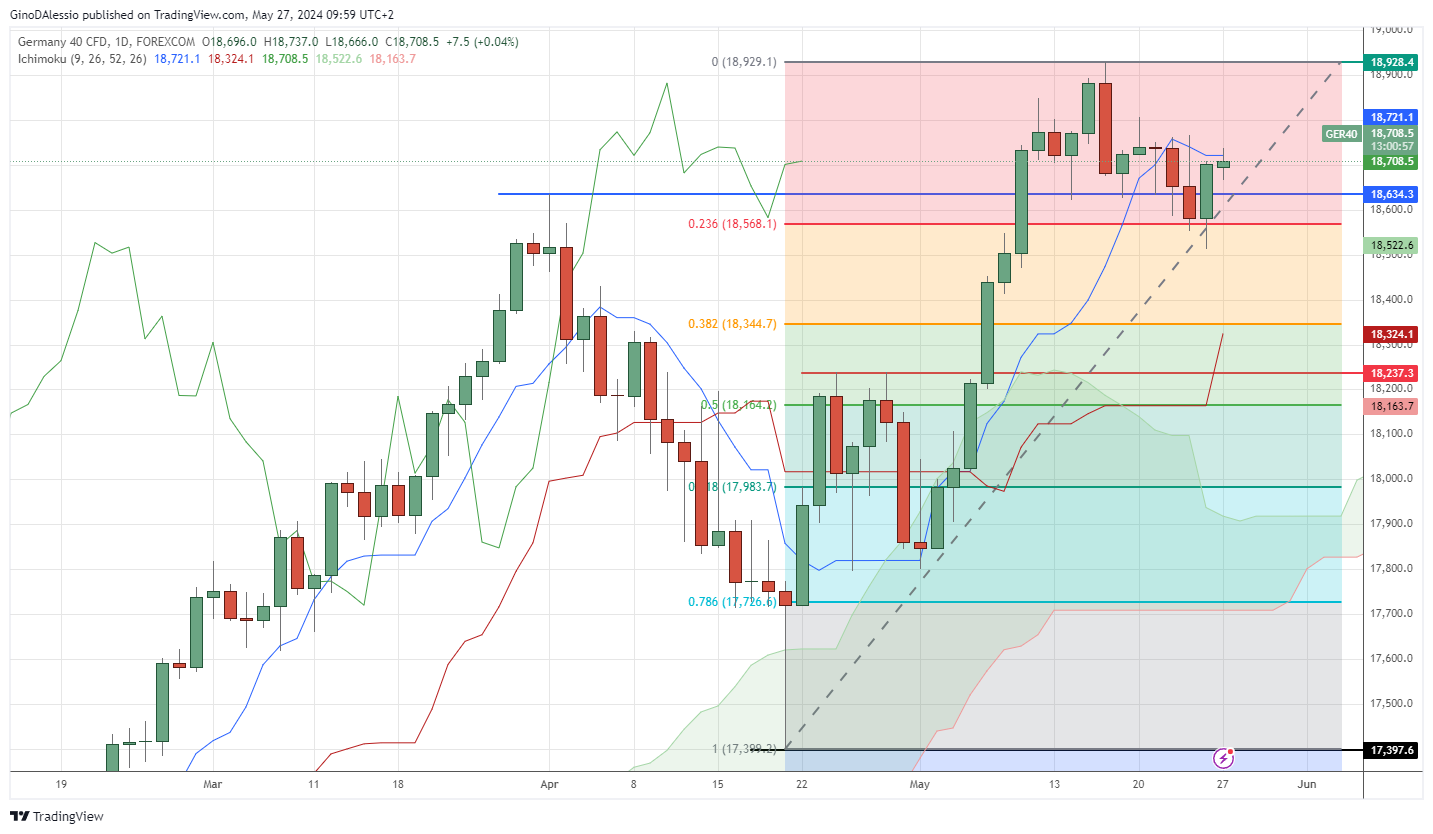

The chart below for the DAX shows a market in a bullish trend, where the current leg is correcting lower. The previous 2 candles dipped below the support level of 18,634 (blue line). However, yesterday’s candle already closed above it, indicating this correction may have ended.

The previous two candles also closed and opened on the Fibonacci retracement level of 0.236 or 18,568 (redline). The bounce on the support level may indicate further momentum higher, which would be met with resistance at the all-time high of 18,928.

To the downside, we would need to see a close below the 0.236 support level, and the next support from the Fibonacci system would be the 0.382 support level of 18,344 (yellow line).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account