EURGBP Sellers Hesitate at the 0.85 Support

For a year, EURGBP has been trading within a narrow range of 0.65 to 0.6850, reflecting a period of market consolidation and hesitation.

For a year, EURGBP has been trading within a narrow range of 0.65 to 0.6850, reflecting a period of market consolidation and hesitation. There have been attempts on both sides, but neither side has prevailed so far. The trading range suggests that the market has been indecisive, but recent buying activity near the upper limit of the range indicates that buyers are attempting to push the exchange rate higher.

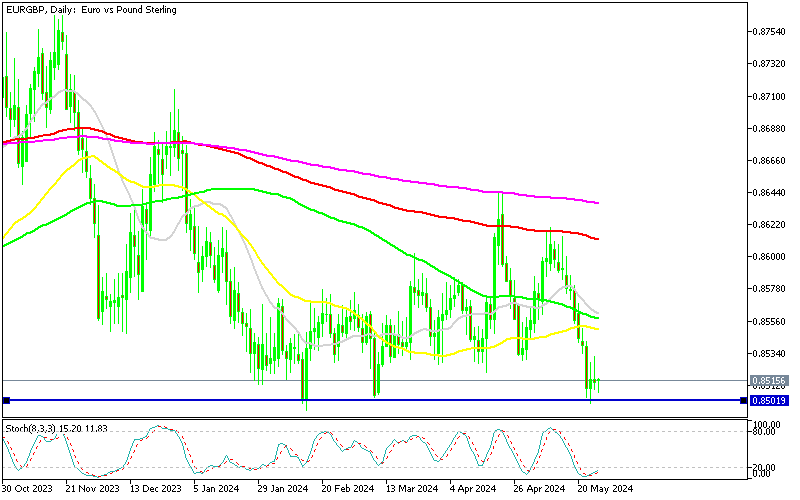

EUR/GBP Chart Daily – The Support at 0.85 Continues to Hold

The attempts to break above the 0.6850 level suggest a growing bullish sentiment among traders. If the EUR/GBP pair manages to sustain a move above this resistance level, it could signal the start of a new upward trend, breaking out of the consolidation phase that has characterized the market for the past several months. Traders should watch for a confirmed break above 0.6850 with increased volume to validate this potential bullish breakout.

On the EUR/GBP daily chart, the 200-day Simple Moving Average (SMA) (represented by the purple line) has acted as resistance since the spike to 0.8645. Prior to this, the 100-day SMA (green) had been functioning as a barrier until it was breached in mid-April. The recent price action shows a reversal at these technical levels, suggesting that the 100-day SMA (green) is now acting as resistance.

Last week EUR/GBP touched 0.85 on Wednesday but the support held and it reversed higher to about 0.8532 as the Euro gained some ground on the back of the better-than-expected Eurozone Preliminary Manufacturing Purchasing Managers Index (PMI). The contraction of the manufacturing sector in the Eurozone improved to 47.4 points in May from 45.7 points in April. This reading above the anticipated value of 46.2 points and reached a 15-month high.

However, the bounce didn’t materalize after the UKP MI data in the contributed to the pound sterling’s (GBP) stability. After improving to 51.3 points in May from 49.1 points in April, the seasonally adjusted UK Manufacturing Purchasing Managers’ Index (PMI) signalled the end of the recession in this sector. Today we had the German Ifo Business Climate index which was expected to continue to improving trend.

German Ifo Business Climate![DEIFO]()

- May Ifo business climate index 89.3 points vs 90.4 points expected

- Prior 89.4 points; revised to 89.3 points

- Current conditions 88.3 points vs 89.8 points expected

- Prior 88.9 points

- Expectations 90.4 points vs 90.9 points expected

- Prior 89.9 points; revised to 89.7 points

The headline index for the Eurozone Preliminary Manufacturing PMI matches the revised April reading, which came in slightly below expectations. Despite the softer-than-anticipated results, there is an encouraging aspect within the data: the expectations/outlook index continues to indicate a positive future outlook. This suggests that, while current conditions may be challenging, there is optimism about improvements in the manufacturing sector moving forward.

EUR/GBP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account