EURUSD Retreat Accelerates As German Inflation Falls

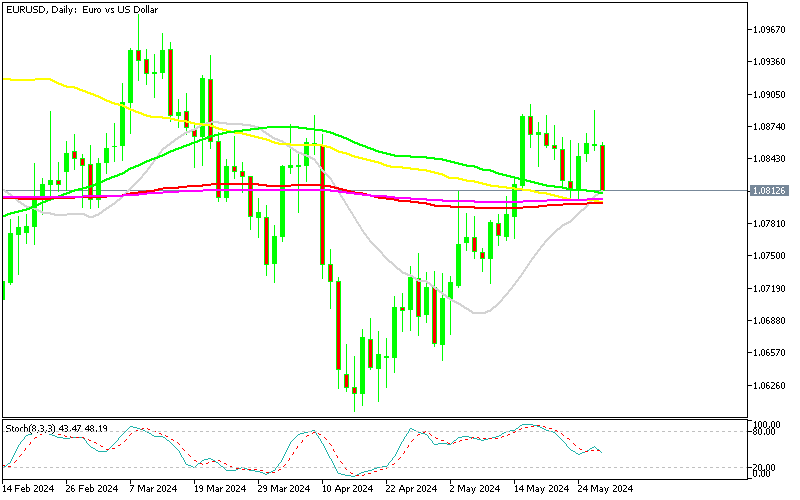

Yesterday the EUR/USD pair achieved a new weekly high of 1.0889, but it pulled back down and closed the day with a doji candlestick.

Yesterday the EUR/USD pair achieved a new weekly high of 1.0889, but it pulled back down and closed the day with a doji candlestick. The upside was driven by a weakening US dollar (USD) and increasing uncertainty about the pace at which the European Central Bank (ECB) will reduce key interest rates following its June meeting, since a 25 bps cut in June is a done deal.

EUR/USD Chart Daily – Yesterday’s Doji Candlestick Indicates A Reversal

This upward movement in the main currency pair followed the market sentiment, favoring the euro amidst these factors. A significant upcoming event is the release of the US core Personal Consumption Expenditure (PCE) price index data for April which is scheduled for Friday. This data is expected to remain stable on both a monthly and annual basis. As the Fed’s preferred measure of inflation, the PCE data will be crucial in shaping market expectations regarding potential rate cuts.

However, market participants are trading other important economic data releases in the meantime. Notably, the German Consumer Price Index (CPI) report for April, released earlier today, provided further insights into inflation dynamics within the Eurozone’s largest economy, which has significant implications for the EUR/USD pair, influencing traders’ perceptions of future monetary policy moves by the ECB after the first interest rate cut.

German State Inflation Numbers – 29 May 2024

Destatis has released the CPI data for various German states for May 2024. Here are the key figures:

- Bavaria: CPI increased by 2.7% y/y, up from the previous 2.5%.

- Hesse: CPI remained steady at 1.9% y/y, unchanged from the prior month.

- Brandenburg: CPI decreased slightly to 2.9% y/y from the previous 3.0%.

- North Rhine Westphalia: CPI rose to 2.5% y/y, compared to 2.3% in the prior period.

- Baden Wuerttemberg: CPI stayed constant at 2.1% y/y, the same as the previous month.

- Saxony: CPI increased significantly to 3.1% y/y from 2.7%.

Key Takeaways

- Rising Inflation in Key States: Notable increases in CPI were observed in Bavaria and Saxony, suggesting that inflationary pressures are growing in these regions.

- Stable Inflation in Some Regions: States like Hesse and Baden Wuerttemberg showed stable inflation rates, indicating regional variations in price dynamics.

- Decreased Inflation in Brandenburg: A slight decrease in CPI was seen in Brandenburg, which contrasts with the overall trend of rising inflation in other states.

Implications for ECB and Market Sentiment

- European Central Bank (ECB) Policy: The mixed inflation data across German states adds complexity to the ECB’s policy outlook. With some regions experiencing higher inflation, the ECB might be cautious about easing monetary policy too soon, despite pressure to support economic growth.

- Market Reaction: The variations in state inflation figures could lead to increased market volatility as investors assess the implications for future ECB rate decisions. Higher-than-expected inflation in several states may temper expectations for immediate rate cuts.

- Euro (EUR) Movement: The Euro could experience some volatility as traders digest the inflation data. Higher inflation readings in key states like Bavaria and Saxony might support the Euro in the short term due to the potential for a more hawkish ECB stance.

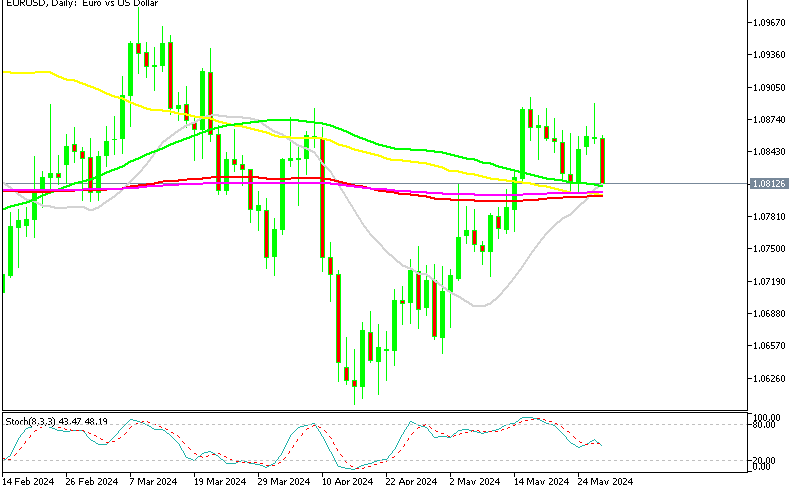

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account