Bearish Chart Pattern Unfolds in AUDUSD As Sentiment Sours

Since April, the USD to AUD exchange rate has been in a bullish trend; however, this week we're seeing a bearish reversal.

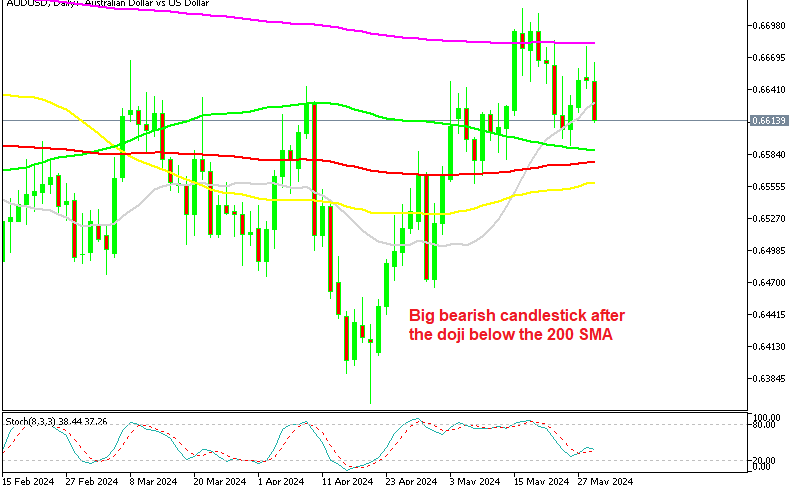

Since April, the USD to AUD exchange rate has been in a bullish trend; however, the pair’s inability to surpass the 200-day Simple Moving Average (SMA) on Tuesday triggered a negative reversal yesterday. The daily chart shows that buyers have repeatedly attempted, but failed, to push the exchange rate above this key technical level, resulting in a price decline.

AUD/USD Chart Daily – Forming A Bearish Reversing Patter at the 200 SMA

Despite the release of higher-than-expected Australian CPI inflation data yesterday, which showed an uptick in April, the AUD did not strengthen significantly. This weakness can be attributed to a muted risk appetite, which has kept commodity-linked currencies like the AUD bearish. At the same time, US Treasury rates and the USD have remained strong, maintaining pressure on the AUD.

In April, the Australian Consumer Price Index (CPI) registered a year-over-year (y/y) increase of 3.6%, surpassing both the previous reading of 3.5% and the consensus forecast of 3.4%. On a month-over-month (m/m) basis, the CPI grew by 0.76%. Additionally, the trimmed mean CPI, which excludes volatile items, rose to 4.1% y/y from 4.0% in the previous month. Excluding volatile goods and vacation expenses, the CPI remained steady at 4.1% y/y. But, apart from a small reaction the higher numbers didn’t help the Aussie much, which continued down, with AUD/USD falling to 0.66 lows.

Today we had the RBA Assist Governor Hunter hold a speech early in the Asian session, followed by the Building Approvals and Private Capital Expenditure from Australia for April.

Comments from RBA Vice President and Head Economist Hunter

- Treasury Forecast on Inflation: If the Treasury forecast aligns with your views, it suggests that you anticipate inflation to remain within a certain range or to follow a particular trajectory based on economic factors.

- CPI Confirmation of Price Strength: The Consumer Price Index (CPI) measures changes in the prices paid by consumers for goods and services. If CPI data confirms strength in certain price sectors, it indicates inflationary pressures in those areas.

- RBA Focus on Inflation: The Reserve Bank of Australia (RBA) plays a crucial role in managing monetary policy in Australia. If the RBA is keen on keeping inflation within a specific target range, it suggests a commitment to price stability and economic health.

- Strength in Inflation: Your acknowledgment of strength in inflation implies that you perceive inflationary pressures in the economy, which can have implications for monetary policy, consumer purchasing power, and overall economic stability.

- Peak in Wages Growth: If you believe that wages growth is around its peak, it suggests that you expect wages to either stabilize or slow down from their current rate of growth. This could impact consumer spending, inflation dynamics, and overall economic activity

The Australian Q1 Capex (Capital Expenditure) data exceeded expectations, with a quarter-on-quarter (q/q) increase of 1.0%, surpassing the expected growth of 0.5%. This marks a positive sign for investment in the Australian economy.

Components from the Australian Q1 Capex Capital Expenditure

- Plant and machinery capex saw a significant increase of 3.3% q/q, indicating robust investment in equipment and machinery, compared to the prior quarter where it experienced a slight decline of -0.1%.

- However, building capex showed a decrease of -0.9% q/q, reversing the positive growth trend seen in the prior quarter (+1.5%). This decline suggests a slowdown in investment in building construction projects during the quarter.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account