German 30 (DAX) Price Decline to $18,475 Despite Positive CPI Data; What’s Next?

Despite the release of May's German CPI data, which was slightly better than expected, the DAX index experienced a decline of 0.96%

Despite the release of May’s German CPI data, which was slightly better than expected, the DAX index experienced a decline of 0.96% on Wednesday, closing at 18,566 and hitting an intraday low of 18,492.

This upbeat data had minimal impact on bolstering the DAX, as investors maintained cautious stance regarding the broader economic landscape and the potential for upcoming interest rate adjustments by the European Central Bank (ECB).

Moreover, the bullish US dollar, backed by the upbeat US economic data and Fed hawkish stance, was seen as another key factor that put pressure on the DAX index as it reduces demand for European stocks, including DAX.

DAX Index Remains on Backfoot Despite German HICP Beating Estimates

On the data front, the German Harmonized Index of Consumer Prices (HICP) rose by 0.2% in May, aligning with expectations. Annually, the HICP increased strongly to 2.8%, surpassing the consensus of 2.7% and the previous reading of 2.4%.

Despite this positive inflation data, the DAX index remained on the back foot. ECB policymakers, such as Dutch central bank chief Klaas Knot, have advised a gradual approach to rate cuts, suggesting decisions should be made based on quarterly economic projections.

Knot highlighted the need to consider dynamic factors such as inflation, demand, and wage growth.

With recent data showing elevated wage growth and an improved Manufacturing PMI, the anticipated rate-cut path based on March projections has been undermined. This uncertainty regarding the ECB’s future actions has kept the DAX under pressure.

US Dollar Renewed Strength Amid Lower Fed Rate Cut Expectations

On the US front, the DAX index’s decline was further bolstered by the strong recovery of the US dollar.

However, the previously released positive economic indicators from the United States and the Federal Reserve’s reluctance to cut interest rates soon have boosted the dollar.

The US Dollar Index (DXY), which measures the dollar against six major currencies, climbed to 104.80. This recovery was driven by traders adjusting their expectations and reducing the probability of a Fed rate cut in September.

Meanwhile, anticipation of steady growth in the upcoming US core Personal Consumption Expenditure (PCE) data has supported the dollar’s position.

This strong dollar, coupled with lower expectations of Fed rate cuts, has contributed to the downward trend in the DAX index, as global market dynamics and currency strength play a significant role in investor decisions.

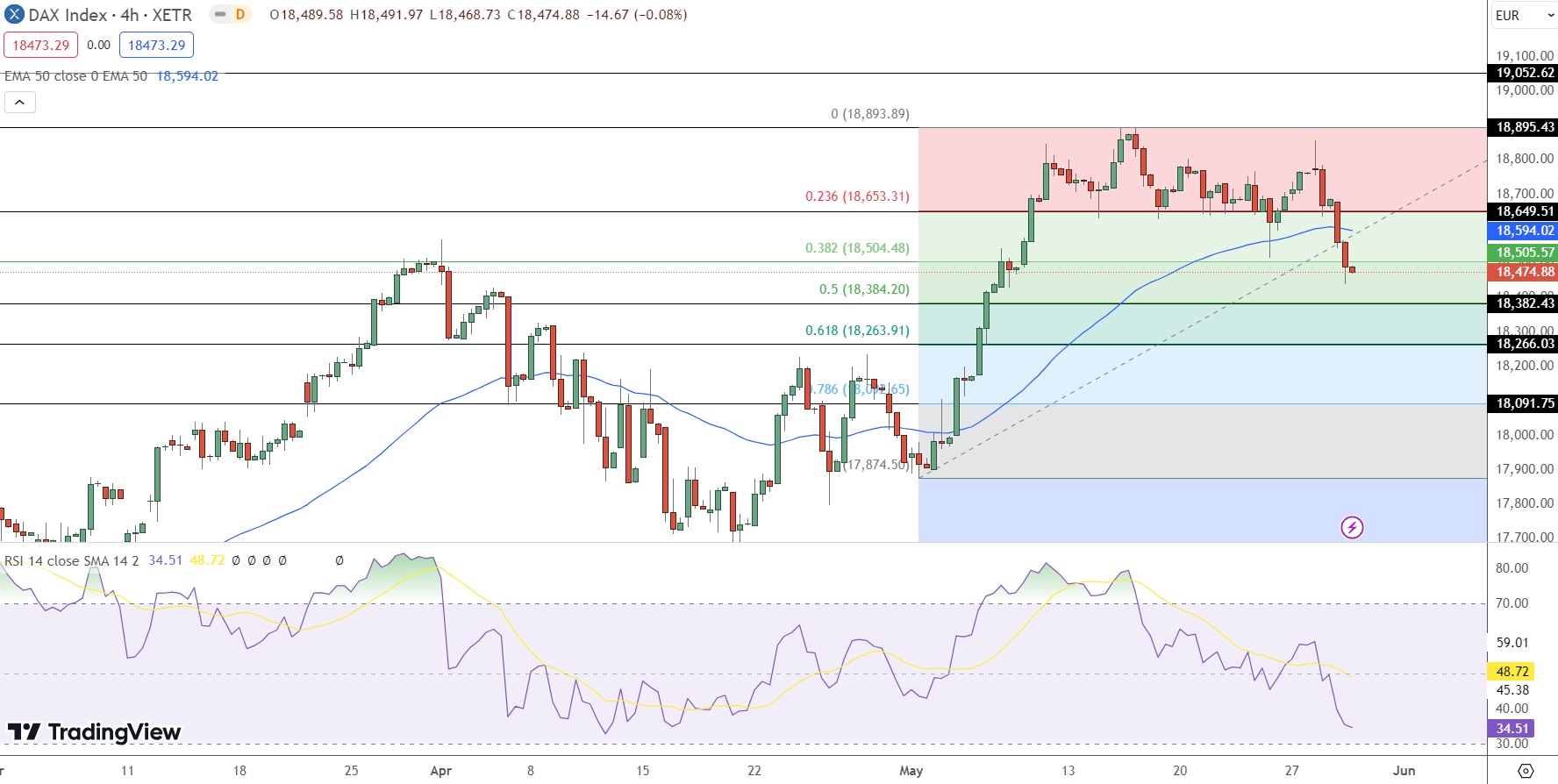

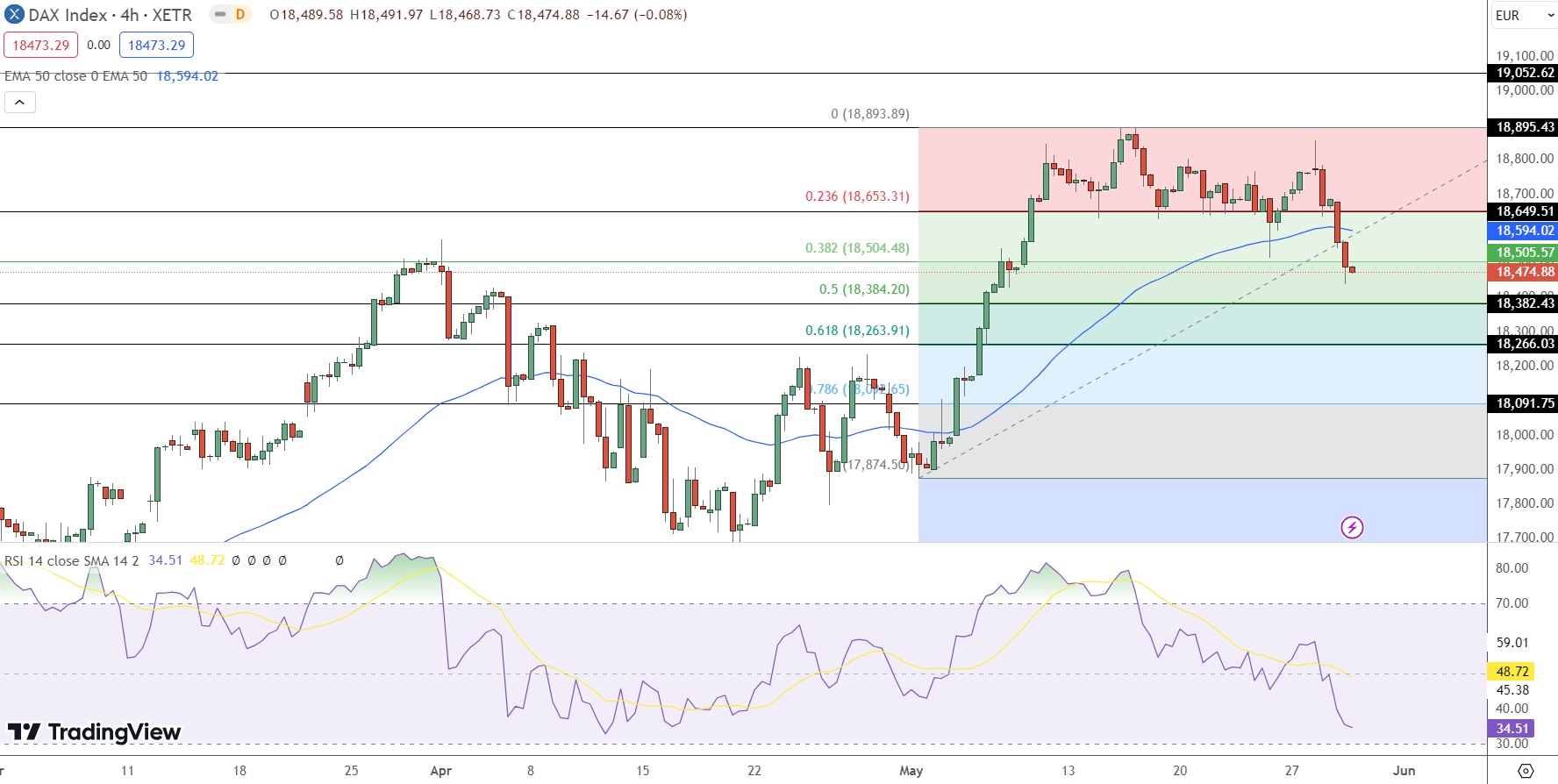

German 30 (DAX) Price Forecast: Technical Outlook

The German 30 (DAX) index is currently trading at $18,474, down 1.10%. The pivot point, marked in green, is $18,505.57, a critical level indicating potential market direction. Immediate resistance levels are found at $18,649.51, $18,895.43, and $19,052.62.

On the downside, key support levels are at $18,382.43, $18,266.03, and $18,091.75.Technical indicators show that the Relative Strength Index (RSI) is at 34, suggesting bearish momentum.

The 50-day Exponential Moving Average (EMA) stands at $18,594.02, which also supports a bearish outlook as the current price is below this level.

Given these technical insights, the DAX is likely to remain bearish below the pivot point of $18,505.57. A break above this level could shift the sentiment to a bullish bias, while staying below it may continue to drive the index lower, targeting the immediate support levels.

In conclusion, the DAX shows a bearish trend below the pivot point of $18,505.57, with potential support at $18,382.43 and further declines possible if it breaks this level.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account