DAX: Gets Boost from Strong China Manufacturing PMI at the Open

China Manufacturing PMI hit a 2-year high giving Asian stocks momentum, the Nikkei rising 1.10% and the Hang Seng 2.37%.

China Manufacturing PMI hit a 2-year high giving Asian stocks momentum, the Nikkei rising 1.10% and the Hang Seng 2.37%.

The Caixin China General Manufacturing PMI rose for the 4th consecutive month to 51.7 from 51.4 in April. The data has created an improved economic sentiment after months of concerns deriving from real estate woes and export declines.

While Eurozone inflation was higher than expected on Friday, a lower PCE MoM and a YoY reading as forecast helped keep stock markets buoyant. Today’s open for the DAX was bullish on the back of the Asian stock market rally.

The sentiment faded quickly as the market perception leaned more towards the risk of interest rates staying high for longer. The DAX was up by 0.60% shortly after the open but lost that ground and is down 0.01% at the time of writing.

Technical View

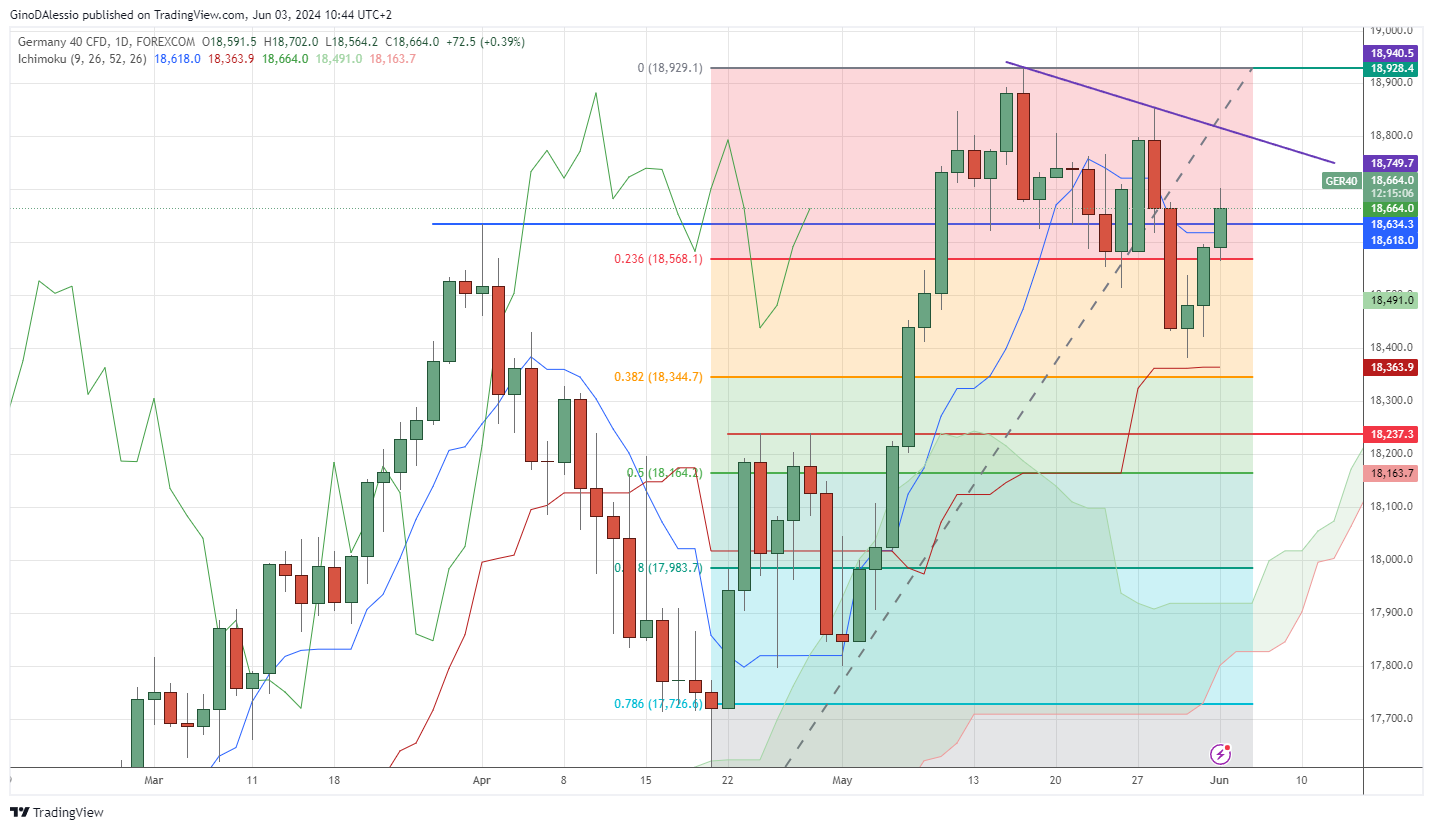

The day chart below for the DAX shows a bullish long-term trend undergoing a correction. The all-time high on May 16, of 18,928 led to a retracement of 2.9% at 18,381. From here the market has attempted to rally again, but for the bullish trend to continue we need to see the market close above 18,928.

Today’s candle bounced off the support of the Fibonacci 0.236 retracement level of 18,568. The next resistance is the trend line of the recent highs (purple line) at 18,810. The immediate support is at 18,634, which is a previous high from April 1.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account