Forex Signals Brief June 4: JOLTS Jobs to Continue Slowing Trend

Yesterday the soft US ISM manufacturing sent the USD 100 pips lower, while today JOLTS job openings are expected to fall again.

Yesterday was a manufacturing day, starting with a slight improvement in Chinese Caixin manufacturing, which was welcomed by markets, while European manufacturing remained little changed. In the US session, we saw a disappointing May ISM manufacturing report, which registered at 48.7 points, down from 49.6 points in April, which left the US Dollar (USD) soft throughout the day.

This marks a continuing trend of underperformance in the manufacturing sector, which has only seen one month of growth in March. The market is particularly sensitive to these signals of slower growth, as it balances the implications for inflation and potential economic downturns. There is a delicate equilibrium between achieving slower growth to curb inflation and avoiding growth that is too sluggish, which could lead to increased unemployment and a more severe economic contraction.

In Canada, the Canadian Dollar (CAD) has been the weakest among major currencies. This is due in part to a $4 drop in crude oil prices following an OPEC+ summit that failed to boost prices. Additionally, weaker manufacturing data has compounded the negative outlook ahead of the Bank of Canada’s rate announcement on Wednesday. In the stock market, Nvidia saw its shares rise by about 5%, while Gamestop experienced a significant surge, with its stock climbing 21% to reach $40.50.

Today’s Market Expectations

Today, the Swiss Consumer Price Index (CPI) release is anticipated to show a month-on-month increase to 0.4% from the previous reading of 0.3%. In the previous release, the year-on-year rate surpassed expectations, coming in at 1.4% compared to the projected 1.1%, although it remained within the Swiss National Bank’s (SNB) estimates. he possibility of a rate cut in June is currently uncertain, with market sentiment split. A downside surprise in the CPI data could increase confidence in another rate cut by the SNB. SNB Chairman Jordan’s remarks suggest that if increased threats to Swiss inflation emerge, they may be associated with a lower Swiss Franc. In such a scenario, the SNB could intervene by selling foreign exchange reserves to support the currency.

The upcoming US Jolts Job Openings report is forecasted to show a decrease to 8.350 million, down from the previous reading of 8.488 million. The latest data suggests a continued decline in job openings as the labor market gradually stabilizes and improves its balance. The anticipated decrease in job openings indicates a gradual improvement in the labor market conditions. While the decline may signal a reduction in available positions, it also reflects a shift towards a more balanced job market. The quits rate, which measures the rate at which employees voluntarily leave their jobs, has fallen to a new cycle low. This trend is typically associated with tightening labor market conditions and may precede an increase in wage growth. Higher wages can contribute to inflationary pressures in the economy.

Yesterday, the May manufacturing data was released, and markets became highly active, with the USD and bond yields plunging on the disappointing readings for the US ISM manufacturing index. We were able to capitalize on opportunities, resulting in a net positive outcome of 5 winning forex signals out of 7 trades across forex, commodities, and stock markets.

The 200 SMA Forcing Gold into Lower Highs

Over the last two weeks, the gold price has failed to resume its upward trend. After achieving a record high of $2,450 on May 20, the XAU/USD pair reversed and has since traded in the lower half of the $2,300 range, with moving averages consistently pushing highs lower. Yesterday’s Asian session saw gold prices slump to a three-week low of $1,915 per ounce. However, the price rallied with the announcement of lower-than-expected US ISM manufacturing and ISM manufacturing prices data. However, the 200-day Simple Moving Average (SMA) has frequently blocked upward momentum, and it provided resistance again yesterday, forming a bearish reversal pattern, prompting us to open a sell Gold signal.

XAU/USD – H1 chart

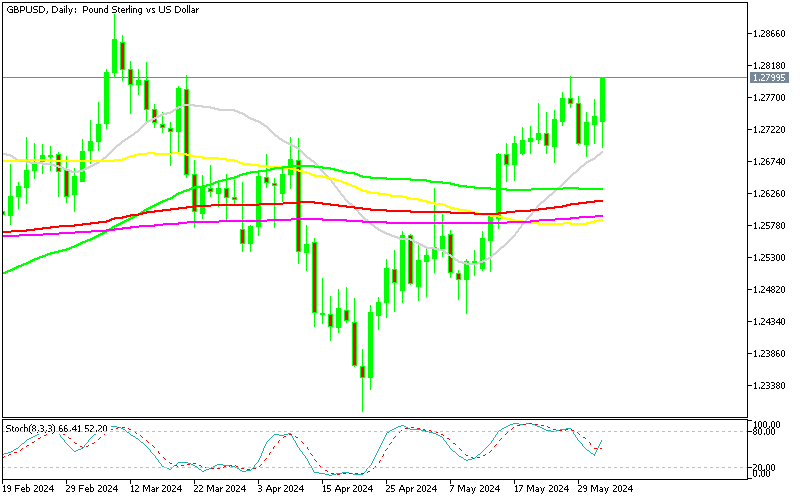

GBP/USD Returns to 1.28 Pretty Fast

The GBP/USD rate has been rising for the past two months, demonstrating the British pound’s strength against the US dollar. However, last week, the pair hit severe resistance above 1.28, forcing the price to fall below 1.27. Despite this fall, the GBP/USD pair regained support at the 20-day Simple Moving Average (SMA), recovered, and reclaimed the 1.28 level yesterday.

AUD/USD – Daily Chart

Cryptocurrency Update

Bitcoin Bounces Off the 20 Daily SMA

Bitcoin’s long-term uptrend remains intact, with the 100-day Simple Moving Average (SMA) serving as a crucial support level. While technical indicators like the 20-day and 50-day SMAs have historically restrained Bitcoin’s upward momentum, recent price action on the daily chart indicates a breakthrough above these resistance levels. This breakout suggests that the 50-day SMA may now act as a new support level moving forward. Despite experiencing a brief three-day decline, Bitcoin maintained its overall upward trajectory on Monday, surpassing the significant $70,000 milestone. This successful breach of key resistance levels reflects a prevailing optimistic sentiment in the market. However, following this surge, Bitcoin’s price retreated below the $70,000 mark and is currently consolidating. This consolidation phase indicates a period of price stabilization and indecision among market participants. yesterday we saw a bounce off the 20 SMA, which sent the price above 70K, but it stalled there.

BTC/USD – Daily chart

Ethereum Consolidates Below $4,000

The recent boost in confidence caused by the SEC’s more favorable stance on spot Ether ETFs has propelled Ether (ETH) to a record high of $3,832.50. This substantial increase from its previous high of around $3,000 marks a remarkable 25% rise in Ethereum’s value. Capitalizing on this upward momentum, we profitably closed our Ethereum buy signal yesterday. The approval of the Ethereum ETF is seen as a significant milestone, likely to drive increased institutional investment and broader adoption of Ethereum. This development is expected to enhance market stability and liquidity, further pushing prices higher. The current upward trend in Ethereum, fueled by the ETF news, reflects high market confidence and strong investor demand.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account