EURUSD Below 1.08 Despite Lower NY FED Inflation Expectations

The strong NFP numbers sent EURUSD down by 100 pips on Friday, but yesterday we saw a climb higher after lower NY FED inflation expectations

The strong NFP statistics sent EURUSD down by 100 pips on Friday, while the right-leaning European Parliament elections pushed this pair even lower. The price ended up 50 pips lower after opening with a negative gap on Monday morning, with EUR/USD falling to 1.0732. However, the price was crawling higher yesterday, with Christine Lagarde comments helping the Euro, as well as some USD weakness.

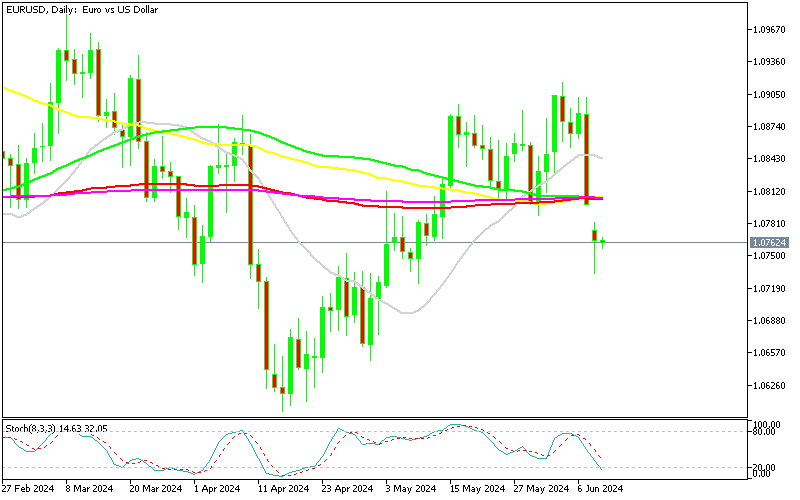

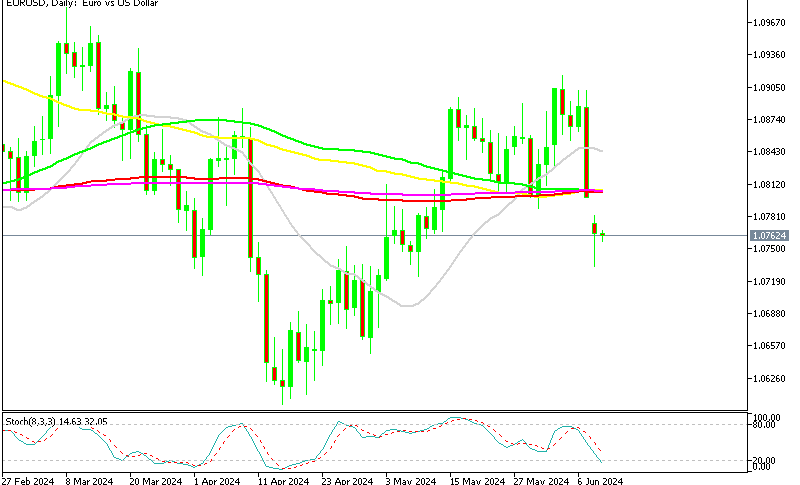

EUR/USD Chart Daily – Trading Below MAs

The outcome of the European elections, in which Liberals and Greens lost significant ground, has increased political uncertainty in the region, putting additional pressure on the EUR/USD exchange rate. However, ECB President Lagarde’s comments yesterday, which confirmed the words from the ECB meeting and implied no commitment to future cuts, were bullish for the Euro.

Yesterday, EURUSD exhibited a trading range between 1.0732 and 1.0767. Buyers entered the market after a significant decline on Friday, and the gap in trading on Monday morning prevented further downside movement in the pair.

Following this rebound, the price approached retracement objectives near 1.0767. However, the upward momentum seemed feeble, and the price struggled to surpass the 1.08 level. Moving averages positioned as resistance on retest further contributed to this resistance.

Besides that, the May inflation expectations from the New York Federal Reserve weighed on the USD, which lent support to this forex pair. The NY FED lower inflation expectation which were lower that the previous ones, area negative factor for the USD, as lower inflation pushes the FED toward cutting interest rates.

NY Fed May Inflation Expectations

1-Year Inflation Expectations:

- Falling Trend: One-year inflation expectations decreased slightly from 3.3% to 3.2% in May, indicating a slight decline in short-term inflation projections.

3-Year and 5-Year Inflation Expectations:

- Stability and Rise: Three-year inflation expectations remained unchanged at 2.8%, while five-year inflation expectations rose from 2.8% to 3.0%. This suggests relative stability in medium-term projections but a modest increase in longer-term inflation expectations.

Median Home Price Growth Expectations:

- Steady Outlook: Median home price growth expectations remained at 3.3%, indicating a consistent outlook for the housing market.

Year-Ahead Price Expectations:

- Sector-Specific Changes: Expectations for gas and food prices remained unchanged, while rent expectations stayed steady. However, there were notable changes in expectations for medical care and college costs.

Labor Market Expectations:

- Earnings Growth: Median expected earnings growth for one year remained stable at 2.7%.

- Unemployment: Mean unemployment expectations rose slightly from 37.2% to 38.6%, suggesting increased pessimism about job prospects.

- Job Leaving and Finding: Probability of job loss decreased, while voluntary job leaving and the probability of finding a new job both increased, indicating mixed sentiments about labor market dynamics.

Household Finance Expectations:

- Income and Spending: Expected household income growth slightly increased, while expected household spending growth decreased, reflecting cautious consumer sentiment.

- Credit Access and Debt Payment: Perceptions of current credit access remained unchanged, but future credit access is expected to tighten. Probability of missing a debt payment decreased, indicating improved financial stability.

- Tax and Government Debt: Expectations for year-ahead tax change and government debt growth both decreased.

- Savings and Financial Situations: Probability of higher savings account interest rates in 12 months increased, and perceptions of financial situations improved, with a majority expecting to be financially the same or better off in 12 months.

U.S. Stock Prices Expectations:

- Optimism: Probability of higher U.S. stock prices in 12 months increased, indicating optimism about the equity market outlook.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account