MAs Still Keeping AUDUSD in Range Ahead of US Inflation

The USD to AUD rate has been moving within a narrow 100-pip range, with moving averages (MAs) acting as barriers for AUD/USD.

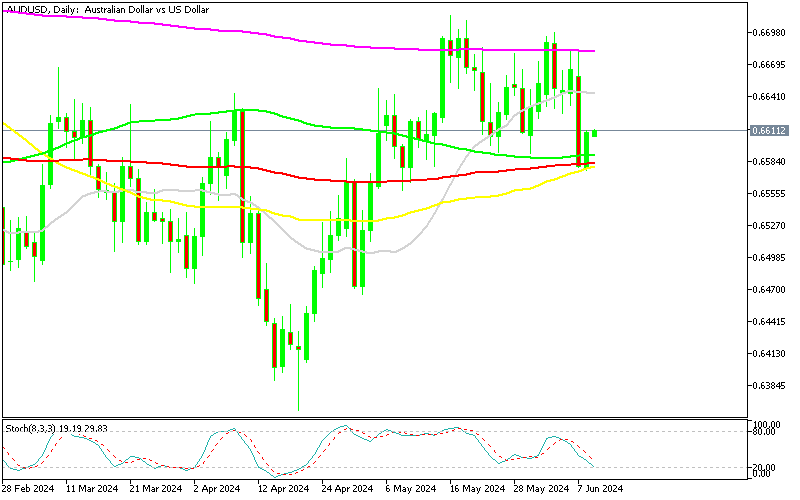

The USD to AUD rate has been moving within a narrow 100-pip range, with moving averages (MAs) acting as barriers for AUD/USD. Following the Non-Farm Payroll (NFP) report on Friday, the pair dropped 100 pips after failing to breach the 200 SMA (purple) resistance. However, the 100 SMA (red) provided support, resulting in a bounce for the Aussie yesterday, on the back of some USD weakness as traders closed some of the Sell trades from Friday.

AUD/USD Chart Daily – The 100 SMA Held Again As Support

Traders are anticipating potential interest rate cuts from both the Federal Reserve (FED) and the Reserve Bank of Australia (RBA) however there hasn’t been any clear signals from them yet. This expectation has been influencing market sentiment for this pair, leaving AUD/USD in no man’s land.

The improving data from China is offering some support for the Australian dollar (AUD) due to the strong trade relationship between Australia and China. However, the data from Australia hasn’t show a particularly bright picture. The NAB Business Confidence Index in Australia which was released during the Asian session remains close to zero, indicating a neutral sentiment among businesses.

Key Events For AUD/USD This Week:

- Federal Reserve Meeting: The Fed is set to meet on Wednesday, with expectations for rates to remain at 5.5%. This meeting will be closely watched by investors for any hints about future monetary policy decisions.

- Consumer Price Index (CPI) Data: CPI data for May, scheduled to be released tomorrow, will provide insights into inflationary pressures in the economy.

Australian NAB Business Confidence for May

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account