Ethereum (ETH) Eyes $3.8K Resistance Amidst Spot ETF Anticipation

Ethereum (ETH) is displaying bullish potential as it navigates a complex technical landscape, currently trading at $3,544 with a 1.70% increase.

Ethereum (ETH) is displaying bullish potential as it navigates a complex technical landscape, currently trading at $3,544 with a 1.70% increase.

The cryptocurrency’s upward trajectory is being tested by a downward trendline and the 50-day Exponential Moving Average (EMA) at $3,584, creating formidable resistance levels.

However, the anticipation surrounding the potential launch of spot Ethereum ETFs as early as July 2nd is fueling optimism among investors.

http://twitter.com/leminht81117513/status/1801899212386267507

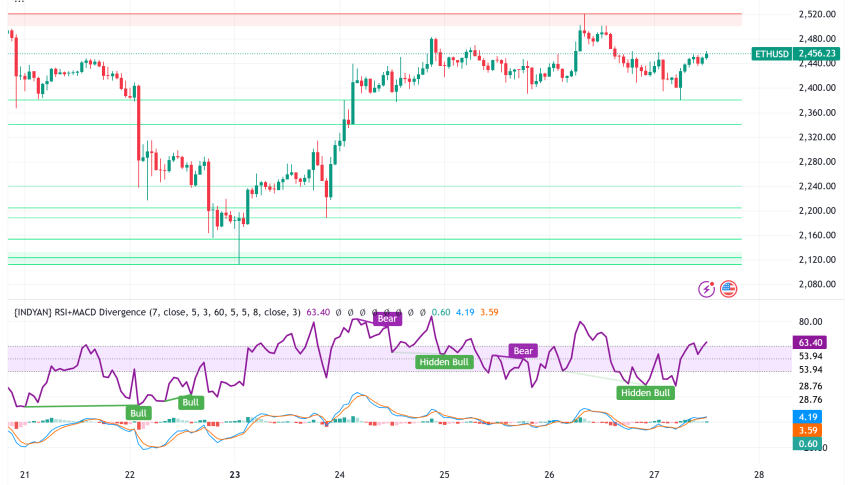

Technical Indicators Paint a Mixed Picture

Ethereum’s immediate resistance levels stand at $3,624, $3,723, and $3,832, while support levels are established at $3,430, $3,331, and $3,219. The Relative Strength Index (RSI) at 51 suggests a balanced market sentiment, indicating that neither buyers nor sellers have a clear advantage.

The downward trendline and the 50-day EMA currently pose challenges for Ethereum’s upward movement. However, a decisive break above these levels could trigger a significant bullish rally, potentially propelling the price towards the resistance levels.

The 50-day Exponential Moving Average (EMA) stands at $61,626, providing further support to the current price. An upward trendline is reinforcing Bitcoin‘s price around the $61,630 level. On the upside, the next resistance is at $63,165, extended by a downward trendline.

— Dendy (@tutdenizka) May 15, 2024

Spot Ethereum ETFs: A Catalyst for Growth?

The prospect of spotting Ethereum ETFs has injected a dose of excitement into the market. These ETFs would allow investors to gain exposure to Ethereum without directly owning the cryptocurrency, potentially attracting a broader range of investors and increasing demand.

The SEC’s approval of multiple spot Ether ETF filings in May has further fueled speculation about their imminent launch.

The Analysts says that, the #SEC's approval of multiple spot #EtherETFs proposals could benefit #Bitcoin. This fosters a broader crypto asset class, featuring tokens, NFTs, and DeFi, with Bitcoin at the forefront. This might also increase the allocation of investments in Bitcoin. pic.twitter.com/YhV5pjzDpZ

— Web3Crusader (@web3_crusader0) May 28, 2024

Some analysts, drawing parallels to Bitcoin’s price surge following its ETF approval, predict a similar trajectory for Ethereum. However, others, like Stephen Richardson of Fireblocks, caution against expecting identical results, citing the unique complexities of Ethereum’s use cases.

The Path Forward for Ethereum

The future of Ethereum’s price remains uncertain, with multiple factors at play. While the anticipation of spot ETFs is a significant bullish catalyst, the ongoing regulatory landscape and broader market sentiment will also influence its trajectory.

Investors should closely monitor the evolving ETF landscape and the cryptocurrency market’s overall sentiment to make informed decisions. A break above the key resistance levels could signal a strong bullish trend, while a failure to maintain support could lead to a deeper correction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account