Can the Data Keep the Bullish Momentum on for USD?

The USD's recent strength, despite lower-than-expected inflation reports, underscores the impact of the Fed's cautious stance on rate cuts.

The USD’s recent strength, despite lower-than-expected inflation reports, underscores the impact of the Fed’s cautious stance on rate cuts. EURUSD’s decline below 1.0800 highlights the current market sentiment favoring the USD, influenced by both political uncertainties in Europe and expectations around US economic data.

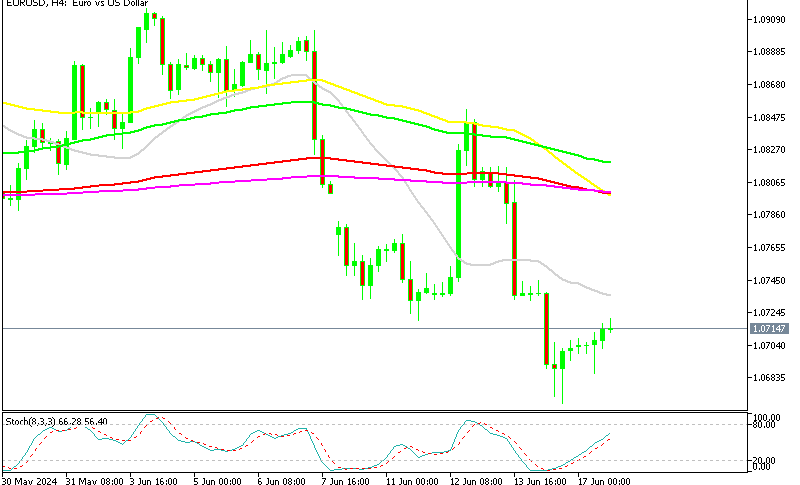

EUR/USD Chart H4 – Trading Below MAs

The US Dollar (USD) wrapped up last week on a positive note, despite disappointing reports on both the May Producer Price Index (PPI) and Consumer Price Index (CPI), which came in lower than expected. Both the monthly CPI and PPI headline figures showed a 0.2% increase, with actual unrounded numbers being even lower, which sent the USD down and EUR/USD more than 1 cent higher.

But the FOMC meeting on Wednesday evening where they kept interest rates steady one again in the range of 5.25% to 5.50%, in line with expectations, they refrained from fiving any signals on rate cuts. Fed policymakers revised down their projections for rate cuts this year compared to three months ago. The updated dot plot from the Fed indicates that officials now anticipate only one rate cut in 2024, a reduction from the three cuts forecasted in March.

As a result, EUR/USD slipped below the key level of 1.0800, while the USD index DXY surged above the important level of 105 points. However, market conditions are fluid, and the dynamics can change swiftly. For EUR/USD, the expectation is for further declines amid shifting political dynamics in Europe post-European elections, but sustained USD momentum will hinge on strong data releases. Today we had the Empire State Manufacturing Index which has been negative since December last year. it was expected to show some improvement this month, but it remains negative.

New York-area Empire State Manufacturing Index for June

- Overall Index:

- June: -6.00

- Expected: -9.00

- Prior (May): -15.6

- The index improved to -6.00 from May’s -15.6, indicating a less severe contraction in manufacturing activity than expected.

- New Orders:

- June: -1.0

- Prior (May): -16.2

- New orders improved significantly to -1.0 from -16.2 in May, suggesting a slowdown in the rate of decline and potential stabilization in future orders.

- Prices Paid:

- June: +24.5

- Prior (May): +33.7

- Prices paid moderated to +24.5 from +33.7 in May, indicating that while input costs continued to rise, the pace of increase slowed slightly.

- Employment:

- June: -8.7

- Prior (May): -5.1

- Employment conditions worsened slightly, with the index declining to -8.7 from -5.1 in May, indicating ongoing challenges in the job market within the manufacturing sector.

- Six-Month Outlook:

- June: +30.1

- Prior (May): +14.5

- The forward-looking six-month outlook index surged to +30.1, reaching a two-year high, suggesting manufacturers are increasingly optimistic about future business conditions and demand.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account