Bitcoin Price Struggles for Direction as Spot ETF Launches in Australia

Bitcoin (BTC) is currently caught in a tug-of-war between potential upside and downside pressures. The recent launch of the first spot BTC

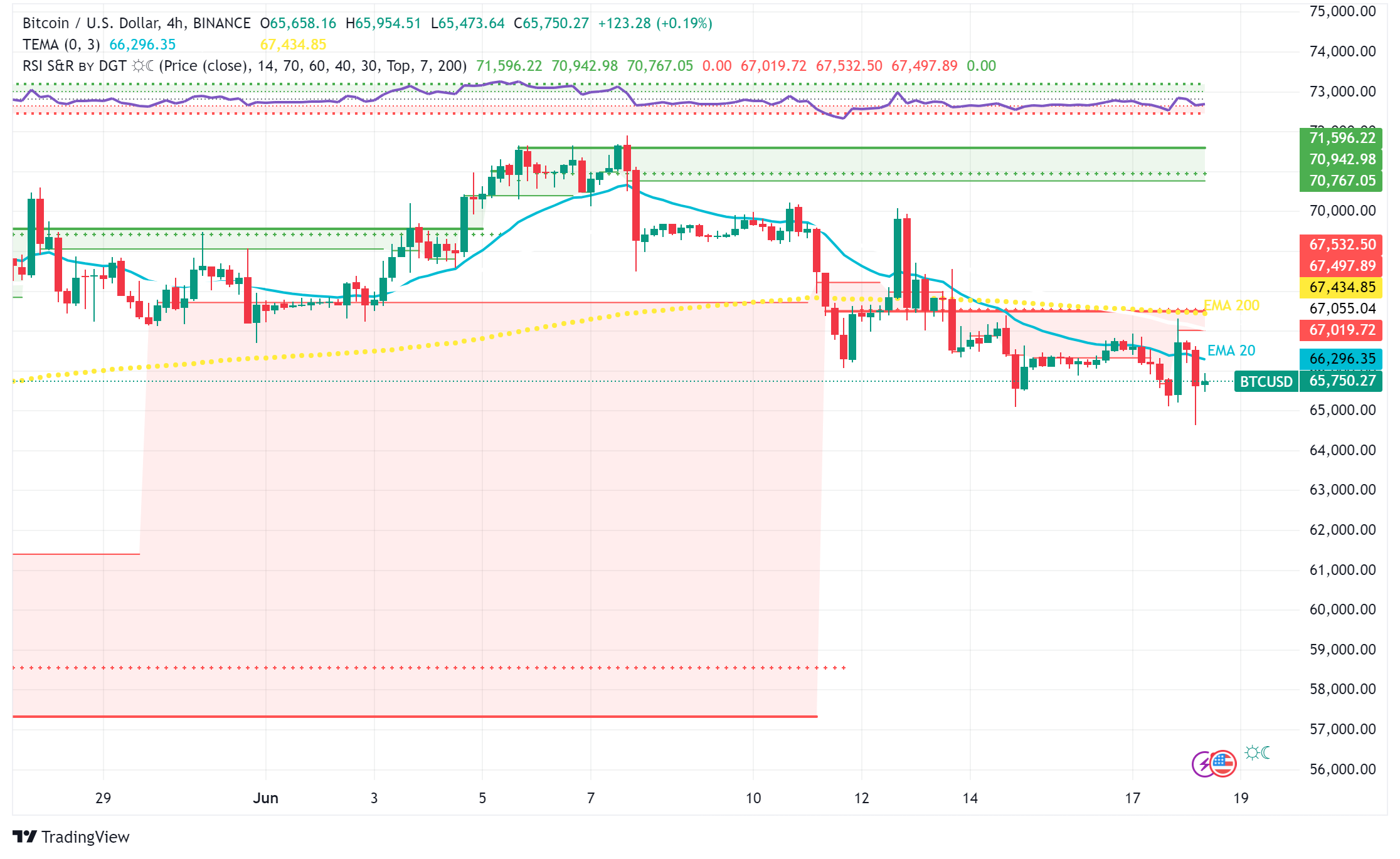

Bitcoin (BTC) is currently caught in a tug-of-war between potential upside and downside pressures. The recent launch of the first spot Bitcoin ETF in Australia offers a glimmer of hope, but technical indicators and short-term holder behavior suggest a possible correction is on the horizon.

TL;DR

- Price Correction Incoming? Technical indicators like price clusters and RSI suggest Bitcoin might be headed for a price correction before a potential parabolic phase. Some analysts believe a drop below $64,000 could be necessary for a healthy reset.

- Support Levels to Watch: Liquidation data shows strong support at $64,500, with the cost basis for short-term holders potentially providing a floor around $62,200.

- Australian Spot ETF Launch: VanEck’s Bitcoin ETF offers Australian investors regulated exposure to Bitcoin, marking a significant step towards wider adoption.

- Market Downturn: Despite initial optimism surrounding softer inflation data, Bitcoin (along with other cryptocurrencies) has experienced a rough week, dropping over 7% in the past seven days.

A Technical Tug-of-War

Analysts are looking at technical indicators to predict Bitcoin’s next move. Price clusters around the $71,600 mark suggest a potential correction, while the Relative Strength Index (RSI) indicates the asset might be overbought and in need of a cool-down.

Support Levels and Short-Term Holders

Despite the potential correction, liquidation data suggests strong support for Bitcoin at $64,500. Additionally, the cost basis for short-term holders (those who bought in the last 155 days) sits around $62,200, potentially acting as another support level.

Australian Spot ETF: A Step Forward

The launch of the first spot Bitcoin ETF in Australia by VanEck marks a significant milestone for cryptocurrency adoption. This regulated product allows Australian investors to gain exposure to Bitcoin through a traditional investment channel.

Market Downturn Dampens Optimism

The recent market downturn, fueled by factors like a less aggressive Federal Reserve and political uncertainty in Europe, has dampened the initial optimism surrounding Bitcoin. The price has fallen over 7% in the past week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account