USDJPY to Continue Higher But Mind Another BOJ Intervention

USDJPY has shown resilience by finding support at the 50-day SMA where we have been buying, and this level will remain critical

USDJPY has shown resilience by finding support at the 50-day SMA where we have been buying, and this level will remain critical for assessing the bullish trend’s durability. The upcoming BoJ meeting in July is pivotal, with potential rate hikes and adjustments in JGB purchases being key factors to watch, however, we have the minutes from the previous meeting tomorrow. But from what they said on the statement and the press conference, USD/JPY buyers don’t have any reason to fear until we approach 160 again, where the Bank of Japan might be lured to intervene again.

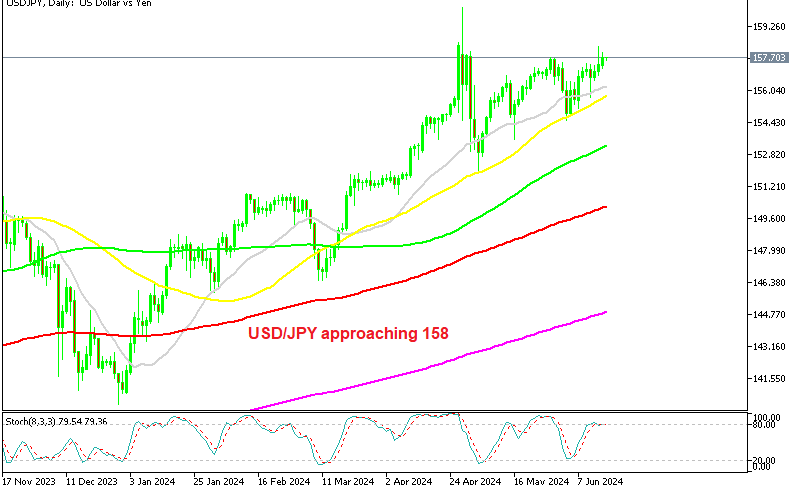

USD/JPY Chart Daily – Buyers Continue to Rely on the 50 SMA

USD/JPY experienced a considerable retreat earlier this month but it kept finding solid support near the 50-day Simple Moving Average (SMA), a key level where buyers frequently enter the market. This SMA has proven pivotal for sustaining the bullish trend, with the price rebounding twice from this level recently.

One of the reasons for this uptrend has been the low inflation in Japan. In its June meeting, the BOJ made no unexpected hawkish moves. However, it announced plans to reduce Japanese Government Bond (JGB) purchases after the July Monetary Policy Meeting, with specific details to follow at that time. However, Nomura forecasts a continuation of Japan’s economic rebound following a contraction in Q1 2024.

Nomura’s Expectations and BOJ Policy

- Rate Hike Prospects: Nomura anticipates the BOJ could potentially raise rates in October 2024, with a possibility of frontloading this hike to July depending on economic conditions and data leading up to the meeting.

- Yen’s Strength: Nomura suggests it’s challenging to foresee a stronger yen, implying that if macroeconomic developments drive USD/JPY higher, Japanese authorities might consider intervening to manage exchange rate movements.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account