NZD to USD Holds in Range Despite Lower GDT Dairy Prices

Following an early last week jump above the range after the soft US CPI inflation, the USD to NZD rate has reverted inside the range.

Following an early last week jump above the range after the soft US CPI inflation, the USD to NZD rate has reverted inside the range. Last night the New Zealand Global Dairy Trade (GDT) showed a decline, which was the first since March, however that didn’t affect the Kiwi much, with NZD/USD bouncing off the bottom of the range and heading toward the top again.

The NZD/USD pair is at the middle of the range, with moving averages around 0.61 and 0.62 playing a crucial role in determining the next directional bias. A break above the 200 SMA (purple) at the top would favor buyers, while a failure to do so would would bring the price back down to the bottom of the range.

Early yesterday NZD/USD was bearish, briefly falling below the 100 moving average on the daily chart and testing levels beneath the previous week’s lows at approximately 0.61. These breakouts, however, did not hold, leading to a reversal as the trading day progressed.

NZD/USD Chart Daily – Stuck Between the 100 SMA and the 200 SMA

By the US session, the price had reversed as the USD turned softer following the weaker US retail sales. This cluster includes the 100-hour and 200-hour moving averages at around 0.6145, as well as the 100-bar moving average on the 4-hour chart at 0.6148. This area around 0.6145-0.6148 is critical for determining the future bias of the market. The current testing of these support and resistance levels will be key in setting the near-term direction for NZD/USD, with traders closely watching for either a breakout or a rejection at these levels to make informed trading decisions.

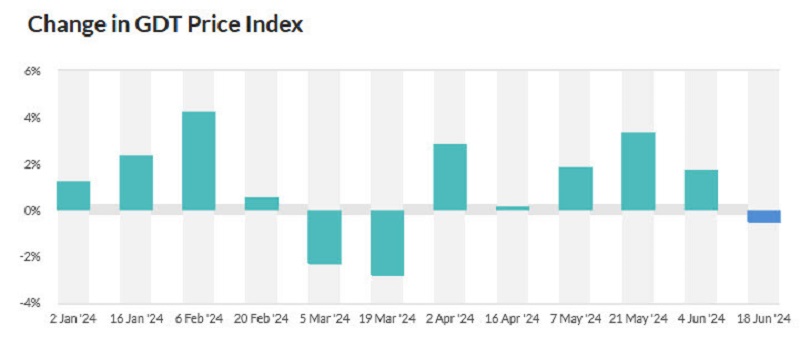

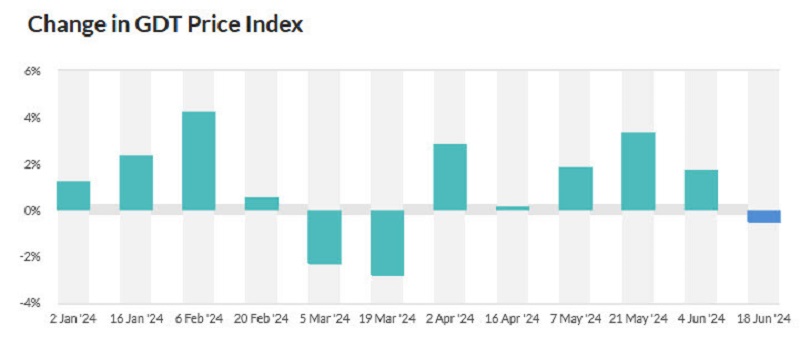

The GDT auction results, showing a decline in the price index and a significant drop in whole milk powder prices, present challenges for New Zealand’s dairy sector and overall economy. The negative impact on export revenues could weigh on the New Zealand dollar and influence economic sentiment.

New Zealand Global Dairy Trade (GDT) Auction Results:

- GDT Price Index:

- The GDT price index fell at -0.5% in the latest auction, reversing the prior gain of 1.7%. This decline indicates a weakening in global dairy prices, which can have significant implications for New Zealand’s economy, as dairy is one of its key export sectors.

- Whole Milk Powder (WMP):

- WMP prices dropped by 2.5%. WMP is a major export product for New Zealand, and a decline in its price can affect the country’s export revenues and trade balance.

Reserve Bank of New Zealand Chief Economist Paul Conway on Inflation

- Inflation may be more sticky in the near term

- But inflation could fall more quickly in the medium term, there is spare capacity emerging in the economy and this may help

- Looking ahead there are some remaining challenges in bringing inflation sustainably back to target

- Overall, a period of restrictive policy is necessary to give confidence that inflation will return to target over a reasonable timeframe

- Inflation will slow down, helped by excess capacity

- NZ not experiencing stagflation

- welcomes the recent fall in expectations for inflation

- headline inflation to drop to target band by year-end

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account