Oil Prices at $80 Amid Strong Dollar and Geopolitical Tensions: Weekly Gain Secured

Oil prices dipped on Friday due to a stronger U.S. dollar, which climbed following positive economic data in June. The data showed stronger

Oil prices dipped on Friday due to a stronger U.S. dollar, which climbed following positive economic data in June. The data showed stronger-than-expected performance in the services and manufacturing sectors, reducing expectations for imminent rate cuts.

As oil is priced in dollars, a stronger dollar makes it more expensive for foreign buyers, thereby impacting demand.

Signs of Increasing U.S. Demand

Despite the dip, oil prices achieved a second consecutive weekly gain, buoyed by signs of improving demand in the U.S., the world’s largest oil consumer.

The Energy Information Administration (EIA) reported a significant drawdown in U.S. crude stockpiles, with a decrease of 2.5 million barrels for the week ending June 14, surpassing the anticipated 2.2 million barrel reduction.

July Natural Gas Futures Search for Direction Following Nearly In-Line Storage Print: The U.S. Energy Information Administration (EIA) on Friday reported an injection of 71 Bcf of natural gas into storage for the week ended June 14. The result modestly… https://t.co/hm4okxTWqW pic.twitter.com/6sWeLqmlUg

— Natural Gas Intel (@NGInews) June 21, 2024

Additionally, total product supplied, a key indicator of demand, rose by 1.9 million barrels per day to 21.1 million bpd.

“The 4-week average implied gasoline demand continues to trend higher as we move deeper into the U.S. summer driving season, easing some concerns over gasoline demand,” noted analysts at ING.

Geopolitical Tensions and Market Impact

Geopolitical tensions also played a role in supporting oil prices. Ukraine’s military reported drone strikes on Russian oil facilities, while ongoing conflicts involving Israel, Hamas, and Hezbollah heightened fears of broader regional disruptions.

❗🇩🇪🤝🇺🇦 – Germany is gearing up to bolster Ukraine's defenses by dispatching a substantial military aid package, as reported by various sources.

The package includes the delivery of several thousand strike drones and 100 Patriot missiles, aiming to enhance Ukraine's… pic.twitter.com/ubYSAQPo3i

— 🔥🗞The Informant (@theinformant_x) June 11, 2024

These factors contribute to market volatility and potential supply chain disruptions. The U.S. oil rig count dropped by three to 485, as reported by Baker Hughes.

This decline in drilling activity comes despite the EIA raising its 2024 crude oil production forecast to 13.24 million barrels per day, up from a previous estimate of 13.20 million barrels per day.

In summary, while a stronger dollar pressured oil prices, signs of increased U.S. demand and geopolitical tensions helped secure a second straight weekly gain. These dynamics highlight the complex interplay of economic and geopolitical factors influencing the oil market.

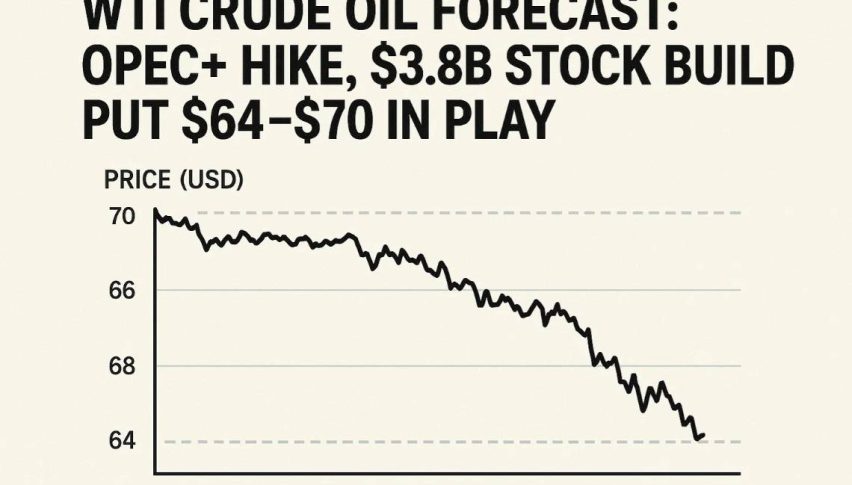

WTI Crude Oil Price Forecast: Technical Outlook

WTI Crude Oil is trading at $80.72, up 0.19%. The pivot point is marked at $80.40, indicated by the green line. Immediate resistance levels are at $81.48, $82.13, and $82.58, suggesting potential upward momentum.

On the downside, immediate support is found at $79.68, with further support at $79.14 and $78.44. The 50-day Exponential Moving Average (EMA) is positioned at $80.41, just above the pivot point, reinforcing the upward trendline that supports a buying trend.

The Relative Strength Index (RSI) is at 49, indicating a neutral market sentiment. Maintaining above $80.40 is crucial for a bullish outlook, while a break below this level could trigger a sharp selling trend

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account