EUR/USD Opens Higher As Macron Losses in France

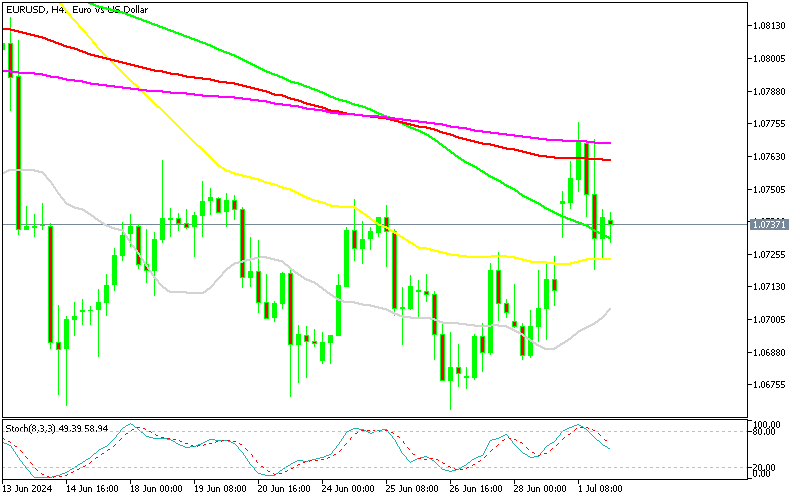

EUR/USD has been on a downtrend since the European Parliament elections, opening with a bearish gap lower but last night it opened up.

EUR/USD has been on a downward trajectory since the European Parliament elections, where the rise of right-wing parties sent this pair opening with a bearish gap lower. However, after the first round of French elections, EUR/USD seems more positive after opening higher last night.

EUR/USD Chart H4 – Opening Above the 100 SMA

After the announcement of the general elections in France, the polls were Le Pen’s victory in France, dampened the sentiment towards the Euro. However, the pair found stability around the 1.0700 mark. Last night’s election results confirmed the shift, with right-wing parties gaining traction in France and Macron’s coalition slipping to third place. Despite this, EUR/USD opened with a bullish gap today, signaling the removal of the 1.0% risk premium previously priced into the exchange rate due to election uncertainties.

Marine Le Pen’s right-wing party has achieved some historically good results, with high turnout in this first round of elections. Alongside, the left has also shown strong performance, raising the possibility of forming a coalition with Macron post-election, potentially leading to a hung parliament. However there is still the second round, which is slated for the upcoming weekend, where further outcomes will be determined.

Besides that, this morning we had the German prelim CPI inflation report for June and the final manufacturing PMI numbers form the Eurozone. The headline federal CPI was expected to show a 0.2% growth in June, but came at 0.1%, showing that inflation has abated considerably in Europe.

Eurozone June Final Manufacturing PMI released by HCOB – 1 July 2024

- Eurozone June final manufacturing PMI 45.8 points vs. 45.6 prelim

Key findings:

- HCOB Eurozone Manufacturing PMI at 45.8 (May: 47.3). 2-month low.

- HCOB Eurozone Manufacturing PMI Output Index at 46.1 (May: 49.3). 6-month low.

- Sharper decline in new orders and costs increase, but outlook remains upbeat.

German CPI Data Released by Destatis – 1 July 2024

- Bavaria June CPI +2.7% vs +2.7% y/y prior

- Brandenburg CPI +2.6% vs +2.9% y/y prior

- Hesse CPI +1.8% vs +1.9% y/y prior

- Saxony CPI +2.8% vs +3.1% y/y prior

- North Rhine Westphalia CPI +2.2% vs +2.5% y/y prior

- Baden Wuerttemberg CPI +1.9% vs +2.1% y/y prior

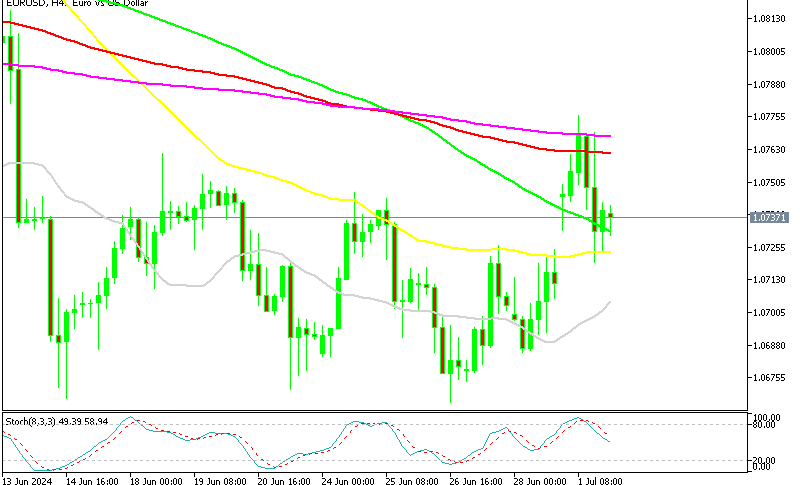

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account