The Bounce off MAs Unfolds in EURUSD As Predicted

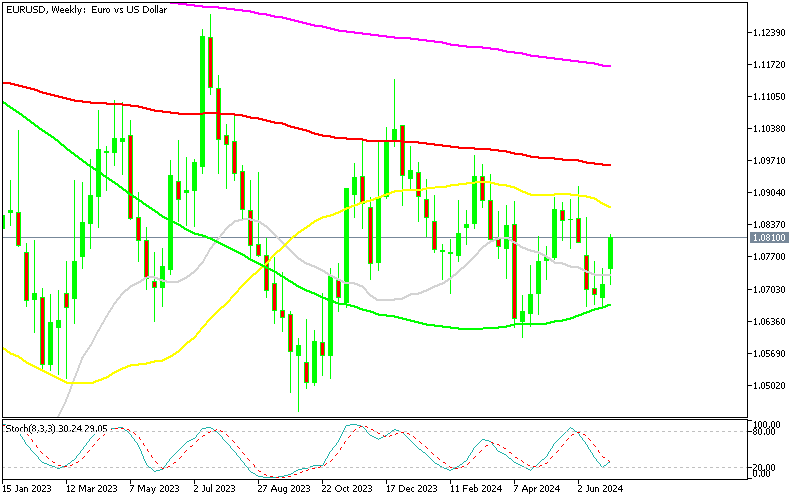

EURUSD has been bound by MAs on the weekly chart since the start of 2023 and it continues the up and down action.

EURUSD has been bound by moving averages on the weekly chart since the start of 2023 and it continues the up and down action, as seen by this week’s rebound off the 100 weekly SMA. The range is getting narrower, but there’s still plenty of profit to be made on this range, buying at the bottom and selling at the top. After the stop and the formation of the doji weekly candlestick following the fall in June, this pair is reversing higher, which we predicted on our previous updates on EUR/USD.

EUR/USD Chart H4 – Finding Resistance at the 200 SMA

Divergence in Monetary Policies

The recent rate cut by the ECB, contrasted with the Fed’s decision to hold rates steady, has initially widened the policy gap between the two central banks. However, recent economic indicators highlighting a weakening US economy have started to narrow this gap. Expectations of economic recovery in the Eurozone, coupled with weaknesses in US economic fundamentals, have lessened this divergence, providing support to the EUR/USD pair over the past two weeks.

Greenback’s Decline and EUR/USD Recovery

The decline in the US dollar has sustained upward pressure on EUR/USD, pushing it back above the crucial 1.0800 level. The pressure on the greenback intensified following negative data from the US economic calendar, particularly concerning the labor market, which reignited speculation about Federal Reserve rate cuts. Earlier this week, disappointing US Jobless Claims and ISM Services PMI figures led to a broad decline in the USD. While these data points didn’t significantly alter interest rate expectations, they reinforced the notion that the Fed might lower rates at least twice before the year’s end.

Market Sentiment and EUR/USD

Throughout June, EUR/USD faced downward pressure as markets questioned the likelihood of a second Fed rate cut, alongside concerns about the European parliamentary elections and the strength of the US dollar influenced by quarter-end cash flows rather than fundamental factors. This week, the US dollar is again under pressure as the market adopts a soft-landing narrative, providing further support to EUR/USD. The pair’s movement continues to reflect the shifting dynamics between the Fed’s cautious stance and the ECB’s proactive measures.

ECB Meeting Accounts

During the recent ECB meeting, several members expressed concerns regarding the data available since the last meeting, indicating that it had not increased their confidence that inflation would converge to the 2% target by 2025.

Inflation and Wage Growth Concerns

- Inflation Risks: These members viewed risks to the inflation outlook as being tilted to the upside. Wage growth had exceeded expectations, and inflation appeared to be more persistent than anticipated.

- Services Inflation: The momentum of services inflation was notably high, and the pace of domestic disinflation had been overestimated. This trend suggested that further significant wage pressures were imminent.

- Disinflation Challenges: The final phase of disinflation, referred to as the “last mile,” was deemed the most challenging.

Policy Considerations

- Undershooting vs. Overshooting: It was argued that a slight undershooting of inflation would be far less costly than a continued overshooting.

- Interest Rate Policy: These considerations suggested that cutting interest rates might not align with the principle of data-dependence. There was a strong case for maintaining interest rates at their current levels during this meeting.

Support for Rate Cuts

Despite these reservations, there was a willingness among some members to support Chief Economist Philip Lane’s proposal to cut interest rates. This support was expressed notwithstanding the concerns raised about the potential implications of such a move.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account