Solana (SOL) Bulls Reassert Dominance Amidst Price Correction

Solana (SOL) has experienced a rollercoaster ride in recent days. After a week of impressive gains, the cryptocurrency encountered a minor

Solana (SOL) has experienced a rollercoaster ride in recent days. After a week of impressive gains, the cryptocurrency encountered a minor pullback, sparking concerns among investors. However, a closer look at the technical charts and underlying fundamentals suggests a bullish outlook for SOL.

SOL Breaks Out of Bullish Pattern

Solana’s price surged over 6% in the past week, but a slight dip in the last 24 hours has tempered investor enthusiasm. Despite this short-term setback, analysts are optimistic about the token’s prospects.

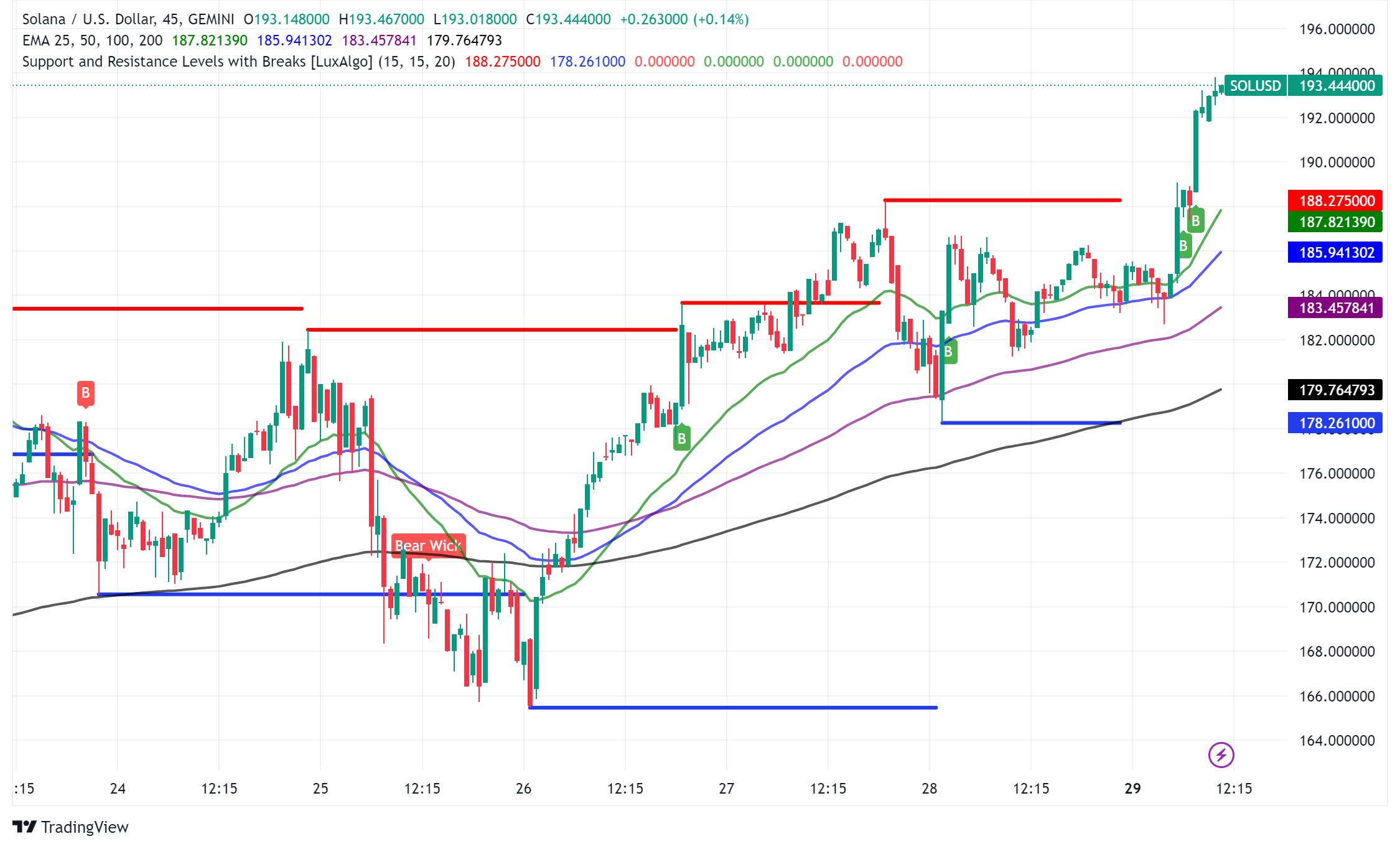

A recent breakout from a bullish pennant pattern, followed by a successful retest of support, has ignited hopes for a sustained rally. This technical formation suggests that SOL is poised for a significant upward move, potentially reaching new all-time highs.

Bullish Indicators and Challenges

While the overall sentiment for Solana is positive, some technical indicators are still flashing cautionary signals. The Chaikin Money Flow (CMF) and Relative Strength Index (RSI) have declined, hinting at potential short-term weakness. However, the long/short ratio has improved, indicating growing investor confidence.

Solana’s price is currently hovering around the $190 level, with the potential to break out and target the $200 mark. A successful breach of this resistance could open the door for a rally towards the all-time high of $260.

Growing Institutional Interest

The cryptocurrency industry has witnessed increased institutional interest in Solana, with VanEck recently submitting an application for a Solana ETF. This development could further bolster SOL’s value and attract new investors to the platform.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account