USD Retreats As US Employment and Wages Weaken Further

The labour market has been holding the US economy afloat since 2020, with US employment remaining solid, but it has been weakening in 2024.

Written by:

Skerdian Meta

•

Wednesday, July 31, 2024

•

2 min read

•

Last updated: Wednesday, July 31, 2024

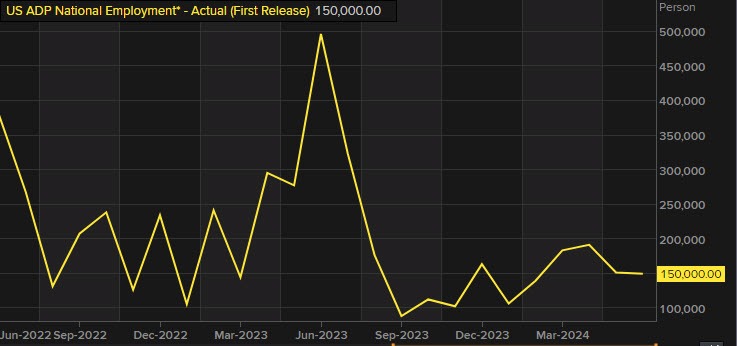

The labour market has been holding the US economy afloat since 2020, with US employment remaining solid, but it increasingly has been showing signs of weakness in 2024. All employment indicators, such as the ADP report which was released earlier today, ahead of the FOMC meeting, have been trending down, as the FED continues to keep interest rates higher, elevating the borrowing costs for individuals, as well as for companies.

ADP July Employment Report

- Employment Change: The ADP report for July showed an employment increase of 122,000 jobs, falling short of the expected 150,000. The previous month’s figures were revised upward from 150,000 to 155,000.

- Annual Pay Growth:

- Job Stayers: The annual pay growth for employees who stayed in their jobs slowed to 4.8%, marking the lowest level in three years and down from 5.0% in the previous period.

- Job Changers: Employees who switched jobs saw their pay gains decrease to 7.2%, down from 7.7%.

- Sector Breakdown:

- Goods-Producing Sectors: Added 37,000 jobs, with construction leading the way at +39,000.

- Services Sectors: Contributed 85,000 new jobs, predominantly in trade, transportation, and utilities, which collectively added 61,000 jobs.

- Professional/Business Services: This sector experienced significant job losses, totaling -37,000.

This is the reasoning behind the move in the USD today. With the employment numbers heading lower, as well as employment costs, which include wages, salaries, bonuses, overtime etc, markets are expecting the FED to pivot and give some strong indications of a September rate cut by them.

As a result, the USD is around 50 pips down across the board today, with safe havens such as the CHF and the JPY making the most of the UD weakness. However, the Bank of Japan delivered a 15 bps rate hike today, which gave the Japanese Yen a strong push earlier in the Asian session.

Nela Richardson, ADP’s chief economist, stated that the labor market is helping the Federal Reserve’s efforts to curb inflation by slowing down wage growth. However, if inflation rises again, labor won’t be the cause. While the overall job market softness is slight, it could boost market confidence that the Fed might signal a shift toward policy normalization.

The annual increase in compensation costs has decelerated to 4.1%, down from 4.5% a year earlier. This improvement is even more pronounced when excluding government wages, with private sector wages rising by 3.9% compared to 4.5% the previous year.

US Employment Cost Index for Q2

- Employment Cost Index (ECI) for Q2: +0.9% (compared to +1.0% expected)

- Previous quarter’s ECI: +1.2%

- Wages increase quarter-over-quarter: +0.9% (down from +1.1% previously)

- Benefits increase: +1.0% (compared to +1.1% in the previous quarter)

The latest Employment Cost Index (ECI) data shows that while wage pressures are easing, they remain above the Fed’s target. The slowing annual growth indicates a cooling labor market, but the quarterly figures are still robust. Wages are a lagging indicator, and the Fed is likely to view them as such.

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles