GBP Dives 1 Cent After the 25 bps BOE Rate Cut but Comes Back

The (Bank of England) BOE rate decision was the highlight of the session, as they narrowly voted to reduce the bank rate by 25 bps to 5.00%.

The (Bank of England) BOE rate decision was the highlight of the European session, as they decided to reduce the bank rate by 25 basis points from 5.25% to 5.00%, with five members in favor of the cut and four members preferring to keep rates unchanged, resulting in a very close vote.

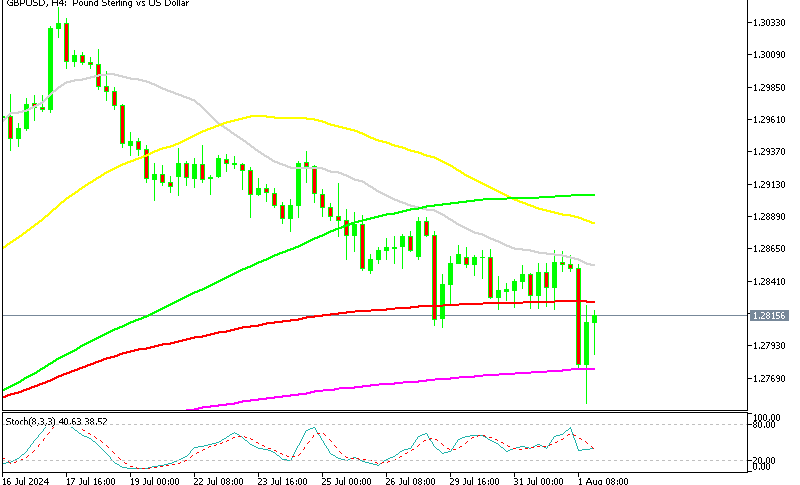

GBP/USD Chart H4 – The 200 SMA Stopped the Decline

However, BOE Governor Andrew Bailey and the BOE made sure not to let markets think that they are embarking on a rate cut journey, so they did not signal any additional measures for September, leading to increased caution in the markets. The GBP/USD exchange rate recovered around 50 pips, climbing above 1.28 after falling around 100 pips earlier. Meanwhile, the U.S. dollar showed resilience, maintaining its strength despite the previous day’s decline following the Federal Reserve’s decisions, which adds the the weakness in the GBP/USD.

BOE August 2024 Monetary Policy Decision

- Rate Cut: BOE reduces bank rate by 25 bps to 5.00% (previously 5.25%)

- Vote Split: 5-0-4 in favor of the cut; dissenters (Pill, Mann, Haskel, Greene) voted to maintain the current rate

- Decision: Described as “finely balanced”

- Inflation Outlook: Domestic inflation expected to diminish over the next few years, but second-round inflationary pressures could persist in the medium term

- Caution on Rate Cuts: Emphasis on not reducing rates too quickly or excessively

- Policy Stance: Commitment to keeping the bank rate at a restrictive level long enough to bring inflation back to the 2% target sustainably

- Policy Decisions: Will assess the appropriate degree of restrictiveness at each meeting

- Quantitative Tightening: Uncertainty remains about the interaction between rate cuts and quantitative tightening measures

Key Points from BOE Governor Andrew Bailey’s Press Conference

- Decision Nature: Described as “finely balanced”

- Inflation Concerns: Services price inflation and domestic inflation pressures remain high

- Future Outlook: Possible slight rise in services price inflation in August, with easing expected later in the year

- Monitoring: Closely watching services prices

- Policy Response: Should not react to every data surprise; careful assessment is needed

- Inflation Target: Ongoing uncertainty about achieving the 2% inflation target sustainably

- Policy Stance: Ensuring that policy remains sufficiently restrictive to bring inflation back to 2%

- Current Adjustment: Considered appropriate to slightly adjust policy restrictiveness at the latest meeting

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account