Gold Prices Waver at $2,409 Amid U.S. Dollar Surge and Fed Speculations

Gold prices are struggling to find their footing as they hover around $2,409, occasionally dipping to lows such as $2,404.

Gold prices are struggling to find their footing as they hover around $2,409, occasionally dipping to lows such as $2,404.

This tumult is largely driven by the strengthening of the US dollar, which is benefiting from a surge in US Treasury bond yields.

Moreover, a shift in investor sentiment towards riskier assets has further dampened the allure of gold. Despite these pressures, potential Federal Reserve rate cuts and ongoing global tensions are providing some buoyancy to the precious metal.

Emergency Federal Reserve rate cuts with a week of a FOMC is essentially proving how corrupt the central banking system really is! Prove us right @federalreserve @NickTimiraos

— WallSt Ponzi (@Jason_Sanders81) August 5, 2024

Economic Factors Weigh on Gold

The resilience of the US dollar, despite anticipation of Federal Reserve rate reductions, continues to cap gains in gold prices.

Analysts are optimistic that the ringgit could strengthen further, as the US dollar is seen weakening in anticipation of an interest rate cut by the US Federal Reserve.https://t.co/aLX1RFTJ5l

— The Star (@staronline) August 6, 2024

The connection is evident as rising Treasury yields bolster the dollar, making gold less attractive by comparison.

Concurrently, disappointing US manufacturing and employment growth have stoked fears of a recession, causing Treasury yields to hit their lowest levels since mid-2023.

Mary Daly, President of the San Francisco Fed, has commented on the economic slowdown, noting that while it is noticeable, it is not alarming, and monetary policies will be adapted to maintain employment and economic stability.

This economic backdrop casts a shadow over gold’s performance. Despite a rise in the US Services PMI to 51.4 from 48.8, surpassing expectations and hinting at underlying economic resilience, the broader economic uncertainties and a strong dollar continue to suppress the potential upswing in gold prices.

Geopolitical Developments and Gold’s Safe-Haven Appeal

Gold’s status as a safe-haven asset remains intact amid escalating tensions in the Middle East.

The recent assassination of Hamas leader Ismail Haniyeh and subsequent threats of retaliation by Iran, Hamas, and Hezbollah have heightened geopolitical risks.

Such uncertainties typically increase the appeal of gold as a secure investment.

“The geopolitical landscape is adding a layer of support to gold prices, counteracting the headwinds from a stronger dollar,” notes a financial analyst.

This delicate balance keeps gold prices in a narrow range as investors weigh these opposing forces.

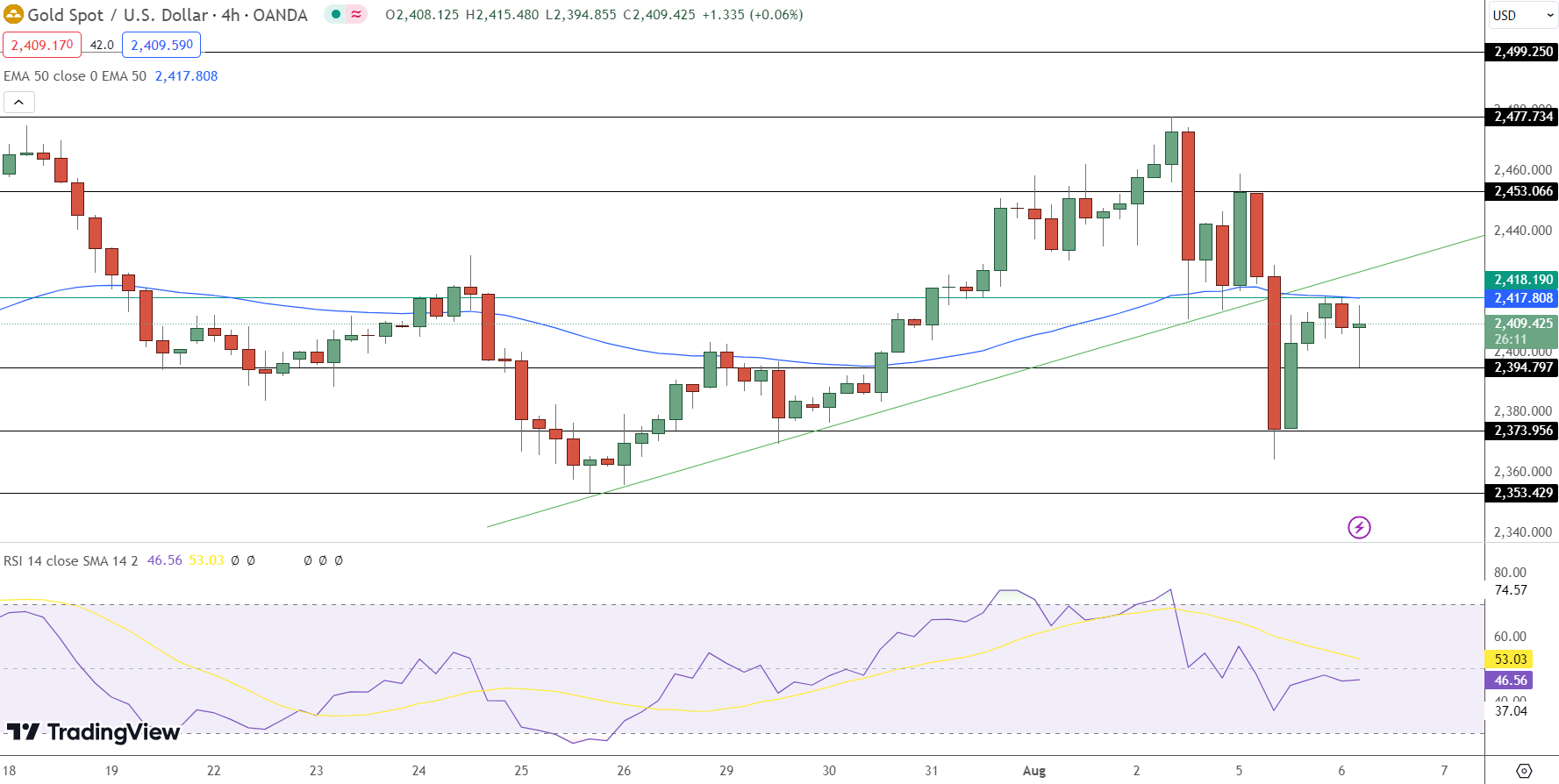

Technical Outlook for Gold Prices

As of now, gold is trading at a slight decline of 0.09% at $2,413.43. Technical indicators suggest a cautious market sentiment.

The price has slid below the critical $2,437.41 pivot point, suggesting a bearish trend might be setting in.

Resistance levels are staged at $2,452.64, $2,477.89, and $2,498.73, which need to be overcome for a bullish reversal. Conversely, support forms at $2,394.93 and extends lower to $2,374.89 and $2,353.65.

The market’s indecision is mirrored by the Relative Strength Index (RSI) at 47, indicating neither overbought nor oversold conditions, hinting at potential market consolidation.

The 50-day EMA at $2,409.23 just below the current price adds to the narrative of short-term selling pressure.

For investors, the strategy might involve setting a buy threshold slightly above $2,400 to take profits at around $2,437, while maintaining a stop-loss near $2,372 to mitigate risks from unforeseen declines.

Navigating the complexities of gold investment requires a careful analysis of both technical indicators and broader economic and geopolitical developments, ensuring investors remain well-informed to make strategic decisions in turbulent times.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account