The Progress in CHF to USD Continues, As USD/CHF Tests 0.85

The CHF to USD rate continues to show volatility as the Swiss Franc rallies, while USD/CHF returns to 0.85 again.

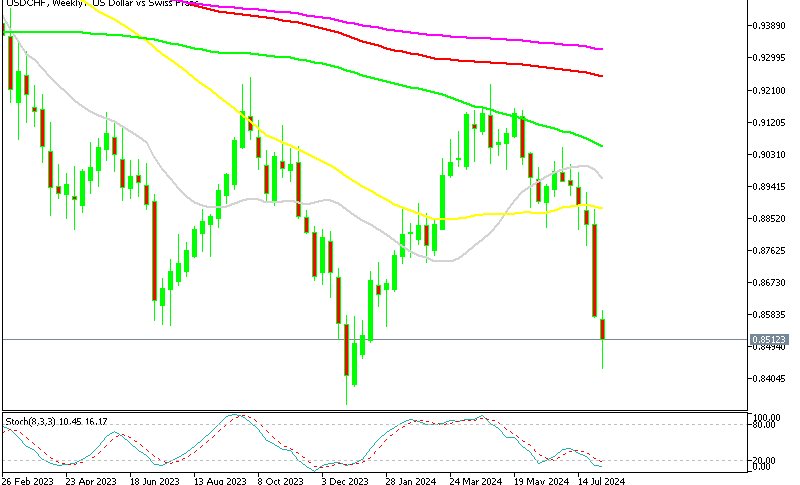

The CHF to USD rate continues to show volatility as the Swiss Franc rallies, while USD/CHF returns to 0.85 again. Since the start of July, this forex pair has lost around 6 cents, with risk sentiment deteriorating and the CHF benefiting as a safe haven currency. Yesterday this forex pair broke below 0.85 as the rout in risk assets intensified early in the day, but in the US session the sentient improved and we saw a 140 pip retrace higher, which seems to be over now as sellers have returned, pushing the price toward 0.85 again.

USD/CHF Chart Daily – Testing Support at 0.8730

The USD/CHF currency pair experienced a strong upward trend during the first four months of 2024. This initial rise of about 8 cents was driven by the Swiss franc’s weakness following two consecutive rate cuts by the Swiss National Bank (SNB). However, since May, the pair has been on a downward trajectory. This decline was primarily due to a series of disappointing US economic data releases, which caused the US dollar to drop and pushed the pair down to lows of 0.84.

Recently, the USD/CHF pair has shown signs of recovery, rebounding in the past few trading sessions after hitting 0.8431 during yesterday’s European session, where the intraday bias initially became neutral. Despite some periods of consolidation on smaller timeframe charts, the 0.8570 resistance level has held back further upward movement. Sellers have since resumed their activity.

Looking ahead, the next target for the USD/CHF pair is the December low of 0.8332, which is below yesterday’s low of 0.8431. Early today we had the Unemployment Rate from Switzerland for July, which remained stable, so the motion in this pair is coming from the risk sentiment in financial markets.

Switzerland July Unemployment Rate (Seasonally Adjusted)

The State Secretariat for Economic Affairs (SECO) released the unemployment data for July 2024 on 6 August 2024:

-

Seasonally Adjusted Unemployment Rate:

- July: 2.5%, in line with expectations

- June: 2.4%

-

Unadjusted Unemployment Rate:

- Remains steady at 2.3% from the previous month

- Number of registered unemployed persons increased to 107,716 in July, up from 104,518 in June

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account