USD-GBP Faces MAs As It Continues to Fall Below 1.27

While risk currencies made some gains against the USD yesterday, the GBP continued to fall, with USD-GBP slipping around 1 cent lower.

While risk currencies made some gains against the USD yesterday, the GBP continued to fall, with USD-GBP slipping around 1 cent lower. That came after some strong construction numbers yesterday, which shows that this sector is expanding at a decent pace, despite elevated interest rates by the Bank of England, which increase borrowing costs.

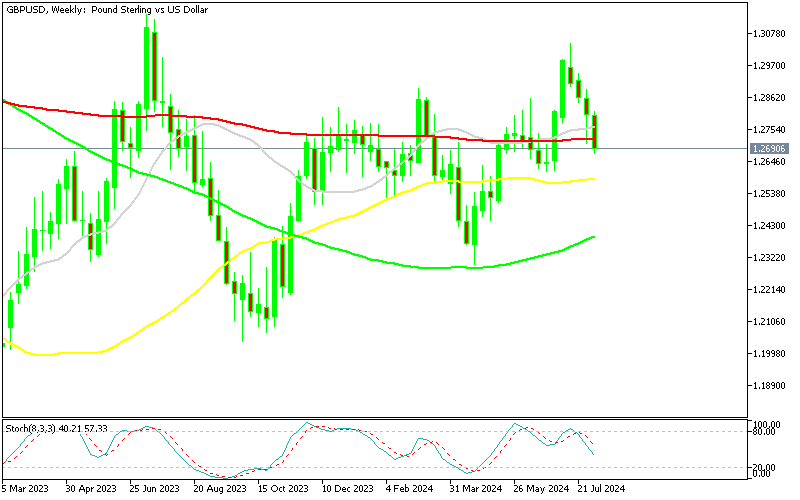

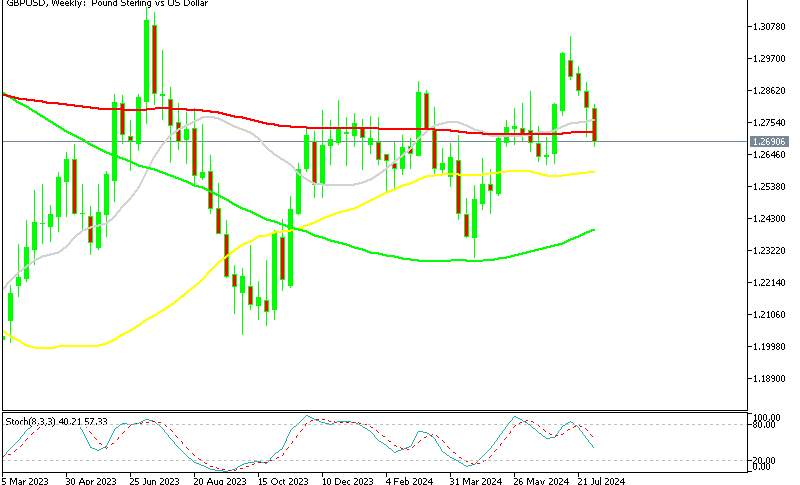

GBP/USD Chart Weekly – The Price is Falling Below the 100 SMA Again

The GBP/USD pair surged above 1.30 in early July following a 4-cent rise, but an inverted hammer candlestick on last week’s weekly chart signaled a bearish reversal. Since then, the price has dropped approximately 3.5 cents from its peak, suggesting that the bullish breakout was a false move. The Bank of England’s recent rate cut, prompted by increasing signs of economic weakness in the UK, contributed to the bearish reversal in this currency pair. However, the BOE did not indicate further immediate rate cuts.

Despite broad-based selling pressure on the US Dollar on Monday, GBP/USD failed to capitalize and ended the day in negative territory. The decline continued yesterday, with the pair falling an additional 100 pips despite positive construction PMI data.

UK Construction PMI Report for July

- July construction PMI 55.3 points vs 52.8 points expected

- June construction PMI was 52.2 points

A surge in new orders contributed to a faster increase in construction activity in the UK last month. The good news is that employment conditions have improved, but price pressures have also risen. S&P Global reported:

“The election-related dip in growth observed in June proved to be temporary, with the rate of expansion accelerating in July. Firms reported the largest gains in new orders and activity since 2022, as stalled projects were resumed amid signs of increased client confidence.”

UK Halifax House Price Index for July

- July Halifax house prices +0.8% vs +0.3% m/m expected

- June Halifax house prices -0.2%

The annual growth rate of house prices also increased further to 2.3%, which is the highest since January. The typical UK property is now seen costing £291,268. Halifax notes that they “anticipate house prices to continue a modest upward trend throughout the remainder of this year”.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account