EUR/USD Falls Below 1.09 but Bounces Back Off the 100 SMA

The USD climbed broadly after the jobless claims fell in the latest week, sending EUR/USD below 1.09, but the buyers came back quickly.

The USD climbed broadly after the jobless claims fell in the latest week, sending EUR/USD below 1.09, but the buyers came back quickly and pushed the price above that level again. The Unemployment Claims came at 233K, which was below the 240K expected and the 250K in the previous week.

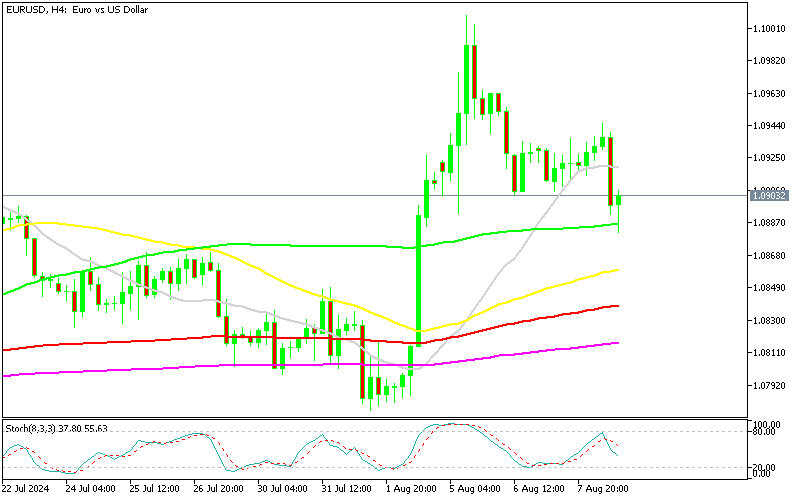

EUR/USD Chart H4 – The 20 SMA Was Broken but the 100 SMA Held

The 17K drop from the previous week’s revised level indicates that the hurricane had a more significant impact on the jobless jump than the employment sector trend. In response to the report, EUR/USD fell to 1.0900 from 1.0930, breaking below the 20 SMA (gray0 which was acting as support on the H4 chart. But the 100 SMA (green) turned into support, holding the decline and EUR/USD bounced off that indicator.

Given the recent uptick, there was considerable anxiety about this data, but the results have provided clarity, leading to a surge in the US dollar. However, despite the new claims decreasing, the rise in continuing claims suggests that some workers are taking longer to find new jobs. The pair’s decline was testing this week’s lows at 1.0880 where the 100 SMA stands, and if this moving average broke, further selling could be expected.

The overall 30-pip increase in the dollar highlights the market’s current sensitivity to economic data, especially given the volatility in unemployment claims. However, the selloff stopped and this forex pair more than 30pips higher, claiming back the losses. The following data was quite weak, with Wholesale Sales for June declining by 0.6%.

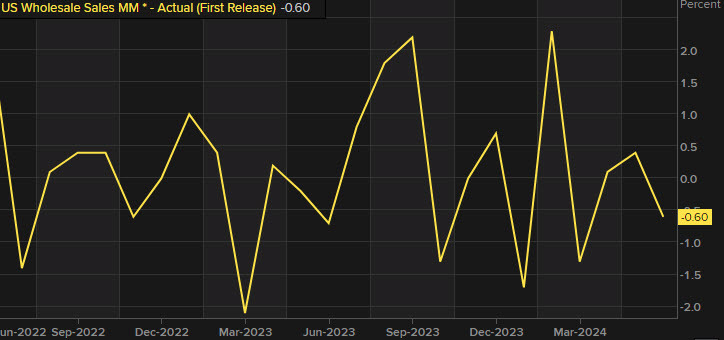

June 2024 US Wholesale Sales and Inventories Report

- US June wholesale sales: Decreased by -0.6% vs the expected increase of +0.3%.

- The prior month’s sales were initially reported as +0.4%, but revised down to +0.3%.

- US June wholesale inventories: Increased by +0.2%, matching expectations.

- The prior month’s inventories also showed a +0.2% increase.

These figures suggest a slowdown in wholesale sales, indicating potential weakening in demand, while inventories continue to grow modestly, aligning with expectations.

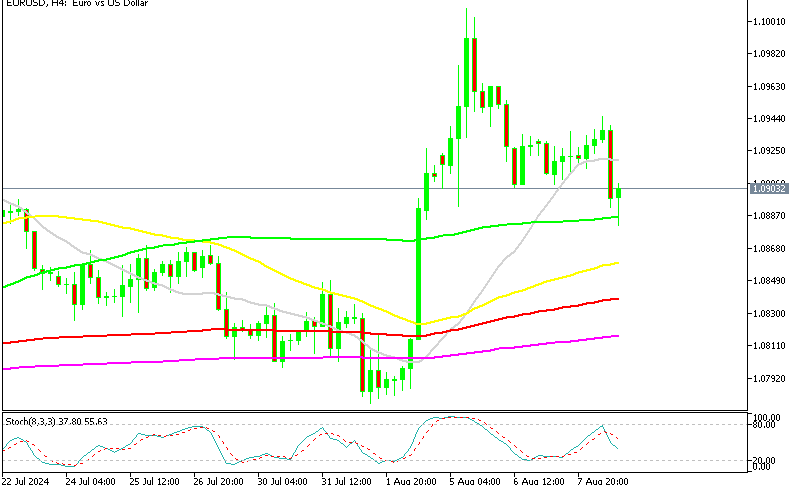

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account