EURUSD Holds Between MAs As ZEW Sentiment Deteriorates

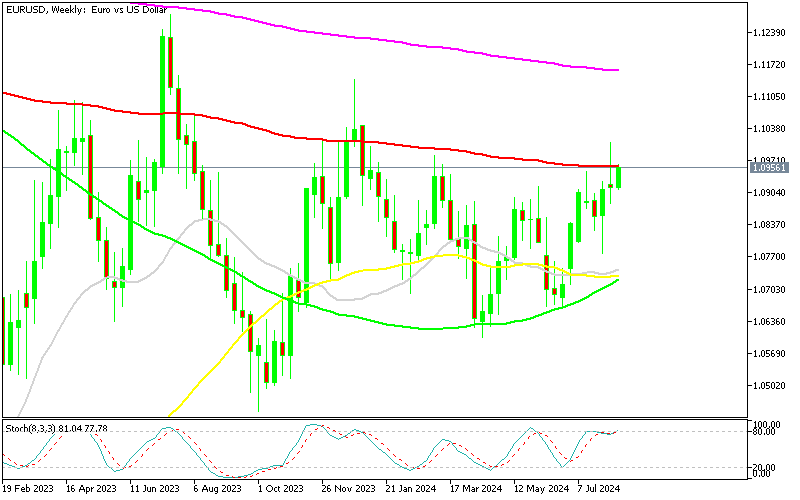

EURUSD has been trading in a range with the 100 weekly SMA acting as resistance and today's soft ZEW economic sentiment didn't offer much.

EURUSD has been trading in a range with the 100 weekly SMA acting as resistance at the top, and last week’s bullish momentum that pushed the price above 1.10 as risk sentiment improved, was not enough to break the range. The price retreated below 1.10 and fell below the 100 SMA (red) which formed a doji candlestick, suggesting a bearish reversal off the top of the range.

EUR/USD Chart Weekly – The 20 SMA Was Broken but the 100 SMA Held

On Monday, markets were cautious due to growing concerns that the Iran-Israel conflict could escalate into a broader Middle East crisis. Yesterday, US stock index futures struggled to gain momentum. If global tensions continue to rise this week, major US equity indices could face declines. In such a scenario, the US Dollar (USD) is likely to maintain its strength against its main rivals, potentially limiting the rise of EUR/USD . This could result in the formation of a bearish reversal chart pattern on the weekly timescale. However, risk sentiment is improving and flows are returning to the markets, which is pushing EUR/USD higher, testing the 100 weekly SMA again.

ZEW August 2024 Economic Sentiment Report for Germany and the Eurozone

Germany:

- Current Conditions: The ZEW survey for August shows a sharp decline in German economic sentiment, with current conditions registering at -77.3 points, below the expected -75.0 points. This is a significant drop from July’s reading of -68.9 points.

- Economic Outlook: The outlook has also weakened, with the index falling to 19.2 points, considerably lower than the anticipated 32.0 points. In comparison, July’s outlook was more optimistic at 41.8 points.

Eurozone:

- Economic Sentiment: The Eurozone’s August ZEW Economic Sentiment index also showed a decline, coming in at 17.9 points, well below the expected 35.4 points. This is a significant decrease from July’s figure of 43.7 points.

These readings highlight a significant setback for both Germany and the broader Eurozone’s economic recovery efforts. The decline in sentiment indicates growing concerns about the health of the German economy, particularly in its export-driven sectors, which are feeling the pressure from worsening economic conditions in key markets such as the euro area, the US, and China. This downturn in sentiment suggests that the economic environment in both Germany and the Eurozone is becoming increasingly challenging, complicating recovery efforts and potentially leading to further economic strain in the coming months.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account