US Retail Sales Jump by 1%, Confirm 25 bps Sept FED Rate Cut

The July 2025 U.S. retail sales data shows a strong performance, with sales rising by 1.0%, confirming the US consumer is holding well.

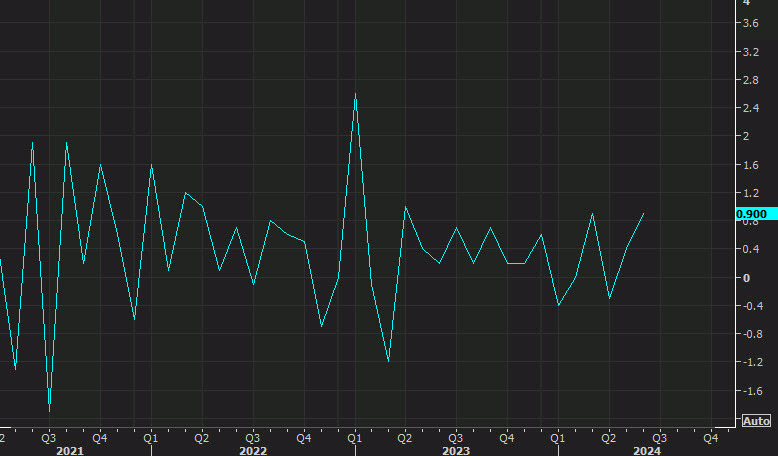

The July 2024 U.S. retail sales data shows a strong performance, with overall retail sales rising by 1.0% month-over-month, significantly exceeding the expected 0.3% growth, which is yet another strong sales report after the June numbers, showing that the US consumer is holding well. This is a positive shift from the revised June figure, which was adjusted down from 0.0% to -0.2%, however the control group sales were quite strong in June. The total retail sales for July amounted to $709.7 billion, up from $704.3 billion in June.

The stronger-than-expected retail sales growth in July suggests that consumer spending remains resilient, despite concerns over rising interest rates and inflation. The significant increase in vehicle sales and steady growth across other sectors indicates that consumers are still willing to spend on both essential and non-essential goods.

This could have positive implications for GDP growth in Q3 2024, reinforcing the idea that the U.S. economy continues to expand. However, the mixed performance in the control group and the modest growth in dining out may indicate some caution among consumers in discretionary spending.

July 2024 U.S. Retail Sales Report

- Overall Growth:

- Retail sales: +1.0% MoM (vs. +0.3% expected)

- Prior month revised: 0.0% to -0.2%

- Total sales: $709.7 billion (vs. $704.3 billion in June)

- Year-over-Year (YoY) Growth:

- Retail sales YoY: +2.7% (vs. +2.3% prior)

- Ex-Autos:

- Sales ex autos: +0.4% (matching prior, estimate was +0.1%)

- Prior ex autos revised: +0.4% to +0.5%

- Control Group:

- Control group: +0.3% (vs. 0.9% prior, estimate was +0.1%)

- Prior month control group: +0.9%

- Ex-Autos and Gas:

- Ex autos and gas: +0.4% (vs. +0.8% prior)

- Sector Breakdown:

- Motor Vehicle & Parts Dealers: +3.6% MoM, indicating strong consumer interest in vehicles.

- Electronics & Appliance Stores: +1.6% MoM, showing resilient demand.

- Building Material & Garden Equipment & Supplies Dealers: +0.9% MoM, surprising strength despite industry warnings.

- Food & Beverage Stores: +0.9% MoM, steady spending at grocery stores.

- Food Services & Drinking Places: +0.3% MoM, continued modest growth in dining out.

- Health & Personal Care Stores: +0.8% MoM, consistent growth in the sector.

- Implications:

- Strong retail sales suggest resilient consumer spending despite economic concerns.

- Significant growth in vehicle sales highlights robust consumer demand.

- Mixed results in the control group and dining out suggest cautious discretionary spending.

These are some solid figures for July after the scare earlier. Equally noteworthy is the CEO’s remark that there has been no drop in global consumer demand so far, including the early part of August, which indicates that U.S. consumers are still holding strong.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account