Forex Signals Brief August 16: UK Retail Sales Close the Week

Today the July retail sales from UK will close a heavy week regarding economic data releases

The release of strong Australian jobs data and the positive UK Q2 GDP report earlier today helped keep both the AUD and GBP strong throughout the trading session. Additionally, upbeat U.S. retail sales and initial unemployment claims data reinforced the view that the economy is resilient and not on the brink of a hard landing. Following these results, the market’s expectations for a 50-basis-point rate hike by the Federal Reserve dropped significantly, from 49% to 24%.

This shift was further bolstered by positive comments from Walmart executives after their earnings report. Today’s sentiment is a stark contrast to last Monday, when concerns about a potential recession and emergency rate cuts were widespread. As the carry trade approaches the 38.2% retracement of the July-August sell-off, market attention has shifted to Japan. The initial response has been a strong wave of U.S. dollar buying, particularly against safe-haven currencies, which led the USD/JPY exchange rate to climb more than 2 cents on the day.

Today’s Market Expectations

The latest economic data from Britain shows that the UK economy has displayed resilience. Retail sales excluding fuel dropped by 0.3% in July, with Morgan Stanley commenting that the consumer isn’t quite ready to spend yet, whether due to the weather, high interest rates, or the cost of discretionary goods. However, data from the British Retail Consortium (BRC) reveals that retail sales in the UK bounced back in July 2024, rising 0.5% year over year, following a -0.2% decline in June. As summer approaches, there has been a notable increase in sales of summer clothing and health and beauty products as consumers prepare for outdoor activities and vacations.

On the other hand, spending on furniture and household appliances decreased, as consumers prioritized holidays and entertainment over indoor purchases, leading to a decline in non-food sales, particularly in physical stores. The BRC also mentioned that retailers are now looking to the Autumn Budget for relief from rising business rates and potential reforms promised by Labour, following the resolution of election-related uncertainties. While summer essentials have driven some growth, KPMG pointed out that the improvement hasn’t been as strong as expected for this crucial period. Sales of technology items like TVs and tablets have increased due to televised sports events, but big-ticket purchases remain subdued. KPMG also noted that rising mortgage and rent payments have strained many households’ budgets, leading to more cautious spending.

Yesterday risk assets were progressing but they dipped after the strong US retail sales and unemployment claims data. However they resumed the upside which caught us on the wrong side of the trade in the afternoon. We opened five trading signals, remaining mostly long on stock indices, and ended up with two winning trading signals and three losing signals.

Gold Fails at Record High Again

Gold remains unable to surpass its record high of $2,483.74, with today’s peak falling short at just under $2,480. The metal has dropped by over 2% today after a third unsuccessful attempt to break through the $2,480 level. Although gold is still up for the week, having surged $50 on Monday, it has since pulled back, failing to surpass the July highs. This retreat is largely attributed to the market scaling back expectations for Federal Reserve rate cuts.

XAU/USD – Daily chart

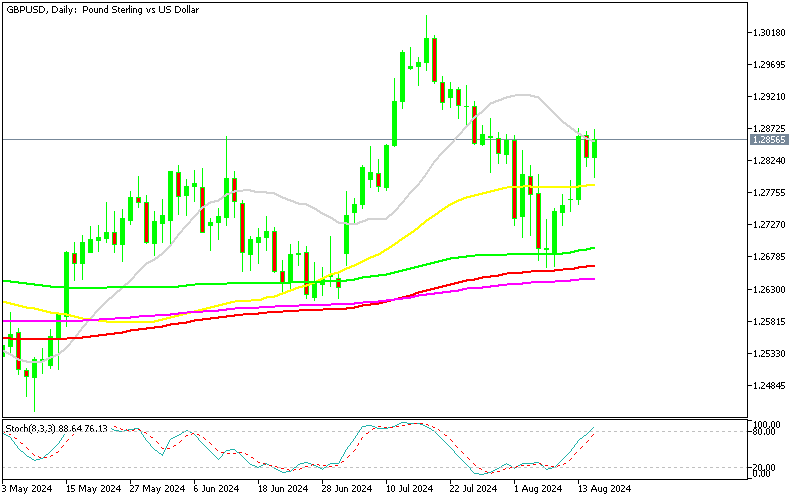

GBP/USD Stalls at the 20 SMA

The highlight of yesterday’s European session was the release of the UK jobs report, which supported the GBPUSD rise despite lower earnings. Despite persistent doubts about the accuracy of the data, it showed a notable decline in the unemployment rate. The stronger-than-expected unemployment rate and increased appetite for market risk have propelled the GBP/USD pair higher. As of now, the pair is up 0.7% on the day, trading at the 1.2870 level.

GBP/USD – Daily Chart

Cryptocurrency Update

Bitcoin Falls to the Support

Bitcoin’s price weakened again this morning amid ongoing geopolitical tensions and a cautious risk environment. Cryptocurrency investors were further discouraged by a conversation on X (formerly Twitter) between Republican presidential candidate Donald Trump and Tesla CEO Elon Musk, which made no mention of cryptocurrency regulations. Although Trump has expressed support for the cryptocurrency sector, even speaking at a recent conference, he has rarely addressed the issue in broader forums. Following this interview, Bitcoin briefly dipped below $58,000, but as risk sentiment improved during the U.S. session, it climbed back toward $61,000.

BTC/USD – Daily chart

Ethereum Fails at the 20 Daily SMA

Ethereum has been showing a pattern of lower highs since March, indicating a potential downturn in August. After peaking at $3,830, Ethereum’s price fell below $3,000 in June. Although buyers managed to push the price above the 50-day SMA, recent selling pressure led to another bearish reversal. As a result, Ethereum’s downward trend persisted, with the price dropping below the 200-day SMA. Yesterday, Ethereum briefly fell to $2,000 before rebounding to $2,400.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account