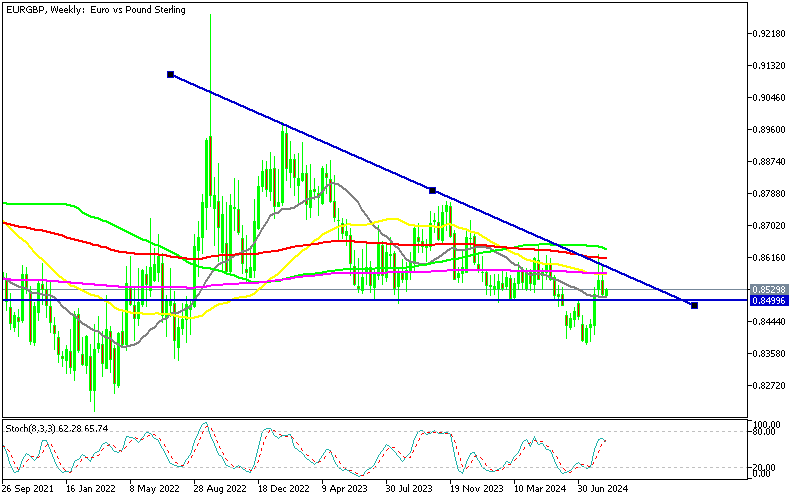

Dead Cat Bounce in EURGBP, As It Keeps Making Lower Highs

EURGBP bounced in late July, pushing above 0.85, but the trendline continues to hold, rejecting the price, as the highs get lower.

EURGBP bounced in late July, pushing above 0.85, but the trendline continues to hold, rejecting the price, as the highs get lower. The EUR/GBP currency pair maintained stability above 0.85 during Q1, which has served as a crucial support level since June 2023. Despite this, the weekly chart continued to show declining highs, indicating persistent downward pressure.

EUR/GBP Chart Weekly – The Declining Trendline Continues to Hold

In Q2, moving averages acted as resistance, causing EUR/GBP to in decline and reach a low of 0.8383 by mid-July. However, a reversal began in late July and continued until last week, but buyers failed once again as the 100 SMA (red) turned into resistance as well on the weekly chart.

Impact of ECB and BOE Policies

The reversal was driven in part by the Bank of England’s (BOE) unexpected decision to lower interest rates by 25 basis points. On the positive side, the most recent GDP statistics showed that the Eurozone economy grew in the second quarter, which was encouraging for the euro. The European Central Bank (ECB) is still in the midst of a monetary policy easing cycle, having already reduced rates twice by 25 basis points. In contrast, the BOE is just beginning its rate-cutting process, starting from a higher level, giving it more room to make further cuts. This difference in central bank policies contributed to a recent rally in EUR/GBP , sending the pair 140 pips higher.

Technical Support and Resistance for EUR/GBP and Market Outlook

Despite the rally, moving averages once again acted as resistance, with the price being rejected earlier this month at 0.8624. This level coincides with a trendline that connects the declining highs since November 2022. Last week’s weekly candlestick closed as a bearish engulfing candlestick. However, the 20-week SMA (gray) held as support just above 0.85, the previous support zone. This week, there has been some renewed buying, but it remains too early to determine the direction. As the week progresses, key economic reports, including the Eurozone and UK manufacturing and services PMI reports for August, will be released on Thursday, which could provide further insight into the pair’s movement. Earlier today, the German PPI producer inflation data for July, along with the Buba report, were also released.

EUR/GBP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account