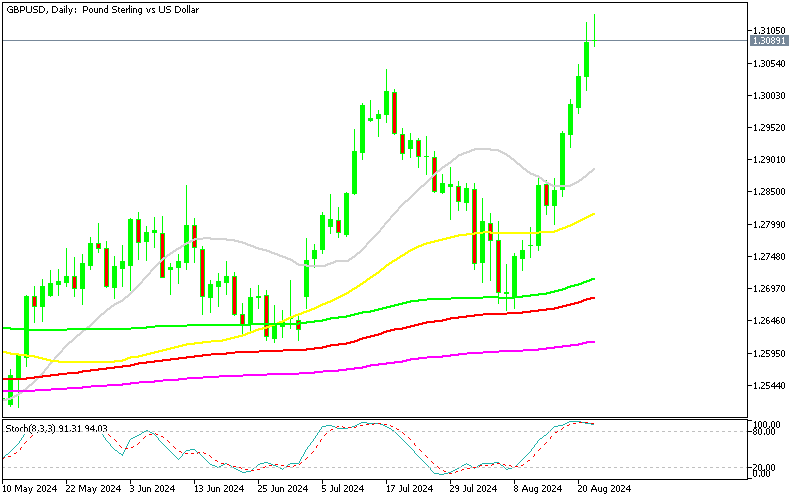

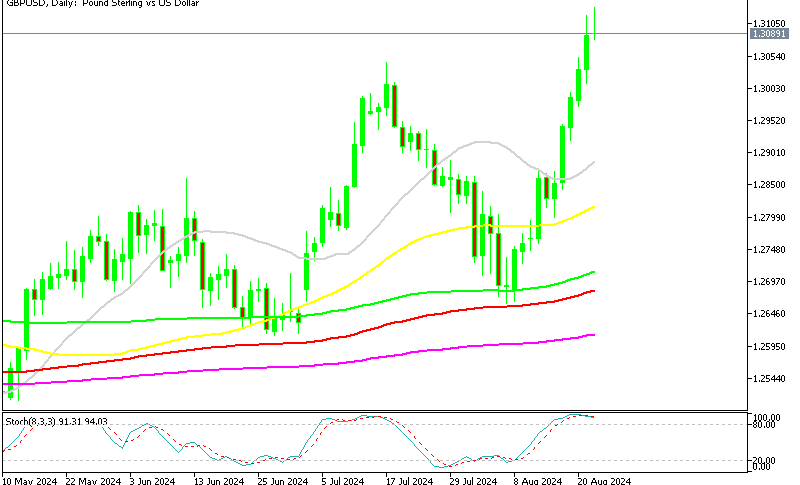

GBPUSD Holds Above 1.30 as UK PMIs Improve

GBP/USD has shown a remarkable rally, rebounding off the moving averages on the daily chart, helped by positive UK data and a weak USD.

With the exception of one daily candlestick, the GBP/USD has shown a remarkable rally, rebounding off the moving averages on the daily chart. Yesterday’s surge to 1.3130 was driven by strong UK Services and Manufacturing PMI data. Today, the UKGfK Consumer Confidence statistics for August were released, which, while still negative, continue to trend upward.

GBP/USD Chart Daily – The Bullish Momentum Has Picked Up Pace in August

After dipping in July, buyers pushed the pair above the 1.30 mark this week. The release of the Q2 GDP report and the stronger-than-expected PMIs for services and manufacturing yesterday provided additional support for the pound, while USD weakness remained consistent even during market pullbacks. As a result, GBP/USD gained about 5 cents in the past two weeks.

UK August Flash Manufacturing and Services PMI Reports

- Services PMI: 53.3 vs 52.8 expected (previously 52.5)

- Manufacturing PMI: 52.5 vs 52.1 expected (previously 52.1)

- Composite PMI: 53.4 vs 52.9 expected (previously 52.8)

S&P Global Observations on August PMI Data

- Economic Growth: August shows a positive trend with stronger economic growth, improved job creation, and reduced inflation.

- Sector Performance: Both manufacturing and service sectors are experiencing solid output growth and increased job gains, supported by high business confidence.

- GDP Growth: Although third-quarter GDP growth is expected to slow compared to the strong first half of the year, the PMI data suggests a steady expansion at about 0.3% for the quarter.

- Inflation Trends: Inflationary pressures have continued to ease in August, including significant moderation in the service sector, a key concern for the Bank of England.

- Interest Rate Outlook: The latest survey data suggests a lower threshold for further interest rate cuts, though persistent inflation in the service sector indicates that the Bank of England will proceed with caution.

The resilience of the UK economy is commendable and should ease the pressure on the Bank of England to consider rate cuts. A positive note in the report is that price pressures have eased over the month, with input cost inflation dropping to its lowest level in nearly three and a half years. However, wage inflation remains high according to service providers, indicating that challenges still lie ahead.

UK GfK Consumer Confidence

- June GfK Consumer Confidence steady at -13 points in August vs -12 expected

- July GfK Consumer Confidence steady at -13)

Joe Staton, client strategy director at GfK:

- “This more positive outlook may be due to a mortgage-friendly interest rate cut at the beginning of August, and hopes of more to come”

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account