7% Oil Price Surge Pauses Amid Middle East Tensions and Libyan Uncertainty

Oil prices saw a temporary pullback on Tuesday, halting a 7% surge that occurred over the previous three sessions.

Oil prices saw a temporary pullback on Tuesday, halting a 7% surge that occurred over the previous three sessions.

The recent rise was driven by growing concerns over potential supply disruptions, sparked by escalating tensions in the Middle East and the possibility of Libyan oil field shutdowns.

In recent developments, military clashes between Israel and Hezbollah in Lebanon have heightened fears of a broader conflict that could impact oil supplies from the region.

In Libya, the situation remains fragile as the eastern-based administration announced plans to close oilfields that contribute nearly all of the country’s production. This move follows increased tension over the leadership of Libya’s central bank, putting at risk the production of approximately 1.17 million barrels per day, according to OPEC data.

Impact of U.S. Interest Rates and Global Oil Demand

In addition to geopolitical factors, expectations of potential U.S. interest rate cuts have also influenced the recent oil price surge. The prospect of lower rates could stimulate economic activity, leading to increased fuel demand.

Over the past three sessions, West Texas Intermediate (WTI) gained 7.6%, while Brent crude climbed 7%. However, bearish sentiments around global oil demand, particularly with weak Chinese demand, continue to weigh on the market, limiting further gains.

Exxon Mobil forecasts global oil demand in 2050 will be the same — or even slightly higher — than current levels, putting efforts to reach net zero carbon emissions by mid-century well out of reach. https://t.co/MVcYgEUxw5 via @climate

— Brookside Energy Limited (@BrooksideEnergy) August 27, 2024

Vortexa analyst Serena Huang noted that while Libya’s potential production halt could tighten global supply, it may not be enough to offset the broader market concerns. Other oil producers might benefit from higher prices but are unlikely to ramp up production immediately.

Technical Outlook for WTI Crude Oil

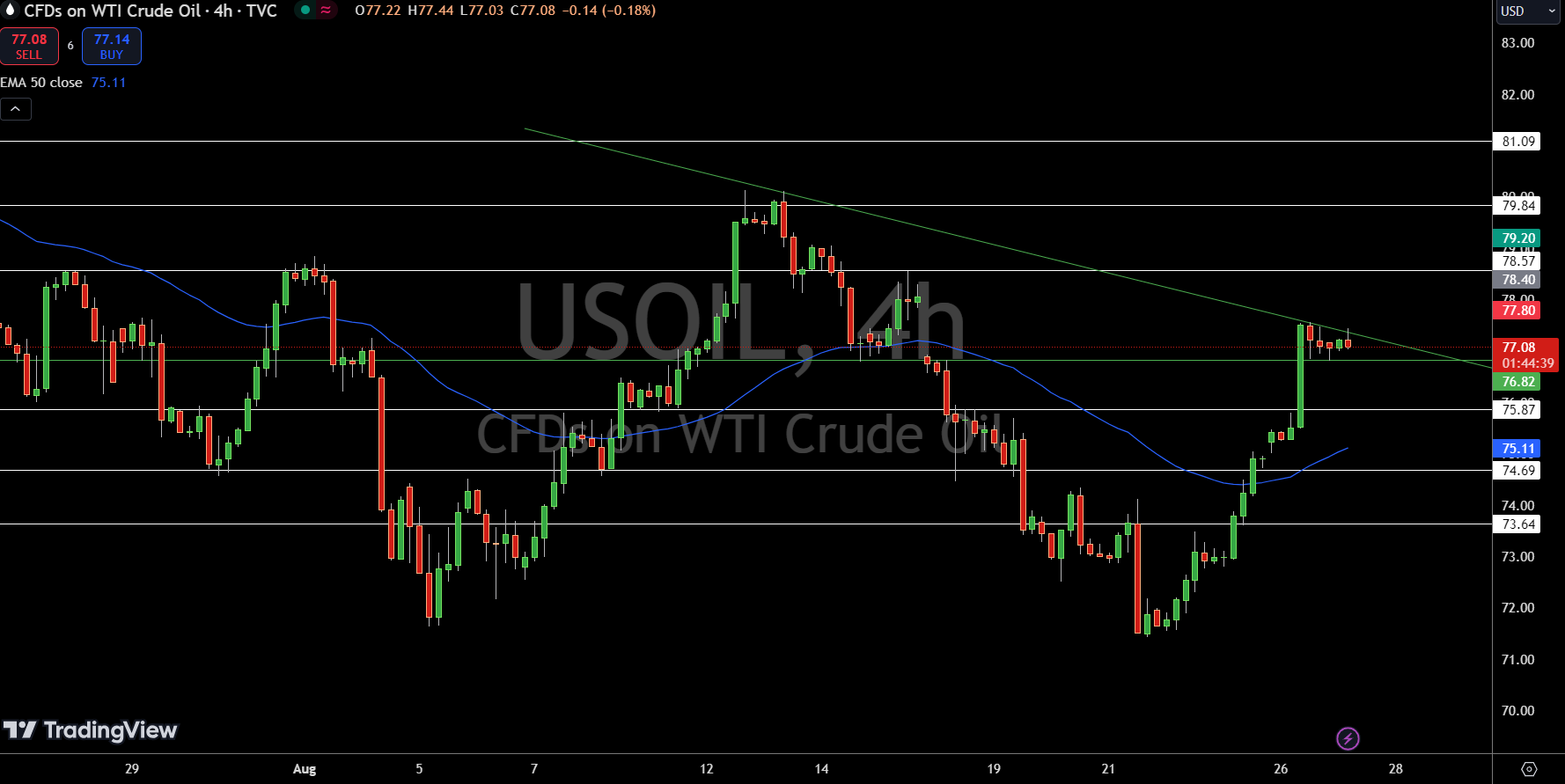

As of the 4-hour chart, WTI Crude Oil is trading at $77.08, with a critical pivot point at $76.82. The price is currently facing strong resistance at $77.80, and breaking above this level could push it towards the next resistance targets at $78.57 and $79.20.

On the downside, immediate support is seen at $75.87, with further support at $75.11, which aligns with the 50-day Exponential Moving Average (EMA). The RSI is neutral, hovering around 50, indicating no strong directional bias.

Traders should watch for any moves above $76.82 for potential upward momentum or a break below this level, which could lead to a retest of the $75.87 support.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account