EURUSD Retreats Below 1.11 After Lower Euro Inflation for August

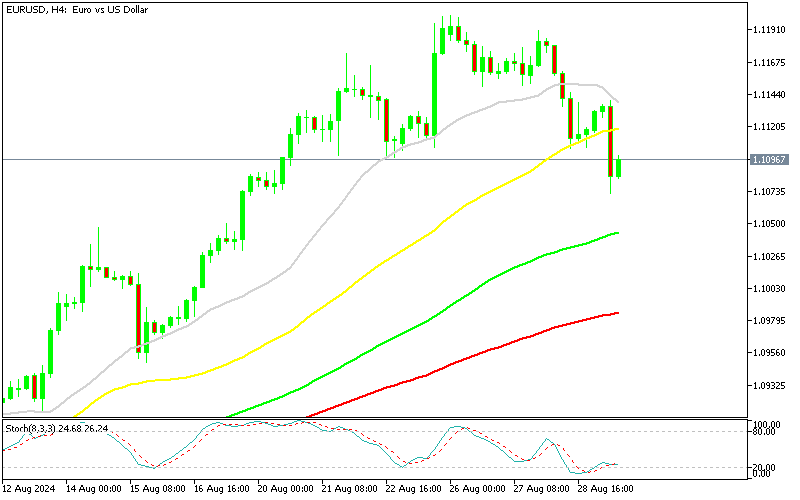

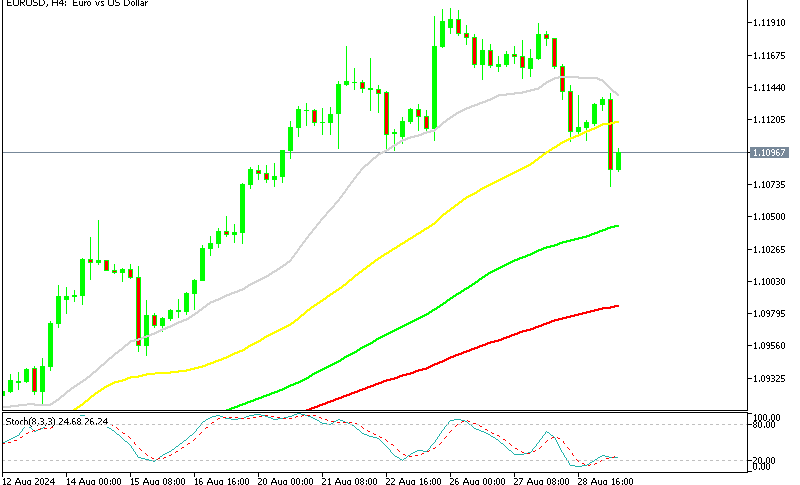

EUR/USD has shown strong bids this month, climbing above 1.12, but yesterday the pair experienced a pullback, dropping 80 pips to 1.11 lows.

EUR/USD pair has shown strong purchasing momentum this month, climbing above 1.12 last Friday after Federal Reserve Chairman Jerome Powell’s dovish remarks at Jackson Hole. This move marked a breakout from a year-long trading range. However, buyers are still facing a key resistance level at 1.1275 and yesterday, the pair experienced a pullback, dropping 80 pips to 1.11 lows.

EUR/USD Chart H4 – The 50 SMA Has been Broken

Mixed Economic Signals from Germany

The economic data from Germany has been mixed. The German August Ifo Business Climate Index fell to 86.6 points, continuing its downward trend and indicating a softening business environment. On the other hand, Germany’s Q2 GDP data (seasonally adjusted) showed a 0.1% increase, outperforming expectations of a -0.1% decline. This suggests slight growth in the German economy compared to the previous quarter, with Year-on-Year (YoY) GDP for Q2 rising by 0.3%.

Focus on German Inflation Data and ECB Policy

Today’s focus is on Germany’s CPI consumer inflation statistics, which could provide further insight into the economic outlook. Despite these developments, the European Central Bank (ECB) has signaled a more accommodative monetary policy stance. However, much of the EUR/USD pair’s recent upward momentum can be attributed to USD movements this month, as markets have been primarily trading based on the dollar’s performance. As traders digest these mixed signals, the EUR/USD pair’s trajectory will likely hinge on upcoming economic data and shifts in market sentiment towards the USD.

German Prelim CPI Inflation Report for August

- Germany Bayern state CPI YY: 2.1% vs 2.5% expected

-

German Hessen state CPI YY: 1.8% vs 1.8% expected

-

German Baden-Wuerttemberg state CPI MYY: 2.1% vs 2.1% expected

Germany Brandenburg state CPI YY: 2.6% vs 2.6% expected

-

Germany Sachsen state CPI YY: 3.1% vs 3.1% expected

Spanish CPI Inflation Report for August

- Spanish Flash HICP Y0Y 2.4% vs 2.5% expected

-

Spanish CPI YY flash: 2.2% vs 2.4% expected, down from 2.8% in July

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account