S&P 500 (SPX) News: Will 5,650 Resistance Hold? Index Poised for Big Move

Wall Street was poised for a lower open on Tuesday as investors adopted a cautious stance ahead of a series of economic reports due later

Wall Street was poised for a lower open on Tuesday as investors adopted a cautious stance ahead of a series of economic reports due later in the week. These reports are expected to provide critical insights into the Federal Reserve’s potential monetary policy adjustments.

Market Recap and Investor Sentiment

The Dow Jones Industrial Average and the S&P 500 ended last week on a high note, with both indices marking their fourth consecutive month of gains. The Dow reached a record high, while the S&P 500 closed within 1% of its own milestone. Despite this strength, the markets are entering September—historically a weak month for stocks—with a sense of caution.

Traders are closely watching the monthly ISM Manufacturing PMI, which is due at 10 a.m. ET. Economists expect the index to rise slightly to 47.5 in August from 46.8 in July, though it remains in contraction territory. The PMI report is one of several economic indicators that will be scrutinized throughout the week, particularly as it may influence the Federal Reserve’s policy decisions.

“The market has been strong, but investors are becoming more cautious as we start September,” said Sam Stovall, chief investment strategist at CFRA Research. “There’s a lot of speculation about the Fed’s next move. If the economic data shows any signs of weakness, investors expect the Fed to respond with more aggressive rate cuts.”

September is historically the worst month for the S&P 500

Let's see how it goes! pic.twitter.com/5z2Lki41EN

— Quality Stocks (@Quality_stocksA) September 2, 2024

At 8:36 a.m. ET, Dow E-minis were down 208 points, or 0.50%, while S&P 500 E-minis dropped 27.75 points, or 0.49%. Nasdaq 100 E-minis declined by 121.25 points, or 0.62%. Rate-sensitive technology stocks led the premarket losses, with Nvidia down 2%, Broadcom dropping 1.2%, and Advanced Micro Devices losing 1.1%.

Economic Data and Fed Rate Cut Expectations

This week’s economic data is crucial for gauging the Federal Reserve’s next steps. The ISM Manufacturing PMI, along with other labor market reports, will play a key role in shaping investor expectations. Notably, July’s non-farm payrolls data, which hinted at a greater-than-expected slowdown, sparked a global sell-off in riskier assets. Now, all eyes are on August’s labor market report, which will be released on Friday.

The Federal Reserve’s meeting later this month will be closely observed, especially following Chair Jerome Powell’s recent remarks supporting forthcoming policy adjustments. According to the CME Group’s FedWatch Tool, there is a 67% chance of a 25-basis-point interest rate cut, while the odds of a more substantial 50-basis-point reduction stand at 33%.

“Speculation about the Fed’s response to any economic weakness is driving market behavior right now,” added Stovall.

Key Movers in the Market

In corporate news, Tesla added 1.1% after a report indicated plans to produce a six-seat variant of its Model Y car in China by late 2025. The automaker also logged its best month of sales in China so far this year in August. Conversely, Boeing shares dropped 3.7% after Wells Fargo downgraded the stock to “underweight” from “equal weight.”

Today’s High Impact News 📰:

– S&P Global Manufacturing PMI

– ISM Manufacturing PMIChart Analysis:

Bitcoin need to hold current support level as well break above resistance line if we must see high target. Otherwise previous low break will decide low targets.$BTC #Bitcoin pic.twitter.com/l0Ea7TRjAQ

— Mails (@Mails_08) September 3, 2024

Unity Software jumped 7% after Morgan Stanley upgraded the company to “overweight” from “equal weight,” citing strong growth potential. Meanwhile, U.S. Steel fell 4.4% following comments by Democratic presidential candidate Kamala Harris expressing concern over the company’s potential acquisition by Japan’s Nippon Steel.

Southwest Airlines saw a 2.3% rise after reports indicated that Elliott Investment now holds 10% of the company’s shares, positioning the hedge fund to call a special meeting at the airline.

S&P 500 Price Forecast – Technical Outlook

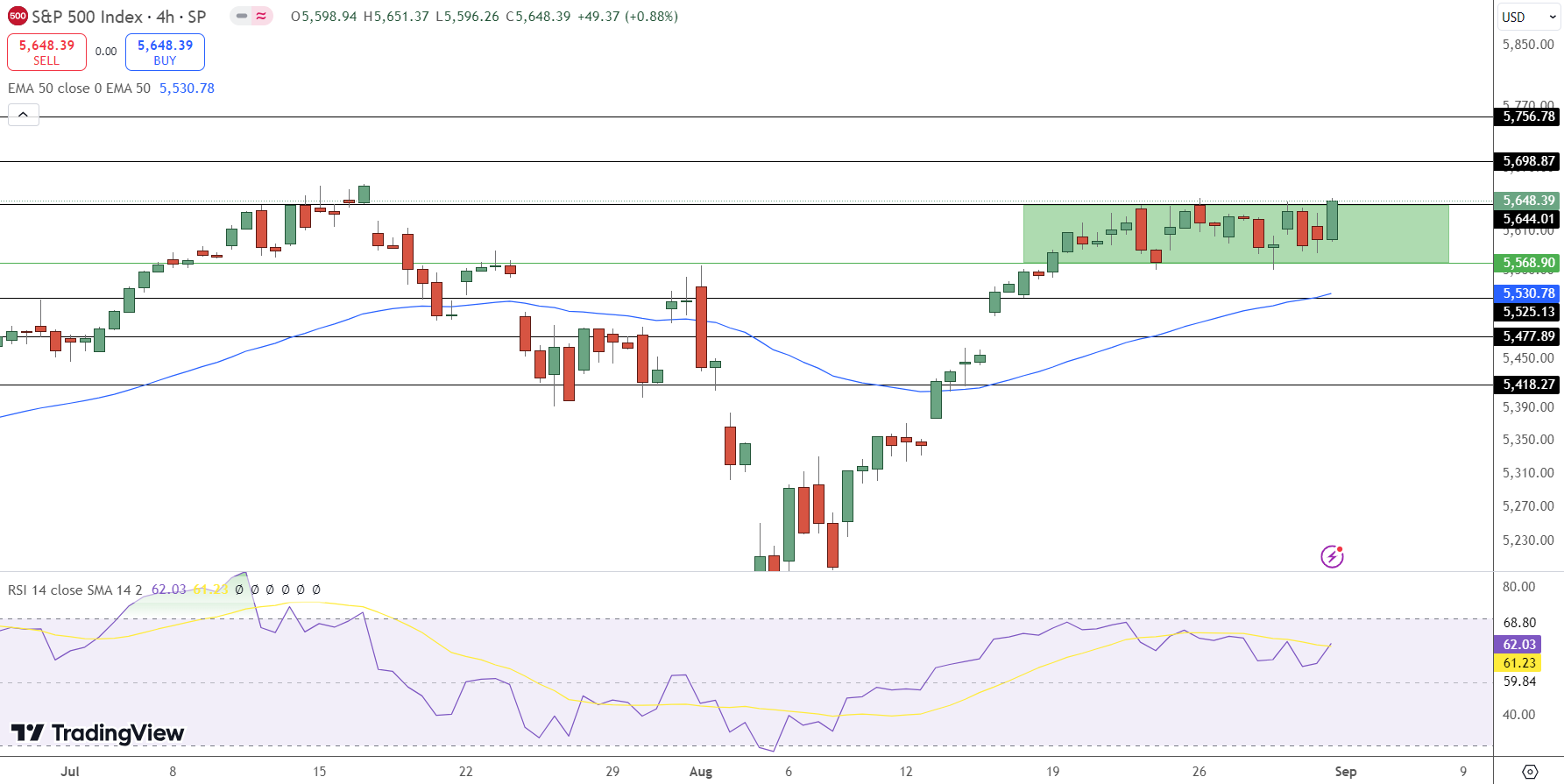

The S&P 500 Index is currently trading around 5,648, showing signs of consolidation within a sideways trading range. This range, defined by immediate resistance at 5,698 and immediate support at 5,568, has limited price movements in recent sessions. The 50-day Exponential Moving Average (EMA) at 5,530 is acting as a crucial support level, maintaining the broader bullish trend.

The Relative Strength Index (RSI) is at 62.03, suggesting moderate bullish momentum. A breakout above 5,698 could propel the index towards the next resistance levels at 5,756 and 5,810. However, a break below 5,568 may lead to further declines, with potential support at 5,530 and lower levels at 5,477 and 5,418.

In conclusion, while the S&P 500 remains in a tight range, a breakout on either side will likely determine the next major move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account