Eurozone GDP Revisions Can’t Push EUR/USD Higher

EUR/USD has moved up again, but the move has been due to USD weakness, because Eurozone GDP and German manufacturing remain weak.

EUR/USD dropped nearly 2 cents this week, reversing the strong buying momentum seen earlier in August. But the decline paused just above 1.10, supported by the 20-day SMA, and has since rebounded over the past two days as buyers attempt to revive the bullish trend. However, the recovery stalled after a 1-cent gain, with traders now waiting for the week’s key event—the August US Non-Farm Payrolls (NFP) report, following a string of disappointing job data recently.

The US dollar has turned soft again recently due to weak employment data from the US. The US ISM Services PMI indicated a continued decline in employment, and Wednesday’s JOLTS Job Openings report also showed further cooling in the labor market. Additionally, the ADP report released yesterday was below expectations. These factors have led to a drop in Treasury yields, putting additional pressure on the dollar, which has benefited EUR/USD , because the Euro doesn’t have many reasons to rally on its own.

The recent rise in the EUR has primarily been driven by the softness of the US dollar. From a monetary policy perspective, the upcoming FOMC meeting the odds are split of either a 25 or 50 basis point rate cut early this morning, with today’s NFP report determining the extent of the cut. Meanwhile, for the ECB, the market is pricing in a 100% probability of a 25 basis point cut at their next meeting, with a total of 60 basis points of easing expected by year-end.

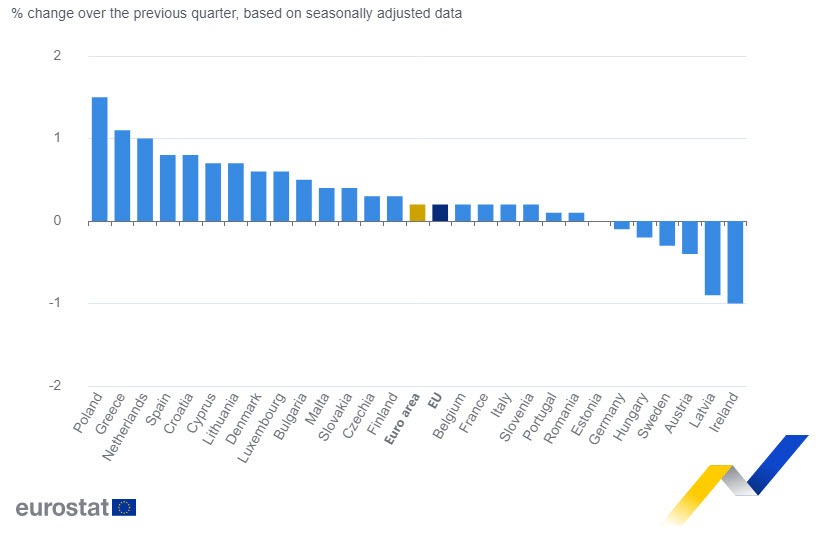

Eurozone Revised GDP for Q2

- Eurozone Q2 final GDP QoQ +0.2% vs +0.3% second estimate

- Previous Q2 GDP estimate was +0.3%

The breakdown shows that household consumption played a relatively minor role during the quarter, and inventory changes were also limited. Government spending added 0.1%, while gross fixed capital formation saw a decline of 0.5%. This was offset by trade (exports minus imports), which contributed 0.5% to quarterly growth. Overall, this highlights the eurozone’s economic resilience in Q2, though the pace has noticeably slowed in Q3.

Germany July industrial Production by Destatis – 6 September 2024

- Germany July industrial production MoM -2.4% vs -0.3% expected

- Prior +1.4%; revised to +1.7%

Factory orders may have received a temporary boost in July from a one-off event, but the broader trend shows industrial output continuing its steep decline as the August numbers suggests, raising further concerns about the health of the German manufacturing sector. Excluding energy and construction, the decline for the month is even more pronounced, at -3.2%. The production of capital goods dropped by 4.2%, intermediate goods by 2.8%, and consumer products by 1.2%.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account