Will Gold Put A New Record High on A Weak NFP Report?

Gold recovery stalled below the all-time high, with traders waiting the August US NFP, following a string of weak jobs data recently.

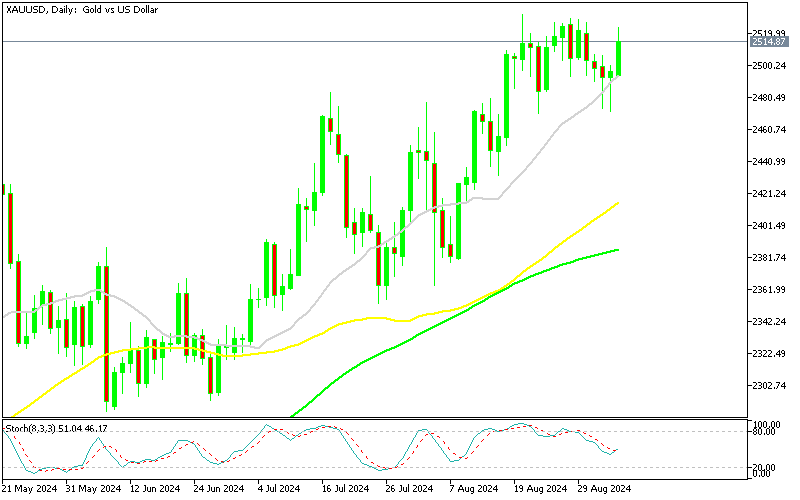

Gold dipped below $2,500 this week, reversing the strong buying momentum from August. The decline paused near the 20-day SMA before bouncing back yesterday, as buyers tried to reignite the bullish trend. However, the recovery has stalled below last month’s peak, with traders now focused on the upcoming August US Non-Farm Payrolls (NFP) report, following a series of weak job data.

Gold Chart Daily – The 20 SMA Held As Support

Earlier in the week, GOLD fell to a low of $2,070 but found solid support at the 20-day SMA (gray) on the daily chart. After forming two bullish reversal signals in the form of hammer candlesticks, buyers returned yesterday, pushing the price above $2,520. The second surge in price has been largely driven by growing expectations of a 50 basis point rate cut by the Federal Reserve, fueled by disappointing job numbers.

ADP August Employment Report

- Jobs added: 99K vs 145K expected

- Previous figure: Revised to 111K from 122K

- Annual pay growth (job-stayers): 4.8%, unchanged

- Annual pay growth (job-changers): 7.3% vs 7.2% prior

- Service-providing sector: Added 72K jobs

- Goods-producing sector: Added 27K jobs

- Construction sector: +27K jobs

- Education/health services: +29K jobs

- Professional/business services: -16K jobs

While this marks the lowest level since January 2021, it only narrowly edges that figure. The data indicates a cooling US labor market. At Jackson Hole, Fed Chair Jerome Powell noted that the downtrend in employment has led to slower hiring, after two years of robust growth. The next key indicator will be wage growth, which is stabilizing after a significant post-pandemic slowdown. Recent US Q2 unit labor cost figures released yesterday also show that wages are lower than before.

US Q2 Labor Costs and Productivity

- Unit labor costs: +0.4% vs 0.8% expected (preliminary: +0.9%)

- Previous quarter: +3.8%

- Productivity growth: +2.5%, matching expectations (preliminary: +2.3%)

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account