EUR to USD Rate Heads to 1.10 on Weakening Euro Economy

The EUR to USD rate has been showing resilience in the last two weeks, despite other risk currencies enduring some hefty losses.

The EUR to USD rate has been showing resilience in the last two weeks, despite other risk currencies enduring some hefty losses, while the Eurozone economy continues to be headed toward a possible recession. In the European session, we had the Sentix Investor Confidence being released, which was expected to show a slight improvement, but remain deep in negative territory.

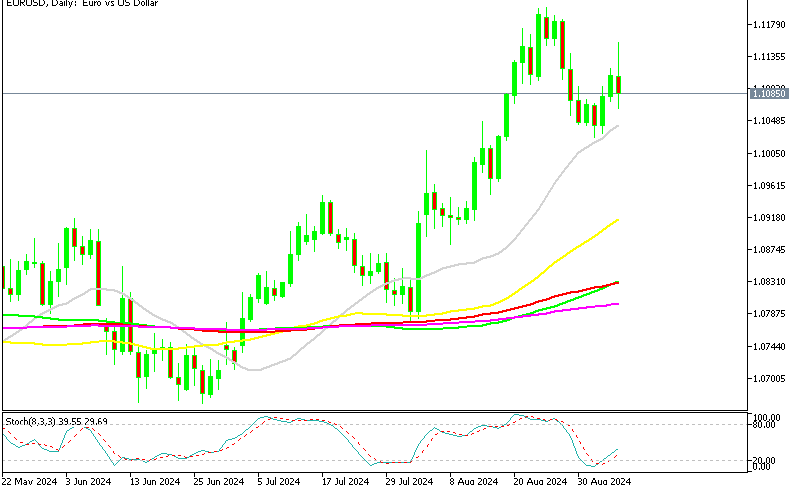

EUR/USD Chart Daily – The 20 SMA Held Last Week

The EUR/USD dropped around 2 cents in the last week of August but found support just above 1.10, aided by the 20-day SMA (gray). Buyers stepped in, pushing the pair higher as they tried to revive the bullish trend. However, the rally lost momentum after a 1-cent gain, and the price fell following the release of the US Non-Farm Payrolls (NFP) report. The data reflected some stability after recent weak job numbers, with the unemployment rate dipping to 4.2% from 4.3% in July, while wages increased—both indicating healthy economic conditions and a low risk of a US recession.

In contrast, the Eurozone economy has shown more concerning signs of weakness. For instance, Germany’s industrial production for August saw a -2.4% MoM decline, and when excluding energy and construction, the drop was even steeper at -3.2%. The breakdown revealed a 4.2% fall in capital goods production, a 2.8% drop in intermediate goods, and a 1.2% dip in consumer products, raising further questions about the health of Germany’s industrial sector.

Despite these concerns, the EUR/USD holding above 1.10 over the past week is a positive sign for the euro, especially given the significant losses suffered by other risk-sensitive currencies. This week’s ECB meeting is anticipated to bring a 50 basis point rate cut, but attention will also focus on key European data like today’s Sentix Investor Confidence report, which could impact market sentiment ahead of the meeting.

Eurozone September Sentix Investor Confidence

- Sentix Investor Confidence Index for September -15.4 points vs -12.5 points expected

- August Sentix Investor Confidence Index was -13.9 points

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account