USD Jump on All Fronts, As Core CPI US Inflation Remains High

The US Dollar retreated lower yesterday as traders closed positions ahead of the US August inflation, but jumped higher after the CPI data.

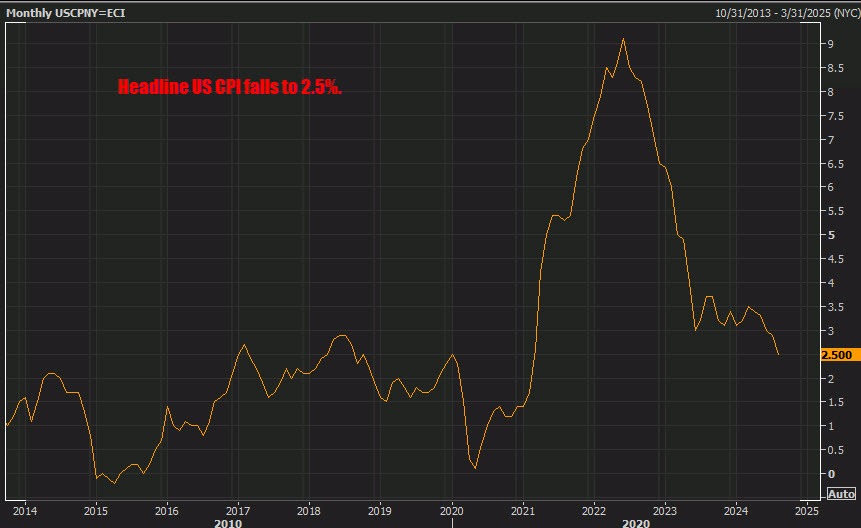

The US Dollar retreated lower yesterday as traders squared their positions ahead of the US inflation report for August, but has jumped higher after the CPI data. The headline inflation continued to fall, getting close to the FED target, but core CPI remains high, showing that core prices for goods continue to increase at a considerable speed.

The August CPI report below shows continued moderation in headline inflation, with headline CPI increasing at its slowest annual rate since February 2021. While core inflation remains somewhat elevated, shelter costs continue to drive much of the price pressure, contributing over 70% to the increase in core prices. Energy prices declined both on a monthly and yearly basis, helping to keep overall inflation contained.

Despite some strength in categories like airline fares and motor vehicle insurance, the overall inflationary environment appears to be stabilizing, with real earnings improving, which could ease concerns of prolonged price pressures. However, the persistently high shelter costs and certain services like medical care and education still present a challenge for policymakers. These mixed signals suggest that the Federal Reserve may need to remain cautious about future rate decisions, as inflation is cooling but not yet fully tamed.

US August 2024 Consumer Price Index Report![CPI]()

- August Headline CPI YoY: +2.5% (smallest 12-month increase since February 2021)

- Previous month: +2.9%

- CPI MoM: +0.2% (in line with expectations)

- Unrounded: +0.187%

Core Measures:

- Core CPI YoY: +3.2% (as expected)

- Core CPI MoM: +0.3% (versus +0.2% expected)

- Unrounded: +0.281%

- Real weekly earnings: +0.5% (versus -0.2% prior)

Category Breakdown:

- Shelter inflation: +0.5%

- Food prices: +0.1% (after rising +0.2% in July)

- Food away from home: +0.3%

- Food at home: Unchanged

- Energy prices: -0.8% (versus unchanged last month)

- Energy index down 4.0% YoY

- Food index up 2.1% YoY

Notable Line Items:

- All items excluding food & energy: +0.3% MoM (up from +0.2% in July)

- Shelter index: +0.5%

- Owners’ equivalent rent: +0.5%

- Rent index: +0.4%

- Lodging away from home: +1.8% (up from +0.2% in July)

- Airline fares: +3.9% (reversing 5 months of declines)

- Motor vehicle insurance: +0.6%

- Used cars and trucks: -1.0% (after a -2.3% drop in July)

- Household furnishings & operations: -0.3%

- Medical care: -0.1% (following -0.2% in July)

- Communication, recreation, & personal care: -0.1%

- New vehicles: Unchanged

12-Month Overview:

- Core items excluding food & energy: +3.2%

- Shelter index: +5.2%, contributing over 70% to the total increase

- Motor vehicle insurance: +16.5%

- Medical care: +3.0%

- Recreation: +1.6%

- Education: +3.1%

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account