Sell USDJPY Signal After Soft Japan Inflation Numbers

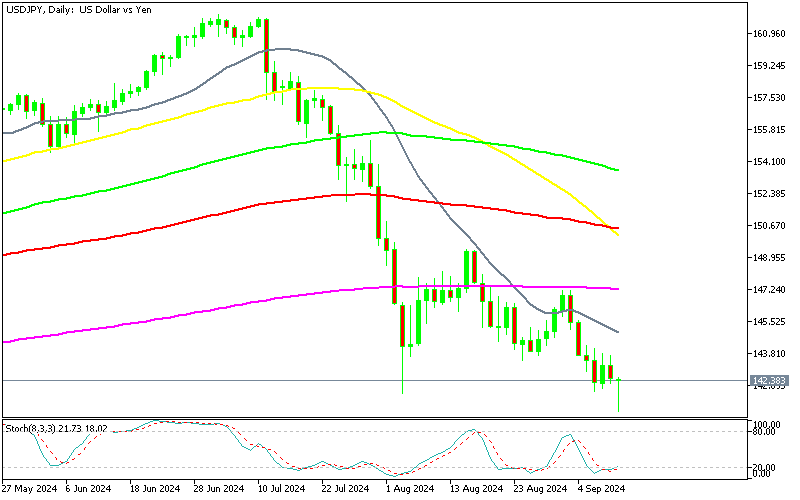

USDJPY has been trending down and yesterday it broke below August's low, falling below 141 as well after the US CPI inflation report.

USDJPY has been trending down and yesterday it broke below August’s low, falling below 141 as well after the US CPI inflation report. The US inflation came in mixed, with the headline numbers continuing to fall toward the FED’s 2% target, but the core CPI YoY continues to remain high, which gave safe havens a boost however, the price pulled back up above 142 where it started the day.

In early August, the USD/JPY pair experienced a 20-cent decline to 141.69, but strong buying interest pushed it up by 7.5 cents, breaking above the 149 level. However, the rally was short-lived as sellers regained control, leading to a sharp reversal. The pair fell back below 142, establishing a temporary support zone.

USD/JPY Chart Weekly – The 100 SMA Has Been Broken

Yesterday, a decisive break through this zone signals potential further losses, possibly dropping below the December 2023 lows near the 140 mark. The pair has continued to hit new lows as US Treasury yields decline, suggesting a strong week for the Yen. Expectations of the Federal Reserve cutting rates by 50 basis points at the next meeting have fallen to just 20%. Meanwhile, the market projects that the Bank of Japan will ease by 8 basis points by the end of the year, with a near certainty of no changes at the upcoming BoJ meeting.

Japan PPI Inflation Report

- Japan PPI MoM (August): -0.2% (vs. +0.0% expected)

- Prior PPI MoM: +0.3%

- Japan PPI YoY (August): +2.5% (vs. +2.8% expected)

- Prior PPI YoY: +3.0%

Key Takeaways:

- Wholesale inflation decreased on both a monthly and yearly basis in August, with a notable decline in the month-on-month figure.

- The stronger yen may have contributed to lower inflation, as reflected in the falling import index, suggesting cheaper costs for imported goods.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account