Booking Profit in USDCAD Buy Signal as Canada Inflation Slows

The CAD has been weakening in September, falling behind the commodity currency pears, with the USDCAD pair rising 2 cents.

The Canadian dollar (CAD) has been weakening throughout September, falling behind the commodity currency pears, with the USDCAD pair rising by about 2 cents from its August lows, trading at 1.36. This decline was largely driven by buying pressure from the strengthening U.S. dollar last week, while this week the growing economic concerns are weighing on the CAD, which has been unable to gain against the USD, while other risk currencies have made some decent gains in the last several days. Today we saw another run to the upside after the soft inflation figures, which triggered the take profit target for our buy USD/CAD signal.

The Bank of Canada (BoC) has cut interest rates by 25 basis points for the third consecutive time, increasing pressure on the Canadian dollar and keeping USD/CAD bullish. This series of rate cuts reflects the central bank’s efforts to address slowing economic conditions. Market expectations are now leaning towards an additional 50 basis point cut at the next BoC meeting, especially after Governor Macklem hinted that the pace of monetary easing could accelerate if economic data continues to justify it.

USD/CAD Chart Weekly – Consolidating at the 50 SMA

Rising Canada Unemployment and CAD Hesitation

The latest jobs report revealed a 6.6% unemployment rate, the highest level since 2017, excluding the COVID era. This elevated unemployment rate has added to the uncertainty surrounding the CAD’s ability to gain momentum, as the weak labor market dampens confidence in a stronger currency.

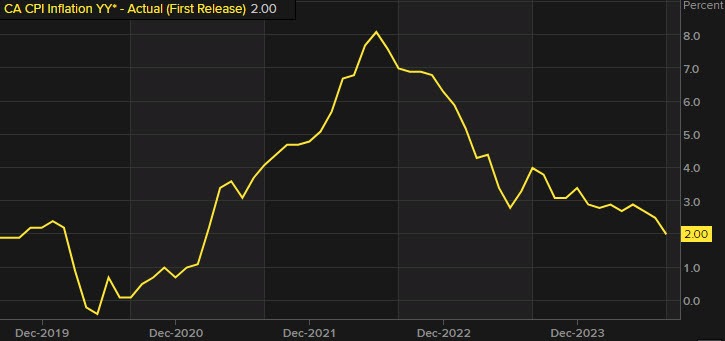

Canadian CPI Report and Inflation Trends

Today, Canada’s August Consumer Price Index (CPI) report showed another decline in inflation, with the rate approaching the central bank’s 2% target. This cooling inflation further supports the possibility of future rate cuts as the BoC continues its efforts to manage economic challenges while keeping inflation in check.

Canada CPI Inflation Report for August

- Canada August CPI 2.0% vs 2.1% expected, lowest since March 2021

- Prior month 2.5%(it came in as expected)

- CPI MoM -0.2% vs 0.0% expected.

- Prior MoM +0.4%

Core measures:

- CPI Bank of Canada core YoY 1.5% vs 1.7% last month

- CPI Bank of Canada core MoM -0.1% versus +0.3% last month

- Core CPI MoM SA 0.1% versus 0.1% last month

- Median 2.3% versus 2.2% estimate. Last month 2.4%

- Trim 2.4% versus 2.5% estimate. Last month .7%

- Common 2.0% versus 2.2% last month

Canada Housing Starts

- August housing starts: 217.4K (vs 252.5K expected)

- Previous figure: 279.5K (revised to 279.8K)

- There’s a notable drop in housing starts after the strong July numbers, indicating some pullback in activity.

- The decline highlights concerns over the shrinking housing pipeline in Canada.

- Investor interest in Canadian real estate has significantly diminished, contributing to the reduced activity and potential future slowdown in housing development.

- Rising interest rates and high costs could further deter investment in the real estate sector, exacerbating the cooling trend.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account