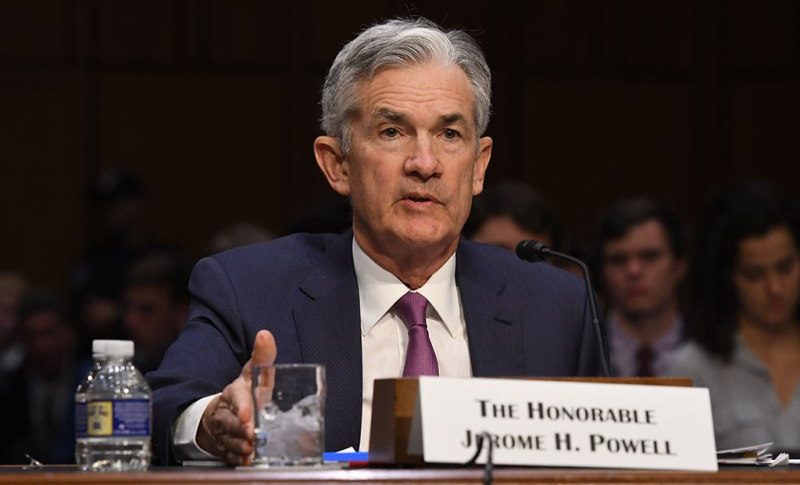

S&P 500 Ends 7 Day Winning Streak after 50 bps FED Rate Cut

After the 50 bps Fed rate cut today, US equities finished the day lower, with S&P 500 making a new high and coming back down.

•

Last updated: Wednesday, September 18, 2024

After the major Fed rate cut of 50 bps today, US equities finished the day lower, with S&P 500 making a new high and coming back down. Prior to the FOMC decision, both the Dow and S&P 500 had hit new record highs, but they closed in the red. The key issue during the decision was that markets were near record levels following a seven-day rally, making it a challenging scenario for the Fed to navigate.

The central bank opted for a significant 50 basis point rate cut, but since stocks couldn’t maintain their upward momentum, it turned into a “sell the fact” situation. The S&P 500 jumped to a new record high, pushing above the resistance zone, but buyers couldn’t hold the gains after the FOMC policy decision and reversed back lower.

S&P 500 Chart Daily – The Resistance Still Holds

- Fed Funds Rate: Lowered to 4.75-5.00% range from the previous 5.25-5.50%.

- Vote: 11-1 in favor of the cut, with Bowman dissenting.

- Quantitative Easing: No changes made, as expected.

- Expectations: Economists widely expected a 25 bps cut, but Fed funds futures had priced a 59% chance of a 50 bps cut, which was realized.

- Inflation: The Committee is more confident inflation is moving sustainably toward the 2% target, with risks to employment and inflation goals seen as balanced.

- Economic Activity: Continues to expand at a solid pace.

- Job Gains: Acknowledged that job gains have slowed (previously stated as “moderated”).

- Inflation Status: Has made progress toward the 2% objective but remains somewhat elevated (slightly revised from the prior statement).

S&P 500 Live Chart

S&P500

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.