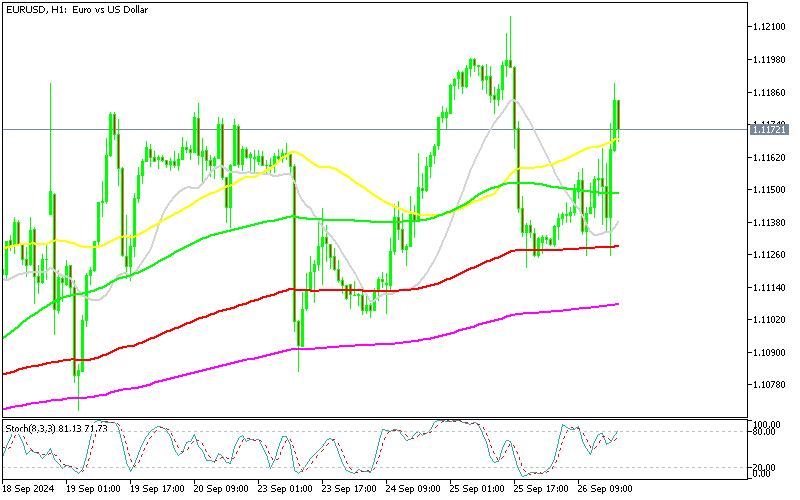

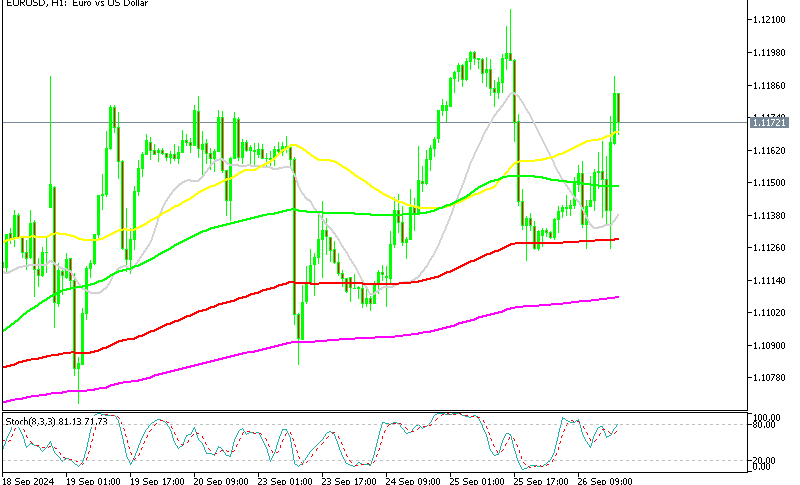

EURUSD Jumps Back Up Despite Positive US Retail Sales

EURUSD took a 1 cent dive yesterday as the USD came back, but has bounced higher today as the sentiment improves on China stimulus hopes.

EURUSD took a 1 cent dive yesterday as the USD came back, but has bounced higher today as the sentiment improves on China stimulus hopes. This week the economic data from the US has shown a stable economy and today’s positive Durable Goods Orders sent the USD higher and EUR/USD lower to 1.1125, but the100 SMA (red) on the h1 chart held as support once again, offering a bounce higher toward 1.12.

EUR/USD Chart – Double Top Pattern Points to 1.08

Despite the weak economic indicators coming out of the Eurozone and the positive data from the U.S., such as today’s figures, the EUR/USD pair has remained above the 1.11 level. The primary driver behind this upward momentum has been the U.S. dollar’s depreciation, following the Federal Reserve’s 50 basis point rate cut announced on Wednesday evening.

However, today we’re also seeing added support for the euro from China, as it plans to move forward with fiscal stimulus measures. This stimulus was a significant contributor to yesterday’s decline in the EUR/USD and the broader risk aversion seen in financial markets.

US August Durable Goods Orders:

-

- Flat at 0.0%, better than the expected -2.6%.

- Ex-Transportation:

- Increased +0.5%, above the expected +0.1%.

- Previous month remained unchanged at +0.1%.

- Excluding Defense:

- New orders fell by -0.2%, down from the prior +10.3%.

- Nondefense Capital Goods Orders (Excluding Aircraft):

- Rose +0.2%, slightly above the expected +0.0%.

- Previous month revised to -0.2% from -0.1%.

- Unfilled Orders:

- Increased +0.4%, compared to the prior +0.2%.

- Inventories:

- Inched up +0.1%, consistent with the previous month’s gain of +0.1%.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account