USDJPY Resumes Decline after Lower PCE Inflation, Japan PM

The USD has been soft, helping in the USDJPY downtrend since July and Friday's PCE inflation report didn't do much to stop the decline

The USD has been soft, helping in the USDJPY downtrend since July and Friday’s PCE inflation report didn’t do much to stop the decline. The PCE numbers came on the softer side again which is negative for the USD, while in Japan we have a clear candidate for the position of Prime Minister, which has boosted the JPY further.

These softer-than-expected PCE and spending figures, combined with weaker income growth, suggest that inflation pressures are easing further, while consumer spending remains subdued, which could weigh on overall economic growth. So, no reason for the FED not to continue with rate cuts as we go ahead, which is negative for the US Dollar, and could send USD/JPY below 140 again soon.

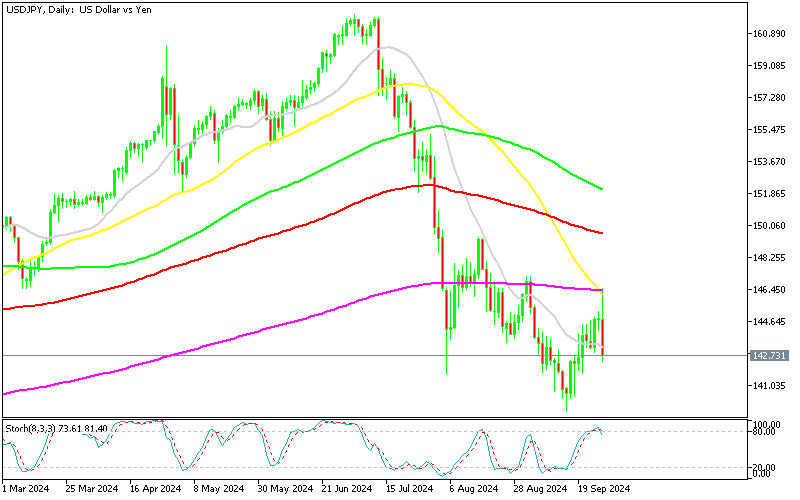

USD/JPY Chart Daily – Retrace Higher Ends at the 200 SMA

So, the decline in US inflation is giving the Federal Reserve more room to potentially reduce interest rates more aggressively. Currently, the market is split between a 50 and 25 basis point cut for the November FED meeting. However, with two non-farm payroll (NFP) reports still due before the decision, much will hinge on the economic data and comments from key policymakers.

US August 2024 Core PCE and Consumer Data Highlights

-

Core PCE Inflation:

- +0.1% m/m, slightly below the expected +0.2%.

- Prior month’s core PCE was +0.2%.

-

Headline PCE Inflation:

- +2.2% y/y, below the expected +2.3%.

- Prior reading was +2.5% y/y.

- PCE Deflator:

- +0.1% m/m, matching expectations.

- Prior month was +0.2%.

- Unrounded figure: +0.0907% m/m vs +0.155% m/m prior.

Consumer Spending and Income for August:

-

Personal income:

- +0.2%, under the expected +0.4%, matching the prior month’s +0.2%.

-

Personal spending:

- +0.2%, below the expected +0.3%.

- Prior month was +0.5%.

-

Real personal spending:

- +0.1%, down from the previous month’s +0.4%.

The unrounded Core PCE figure came in at +0.1304%, just below the +0.14% claimed by Fed’s Waller. Additionally, both spending and income numbers were softer than expected, reinforcing the narrative of a cooling economy. This softer data should boost confidence in the Federal Reserve’s inflation fight. Following the release, the US dollar edged lower to a session low against the yen, although the currency movements remained relatively modest. The data suggests that inflation pressures are easing, and economic momentum may be slowing, which could temper further aggressive policy moves from the Fed.

In Japan, the Japanese yen has strengthened as Ishiba emerged victorious in the leadership contest, becoming Japan’s next prime minister. The JPY gained as Takaichi, a more outspoken candidate who argued that the BOJ was raising rates prematurely, lost momentum in the election.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account