EURUSD Breaks Below 100 Weekly SMA As ECB-FED Policies Diverge

EURUSD continued to grind lower yesterday without any resistance, which shows that the pressure has shifted to the downside for this pair.

EURUSD continued to grind lower yesterday without any resistance, which shows that the pressure has shifted to the downside for this forex pair. The ECB is sounding increasingly dovish as the Eurozone economy weakens while the FED is feeling more comfortable now after the rate cut earlier, which points down for EUR/USD.

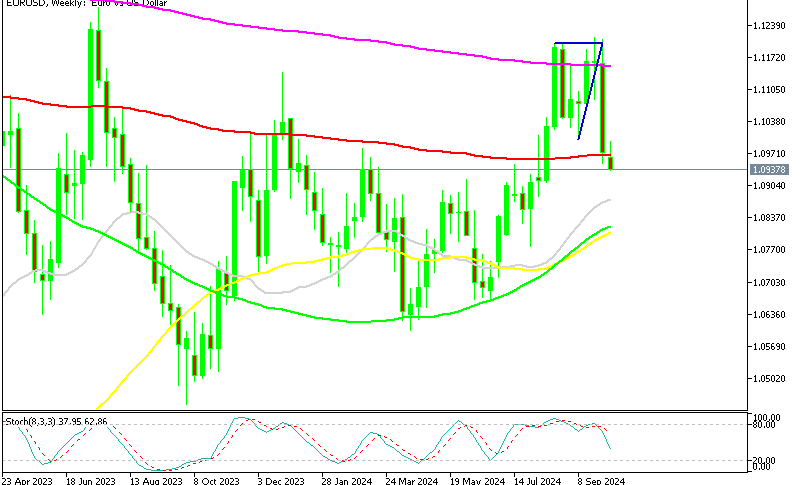

EUR/USD Chart Weekly – Breaking Below the 100 SMA

The EUR/USD pair experienced a strong rally in June and July, climbing from under 1.07 to reach 1.12. However, this surge quickly met with strong resistance, and buyers struggled to maintain the momentum. As a result, the pair began to pull back, with 1.10 emerging as a key resistance level once again. Earlier this week, the EUR/USD showed signs of recovery, edging closer to 1.10. Yet, buyers couldn’t sustain the move above this barrier, highlighting ongoing weakness.

Following last week’s steep decline, the pair dropped below 1.10, shedding over two cents. On the weekly chart, the price had initially bounced back from the 100 SMA at 1.0970, but the rebound was short-lived, as the pair fell again amidst a broader decline in riskier currencies. This breakdown signals a potential shift away from the bullish trend, with 1.09 as the immediate target, followed by 1.08.

German Economy Headed for Contraction

The European Central Bank’s increasingly dovish stance has further weakened the Euro, coupled with downward revisions in Germany’s economic outlook. The German Ministry of Economy now expects a 0.2% contraction in GDP for 2024, compared to the previous forecast of a 0.3% expansion. Growth is projected to pick up slowly in 2025 at 1.1%, reaching 1.6% by 2026. Inflation is forecasted to decrease gradually from 2.2% in 2024 to 2.0% in 2025 and then to 1.9% in 2026. In contrast, the Federal Reserve appears less dovish, as reflected in yesterday’s FOMC meeting minutes. Many Fed members are not in a hurry to implement another 50-basis point rate cut, reinforcing support for the USD.

Germany August retail sales

- August retail sales MoM +1.6% vs +0.1% expected

- July retail sales Mom were -1.2%

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account