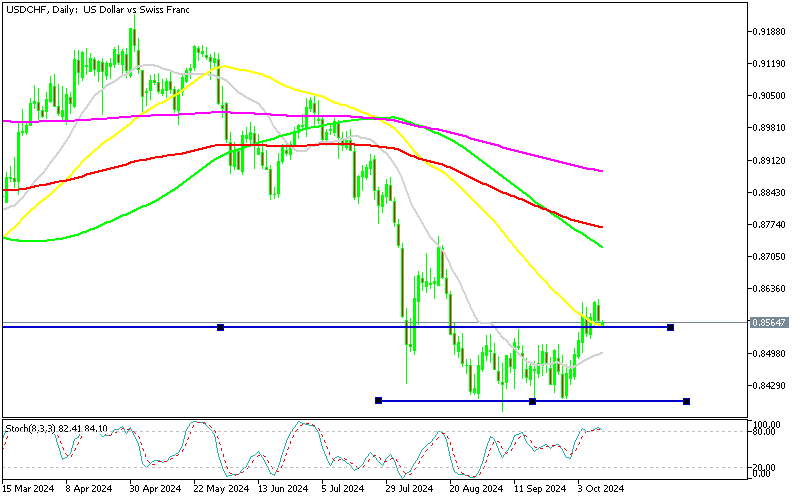

USDCHF 0.8550 Support

USDCHF encountered volatility again yesterday and retreated around 50 pips lower but the decline stalled at the previous resistance zone.

USDCHF encountered volatility again yesterday and retreated around 50 pips lower but the decline stalled at the previous resistance zone. That was also partly due to the vice president of the Swiss National Bank. who made some dovish comments, mentioning further interest cuts after the SNB has already lowered rates by 75 basis points.

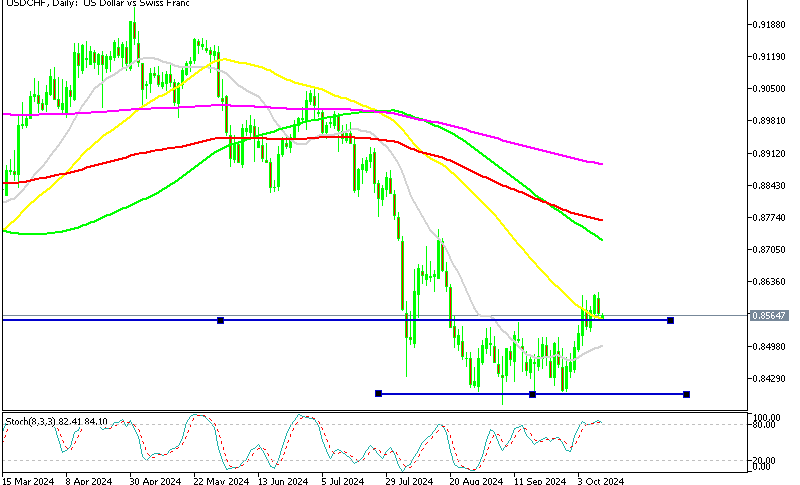

USD/CHF Chart Daily – Will the 50 MA Hold as Support?

The USD/CHF exchange rate recently climbed past the 1-cent level after last Friday’s strong U.S. Non-Farm Payrolls report, gaining nearly 2 cents throughout October as the market turned more bullish in the short term. Meanwhile, geopolitical tensions in the Middle East are easing, with no signs of escalating into a major conflict. During the European session, however, the pair experienced a pullback following U.S. economic data.

While higher-than-expected CPI consumer inflation provided support for the USD, the currency faced pressure from a jump in unemployment claims. This brought USD/CHF down to around the 0.8550 level, where we saw an opportunity to open a buy position. The U.S. dollar has shown strength this month, recently breaking through the 1-cent range. Although higher CPI inflation was expected to push the USD/CHF pair even higher, the increase in unemployment claims tempered the USD’s gains, leading to a dip back to its support zone.

Comments from the SNB Vice President Martin

- Inflation expectations in Switzerland have decreased significantly.

- The Swiss National Bank (SNB) has hinted at a potential rate cut, though no definitive commitments have been made.

- With low inflation and a relatively weaker economy, indications suggest a likelihood of lower interest rates.

- It is expected that Swiss inflation will stay comfortably within the 0-2% price stability range.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account