GBPUSD Falls in Range After UK Services, BOE Turns Dovish

The uptrend in GBPUSD is officially over now, with the price testing 1.29 and the BOE turning dovish on lower UK inflation.

The uptrend in GBPUSD is officially over now, with the price testing 1.29 and the BOE turning dovish on lower UK inflation. The price has now entered the previous range and fundamentals point to further downside for this forex pair, as the US economy has been recovering, while the UK economy continues to show immense weakness.

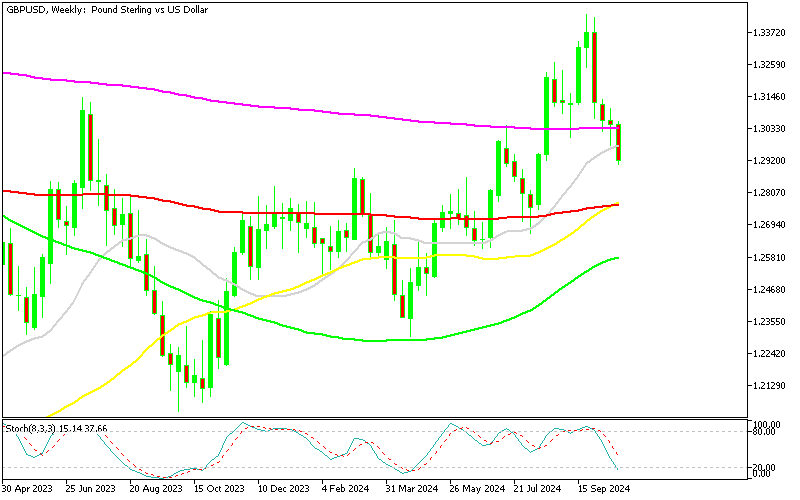

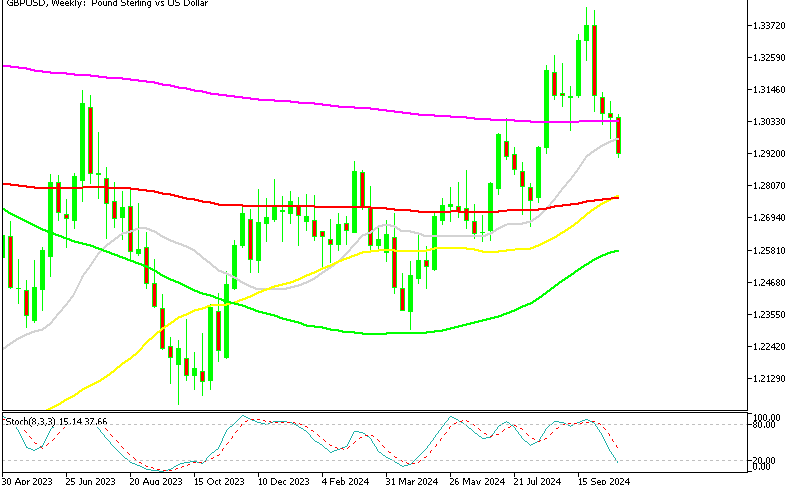

GBP/USD Chart Weekly – The 200 SMA Has Been Broken

Following disappointing UK CPI inflation data for September, the Bank of England’s rhetoric has started to shift toward a more dovish tone. Governor Andrew Bailey’s comments yesterday suggested a softening stance, with the market now expecting a 25 basis point rate cut in December. The data also raised expectations of four additional rate cuts in 2025.

As a result, sellers have remained in control of the GBP/USD pair, which has dropped 4 cents so far in October after a bearish reversal from above 1.34. This week, the pair broke below the 200-week simple moving average (SMA) near the key 1.30 level. Although the GBP/USD attempted to recover from below 1.30, the rebound was weak, and sellers quickly regained control, causing the pair to drop by nearly 1 cent yesterday. The ongoing pressure suggests the pair may continue to face downward momentum in the near term.

Comments from the BOE Governor Andrew Bailey

- Disinflation has taken place faster than expected in the UK and elsewhere

- Inflation below target pushed around by annual base effects

- High savings rate reflects consumer caution

- Pensions funds should not have to make compulsory allocations to UK assets

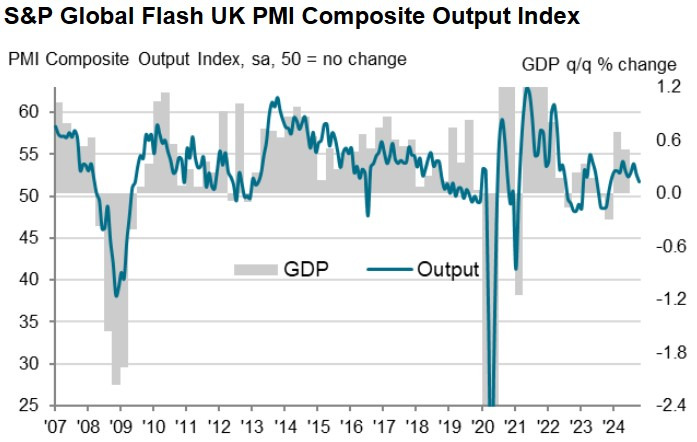

This morning we had the Services and Manufacturing PMI reports from the UK for September.

UK Services and Manufacturing PMI Data for October

- Services PMI 51.8 vs 52.4 expected and 52.4 prior.

- Manufacturing PMI 50.3 vs 51.4 expected and 51.5 prior.

- Composite PMI 51.7 vs 52.6 expected and 52.6 prior.

Key Findings:

- Flash UK PMI Composite Output Index(1) at 51.7 (Sep: 52.6). 11-month low.

- Flash UK Services PMI Business Activity Index(2) at 51.8 (Sep: 52.4). 11-month low.

- Flash UK Manufacturing Output Index(3) at 50.9 (Sep: 53.6). 6-month low.

- Flash UK Manufacturing PMI(4) at 50.3 (Sep: 51.5). 6-month low.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account